Current trend

During the Asian session, prices for Brent Crude Oil are trying to develop the “bearish” momentum formed yesterday and are testing the level of 82.30 for a breakdown against low market activity.

Tomorrow, trading participants expect a speech by US Federal Reserve Chairman Jerome Powell in Congress, as well as the publication of data from Automatic Data Processing (ADP) on private sector employment and the monthly Beige Book economic review. Meanwhile, some pressure on the position of the American currency is exerted by national macroeconomic statistics, which increased the likelihood of an early transition to the “dovish” rate: the February index of business activity from the Institute for Supply Management (ISM) in the manufacturing sector decreased from 49.1 points to 47.8 points relative to forecasts for growth to 49.5 points, and the consumer confidence indicator from the University of Michigan decreased for the first time in the last three months, adjusting from 79.6 points to 76.9 points, while analysts expected zero dynamics.

Oil price is supported by the recent decision of OPEC to extend voluntary restrictions on oil production until the end of the second quarter: the total reduction currently amounts to 2.2M barrels per day. Experts from the International Energy Agency (IEA) note that given the slowdown in global fuel demand and increased supplies from North and South America, the organization will have to expand measures throughout 2024. Meanwhile, representatives of the Russian Federation expressed their intention to further reduce oil exports by another 471.0K barrels per day in the next quarter (previously, the figure reached 500.0K barrels per day). However, according to the Minister of Energy of the Russian Federation, Alexander Novak, the country intends to gradually restore additional supply and export volumes within OPEC if market conditions require it.

Support and resistance

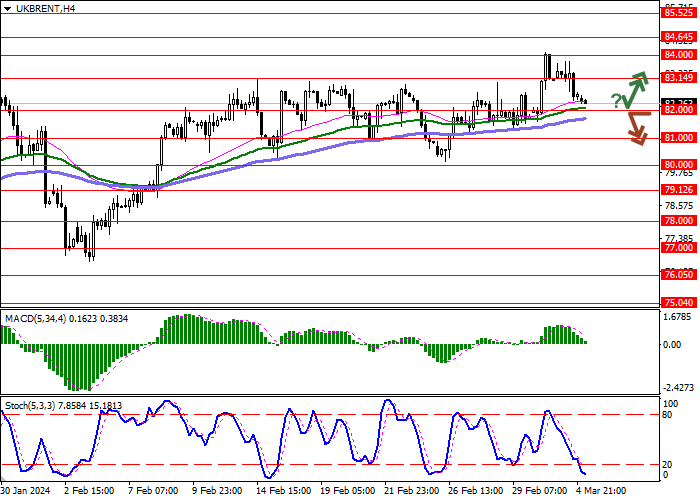

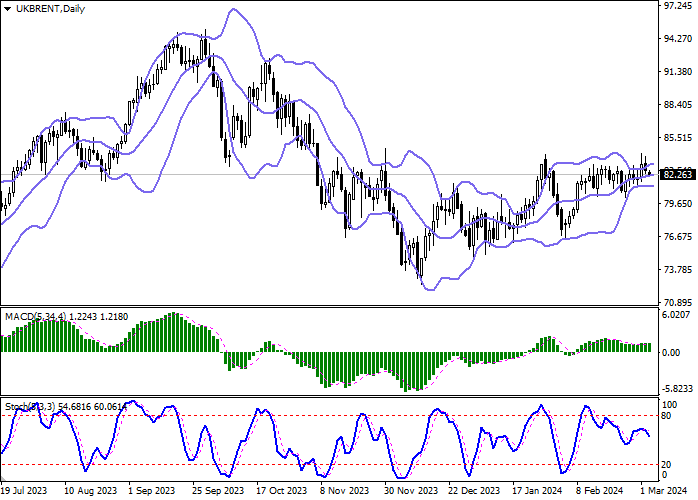

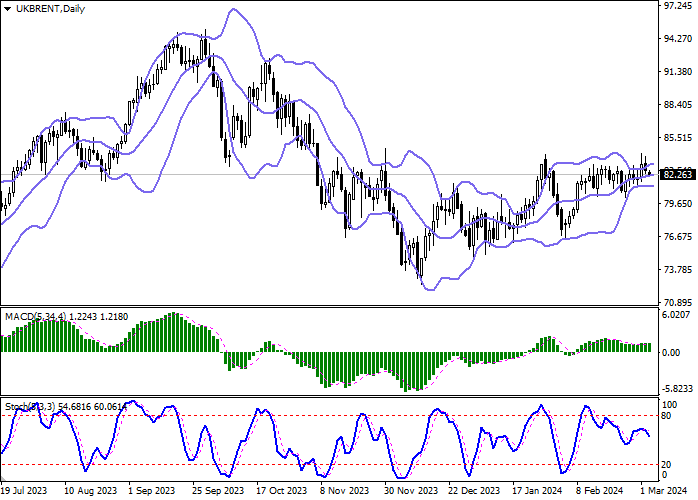

On the daily chart, Bollinger Bands are growing: the price range changes slightly, remaining not spacious enough for the current market activity level. The MACD indicator tries to reverse into a downward plane, maintaining the previous buy signal (the histogram is above the signal line). Stochastic shows similar dynamics in the center of the working area, which signals sufficient potential for the development of the “bearish” trend in the ultra-short term.

Resistance levels: 83.14, 84.00, 84.64, 85.52.

Support levels: 82.00, 81.00, 80.00, 79.12.

Trading tips

Short positions may be opened after a breakdown of 82.00, with the target at 80.00. Stop loss – 83.14. Implementation time: 2–3 days.

Long positions may be opened after a rebound from 82.00 and a breakout of 83.14, with the target at 85.52. Stop loss – 82.00.

Hot

No comment on record. Start new comment.