Current trend

The AUD/USD pair is showing a moderate decline, building on the "bearish" short-term momentum formed last week and testing 0.6500 for a breakdown, despite strong macroeconomic data from Australia.

The Commonwealth Bank Services PMI rose from 52.8 points to 53.1 points in February, and the Composite PMI rose from 51.8 points to 52.1 points. The current account balance for the fourth quarter of 2023 increased significantly from 1.3 billion Australian dollars to 11.8 billion Australian dollars, beating expectations of 5.6 billion Australian dollars. In turn, Chinese Caixin Services PMI corrected from 52.7 points to 52.5 points in February, while the market expected 52.9 points.

On Wednesday, Australia will publish Gross Domestic Product (GDP) data for the fourth quarter of 2023: the national economy is projected to slow down from 2.1% to 1.4% in annual terms, and grow from 0.2% up to 0.3% in quarterly terms. Although Australia's January inflation rate remained unchanged from the previous month, it was the lowest level since November 2021, especially compared to a peak of 8.4% recorded in December 2022. Thirteen interest rate hikes by the Reserve Bank of Australia since May 2022 have kept a lid on price pressures. The most significant contribution to the annual dynamics of the January Consumer Price Index came from housing costs ( 4.6%), food and non-alcoholic drinks ( 4.4%), alcohol and tobacco products ( 6.7%), and insurance and financial services ( 8.2%).

In the US, the monthly economic review from the US Federal Reserve (Beige Book) will be published tomorrow, and the first of two planned speeches by the Chair of the American regulator, Jerome Powell, will take place in Congress. In addition, a report from Automatic Data Processing (ADP) on employment in the private sector will be presented: the number of jobs is projected to increase from 107.0 thousand to 150.0 thousand.

Support and resistance

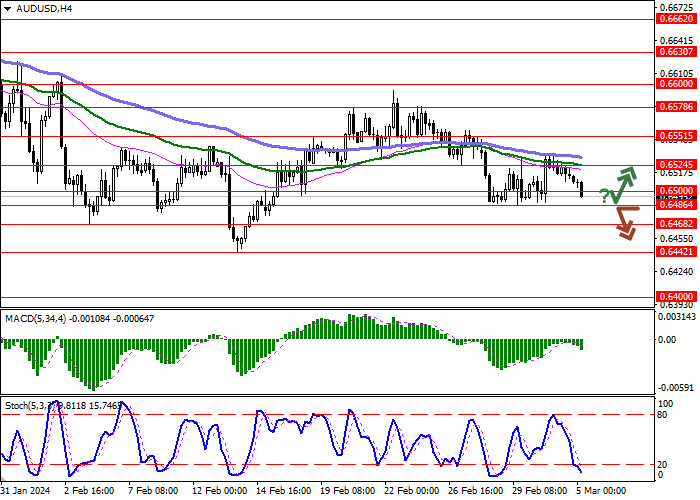

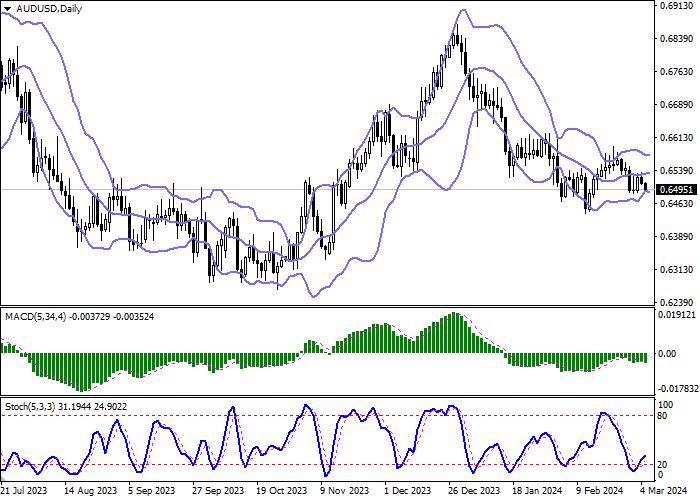

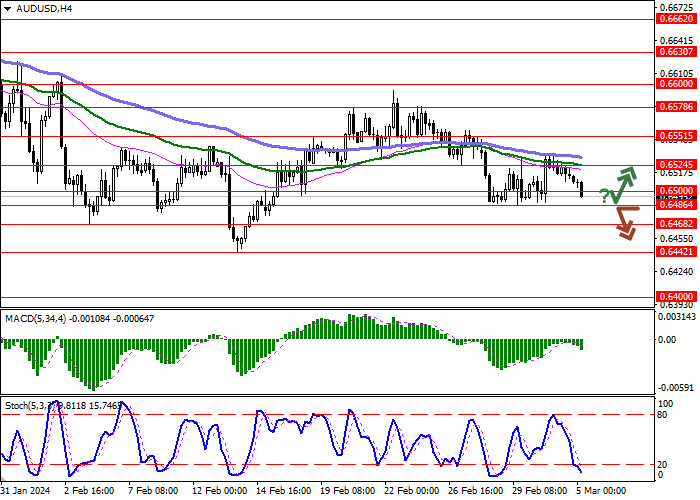

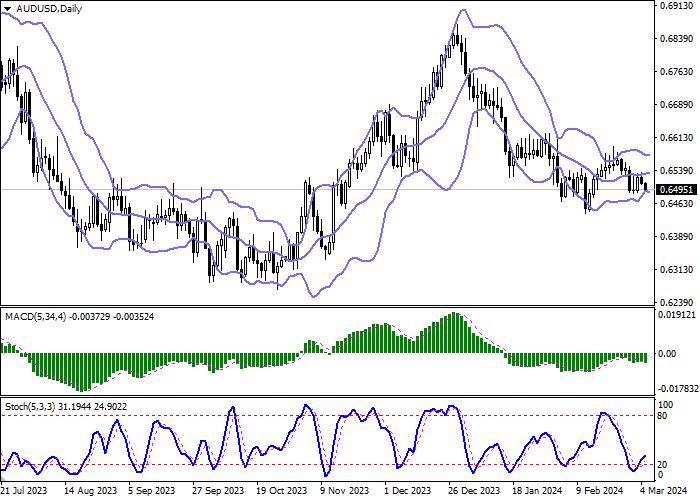

On the D1 chart Bollinger Bands are trying to reverse horisontally. The price range changes slightly, limiting short-term "bears" in the further development of the downward trend. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic, having retreated from its lows, remains in an upward direction, signaling the risks of a full-fledged "bullish" correction in the ultra-short term.

Resistance levels: 0.6524, 0.6551, 0.6578, 0.6600.

Support levels: 0.6500, 0.6486, 0.6468, 0.6442.

Trading tips

Short positions may be opened after a breakdown of 0.6486 with the target at 0.6442. Stop-loss — 0.6515. Implementation time: 1-2 days.

A rebound from 0.6486 as from support followed by a breakout of 0.6500 may become a signal for opening new long positions with the target at 0.6551. Stop-loss — 0.6475.

Hot

No comment on record. Start new comment.