Current trend

The EUR/USD pair shows ambiguous trading dynamics, consolidating near 1.0850. Trading participants are in no hurry to open new positions ahead of the publication of macroeconomic statistics.

Today the EU will present February business activity data from S&P Global: it is predicted that the Services PMI will remain at around 50.0 points, and the Manufacturing PMI at 48.9 points. Also during the day, investors will evaluate January data on producer inflation in the eurozone, which will complement statistics on consumer price dynamics published at the end of last week. On an annual basis, the Producer Price Index is expected to lose 8.1% after -10.6% in the previous month, and on a monthly basis the indicator could decline by 0.1% after -0.8% in December.

According to updated forecasts by analysts at the investment company The Goldman Sachs Group Inc. regarding further actions of the European Central Bank (ECB), as a result of the February slowdown in the rate of decline in inflation (the CPI excluding Food and Energy adjusted from 3.3% to 3.1%, becoming the lowest since March 2022), the regulator will begin to ease monetary policy no earlier than June, although previously it was expected that this process could begin in April.

Also today, February statistics on business activity in the US from S&P and the Institute for Supply Management (ISM) will hit the market. Experts expect that the ISM Services PMI will decline from 53.4 points to 53.0 points.

Tomorrow, investors will pay attention to January data on the dynamics of Retail Sales in the eurozone, as well as the publication of the Beige Book, an economic review from the US Federal Reserve. In addition, on Wednesday at 17:00 (GMT 2) the Chair of the American regulator, Jerome Powell, will speak in the US Congress. On Thursday, March 7, there will be a meeting of the ECB whose official representatives have not yet openly spoken about the prospects for lowering interest rates in the foreseeable future, so analysts expect the regulator to maintain a neutral position.

Support and resistance

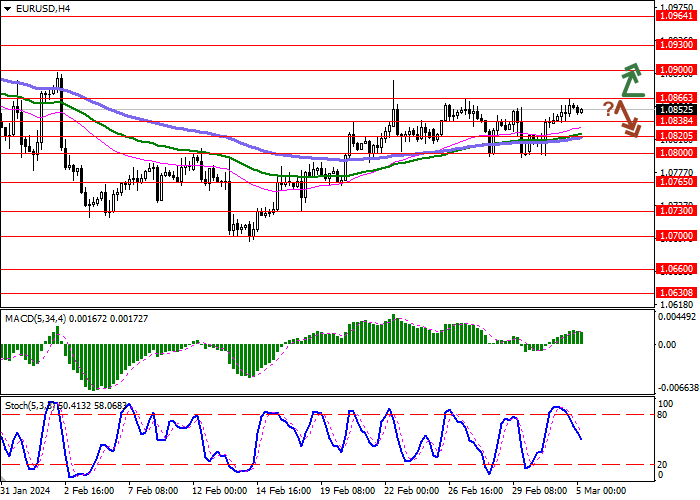

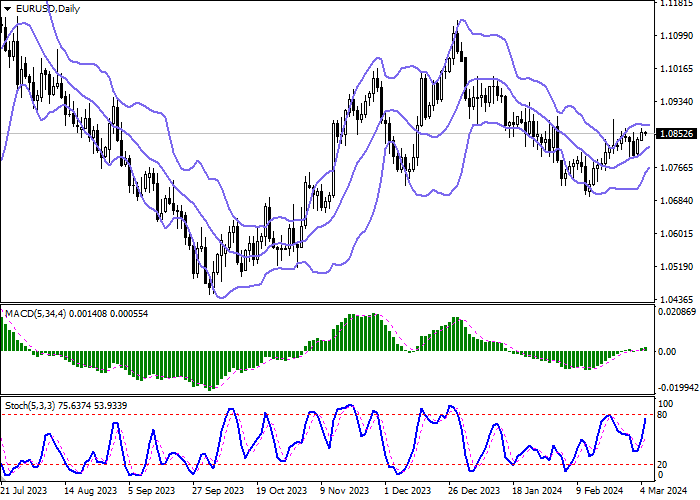

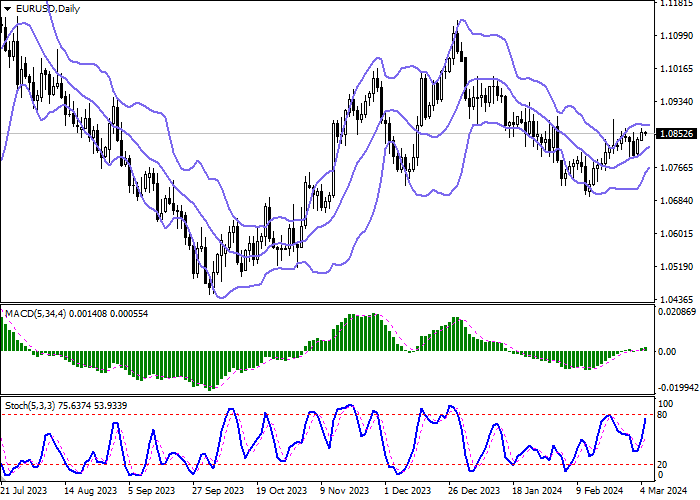

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic grows more steadily but is rapidly approaching its highs, which reflects risks of the overbought euro in the ultra-short term.

Resistance levels: 1.0866, 1.0900, 1.0930, 1.0964.

Support levels: 1.0838, 1.0820, 1.0800, 1.0765.

Trading tips

Long positions can be opened after a breakout of 1.0866 with the target of 1.0930. Stop-loss — 1.0838. Implementation time: 2-3 days.

A rebound from 1.0866 as from resistance, followed by a breakdown of 1.0838 may become a signal for opening of new short positions with the target at 1.0765. Stop-loss — 1.0875.

Hot

No comment on record. Start new comment.