Current trend

The USD/CHF pair is holding near 0.8840 during morning trading: market participants are in no hurry to open new positions ahead of the publication of macroeconomic statistics.

Today at 17:00 (GMT 2) the first of two planned speeches by US Federal Reserve Chairman Jerome Powell will take place in US Congress, where a semi-annual report will be presented, within which the official will likely again point out the existing risks of a return to inflation, which will be a new signal in the benefit of a slower decline in borrowing costs this year. In addition, at 15:15 (GMT 2) February data from Automatic Data Processing (ADP) on employment in the private sector will be published: the indicator is expected to rise from 107.0 thousand to 150.0 thousand. Towards the close of the day's session, investors will turn their attention to the Beige Book, a monthly economic review from the US Federal Reserve.

Analysts continue to evaluate the February inflation data in Switzerland published on Monday: Consumer Price Index added 0.6% after increasing by 0.2% a month earlier, and in annual terms the figure adjusted from 1.3% to 1.2%, with expectations for 1.1%. Statistics on the Unemployment Rate will be presented tomorrow, and it is likely to remain at 2.2%. Investors will also be assessing the outcome of the meeting of the European Central Bank (ECB), which is expected to clarify the prospects for a possible adjustment to borrowing costs later this year.

Meanwhile, the Swiss National Bank reported an annual loss of 3.2 billion Swiss francs. The decline in the indicator was primarily due to the situation in the financial market and the strong position of the national currency. The institution recorded a profit of 4.0 billion francs on foreign exchange positions and 1.7 billion francs on gold and foreign exchange reserves; however, it recorded a loss of 8.5 billion francs on positions in local currency in addition to 0.4 billion francs on operating expenses.

Support and resistance

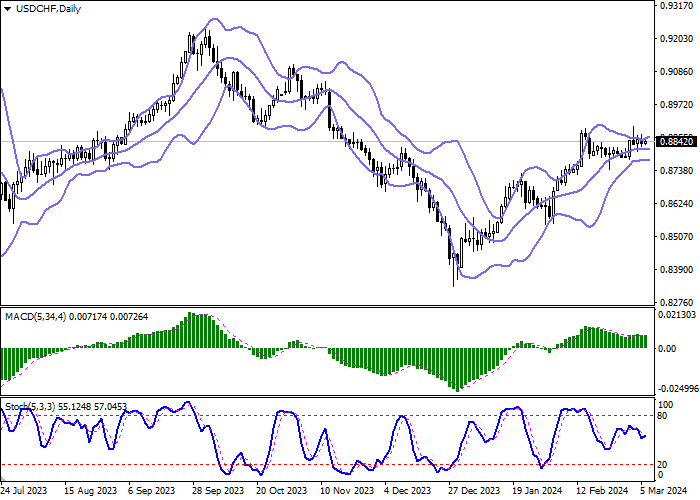

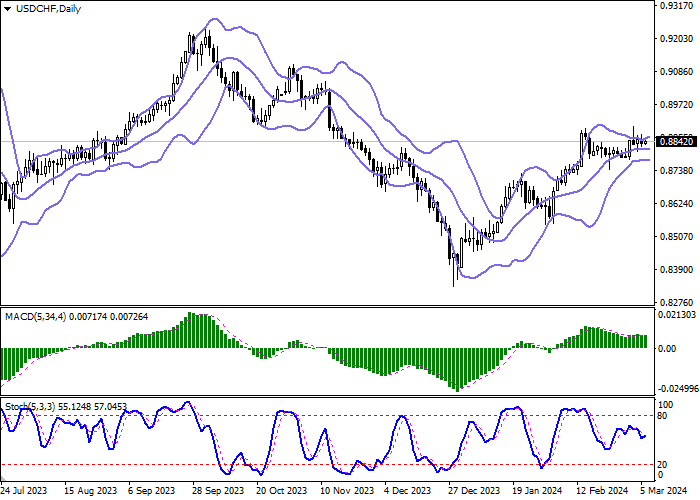

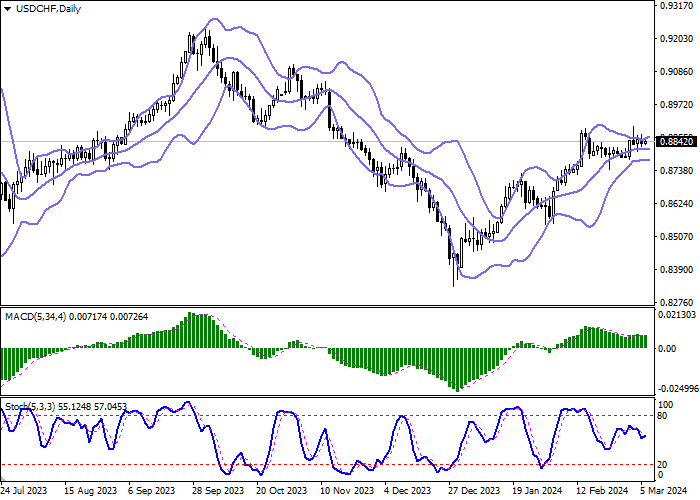

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is slightly expanding from above, being spacious enough for the current activity level in the market. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic, located approximately in the center of its area, maintains an uncertain upward direction.

To open new positions, it is necessary to wait for the trade signals to become clear.

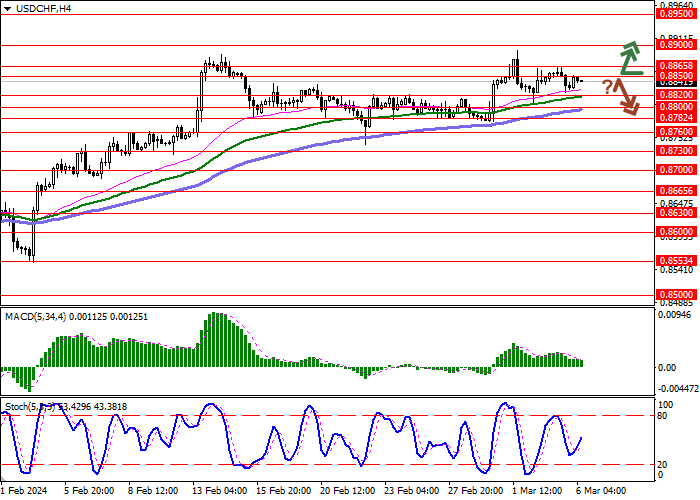

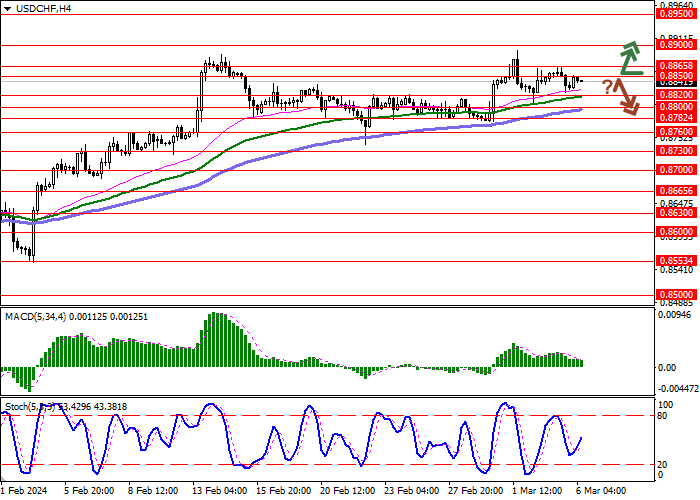

Resistance levels: 0.8850, 0.8865, 0.8900, 0.8950.

Support levels: 0.8820, 0.8800, 0.8782, 0.8760.

Trading tips

Long positions can be opened after a breakout of 0.8850 with the target of 0.8900. Stop-loss — 0.8820. Implementation time: 1-2 days.

A rebound from 0.8850 as from resistance, followed by a breakdown of 0.8820 may become a signal for opening of short positions with the target at 0.8760. Stop-loss — 0.8850.

Hot

No comment on record. Start new comment.