Current trend

Shares of 3M Co., an American diversified innovation and manufacturing company, are trading in a corrective trend near the 93.00 mark.

Ahead of the financial report for the first quarter, which will be published on April 23, the company published its forecast, which disappointed investors: profit in 2024 is expected to range from 9.35 dollars to 9.75 dollars per share, which is equivalent to an average of 2.36 dollars, and is inferior to the fourth quarter of last year at 2.42 dollars. 3M Co. also assumes that the restructuring of the business will save from 700.0–900.0 million dollars, but this will not be enough to match last year's profitability levels. The company's reputation continues to be heavily pressured by the consequences of litigation regarding Combat Arms earplugs, as well as problems with "eternal chemicals": in January, an agreement was signed with a number of US states to allocate 10.3 billion dollars to mitigate the effects of environmental pollution associated with them.

According to preliminary analyst estimates, 3M Co.'s revenue could reach 7.65 billion dollars, which is slightly lower than 7.69 billion dollars in the previous quarter. Earnings per share (EPS) are expected at 2.08 dollars, also down from 2.42 dollars previously.

Support and resistance

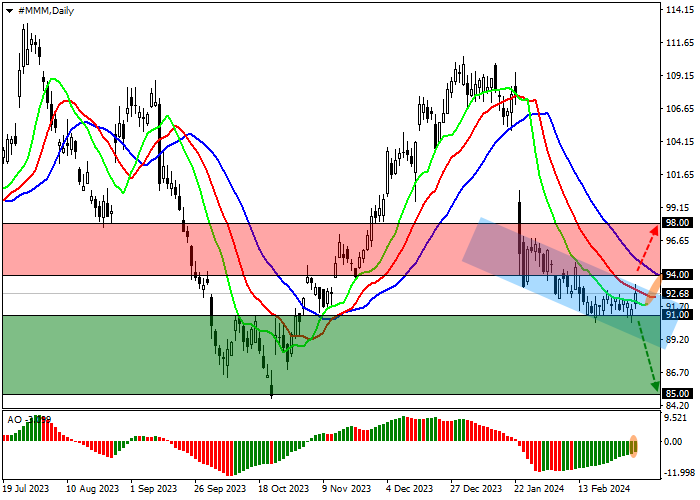

On the D1 chart of the asset, the price is at the stage of forming a local downward corridor with the borders of 93.00–89.00.

Technical indicators hold a stable sell signal, slowing it down somewhat against the background of a local correction: the AO histogram forms new ascending bars, and the fast EMAs of the Alligator indicator is held below the signal line.

Support levels: 91.00, 85.00.

Resistance levels: 94.00, 98.00.

Trading tips

If the asset continues to decline and the price consolidates below the support level of 91.00, one can open short positions with the target of 85.00 and stop-loss of 94.00. Implementation time: 7 days and more.

If the asset continues to grow and the price consolidates above the local resistance level at 94.00, one may open long positions with the target of 98.00 and stop-loss of 92.00.

Hot

No comment on record. Start new comment.