Current trend

One of the leading indices of the European economy, the CAC 40, is being adjusted at 7938.0 amid mixed expectations from the publication of reports from component companies and a local decline in the bond market.

The quarterly results of the Thales Group industrial group will be presented today, with revenue expected to grow significantly to 9.71 billion euros from 4.14 billion euros in the previous quarter, and earnings per share (EPS) increasing to 4.23 euros from 3.87 euros. In turn, Teleperformance SE, a company specializing in customer service management, can demonstrate revenue of 2.58 billion euros, which significantly exceeds 1.99 billion euros a quarter earlier, and EPS will increase to 7.94 euros from 6.96 euros.

In addition, local pressure on the stock market has eased due to a new decline in the domestic bond market after a long upward correction: 10-year securities are trading at a rate of 2.789% after Friday's 2.905%, and the yield of 20-year bonds is 3.164%, down from 3.285% recorded last week.

The growth leaders in the index are Thales Group ( 9.07%), Engie SA ( 2.15%), Carrefour SA ( 1.81%).

Among the leaders of the decline are Alstom SA (-3.56%), Dassault Systemes SE (-3.21%), Schneider Electric SE (-2.10%), Capgemini SE (-1.95%).

Support and resistance

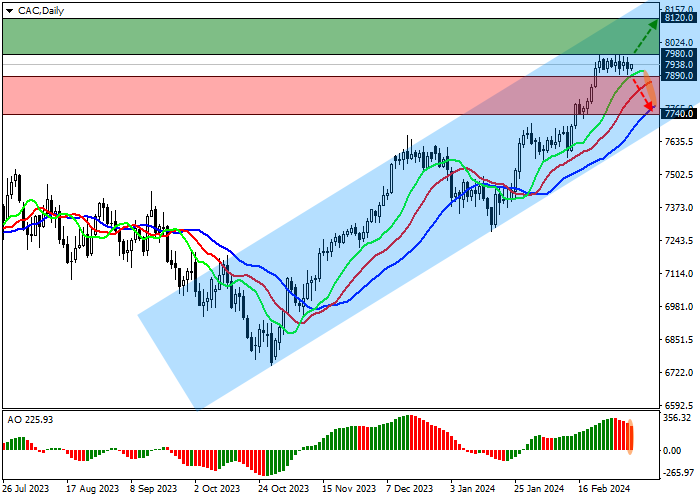

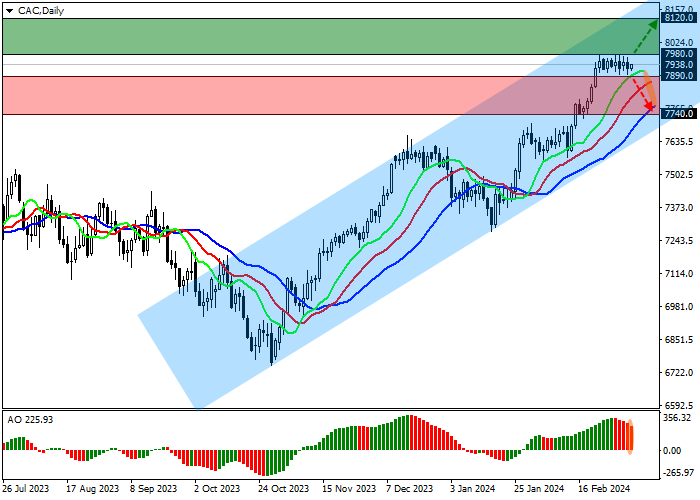

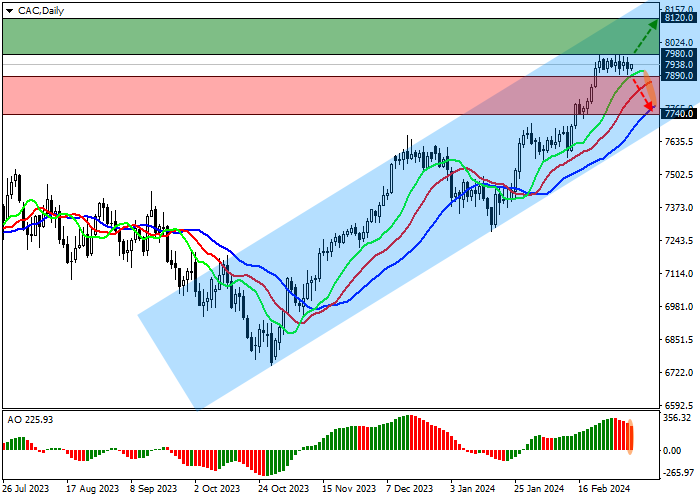

On the D1 chart, quotes continue to grow globally, moving in the direction of the resistance line of the ascending channel with dynamic borders of 8030.0–7700.0.

Technical indicators maintain a stable buy signal: the fast EMAs on the Alligator indicator remain above the signal line, and the AO histogram, being above the transition level, forms corrective bars.

Support levels: 7890.0, 7740.0.

Resistance levels: 7980.0, 8120.0.

Trading tips

In case of continued growth of the asset, as well as price consolidation above the local resistance level of 7980.0, buy positions with the target of 8120.0 and stop-loss of 7920.0 will be relevant. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the local support level of 7890.0, sell positions with the target of 7740.0 can be opened. Stop-loss – 7950.0.

Hot

No comment on record. Start new comment.