Current trend

Shares of General Electric Co., an American diversified corporation, are moving within the global uptrend and are trading around 161.00.

Management announced that GE Vernova's renewable energy division will be separated from the parent corporation on April 2, and until then, all shareholders registered on March 19 will receive one GE Vernova share for every four General Electric Co securities. The new company will be listed for trading on the New York Stock Exchange (NYSE) with the GEV ticker, while the GE Aerospace division will continue to trade under the GE ticker. Against this background, Deutsche Bank analysts maintained a "buy" rating, raising the target share price to 185.0 dollars per share from 165.0 dollars previously.

The General Electric Co. financial report is scheduled for April 23: analysts expect revenue at 15.23 billion dollars, which is lower than 19.4 billion dollars earlier, since by the date of the report GE Vernova will already be separated from the parent company. Earnings per share (EPS) will also decrease from 1.03 dollars to 0.637 dollars.

Support and resistance

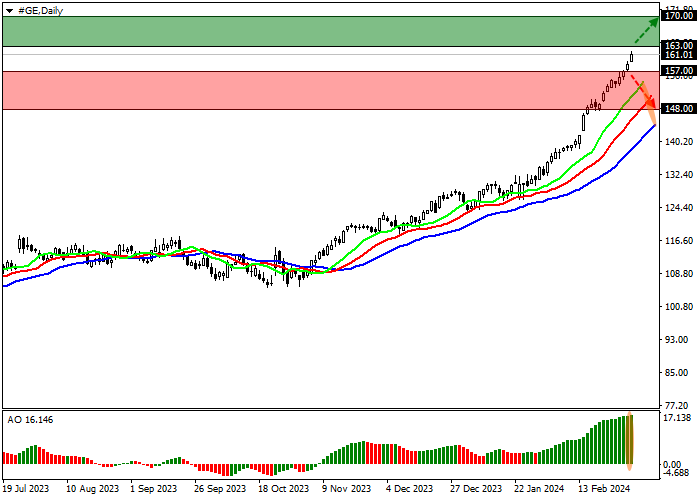

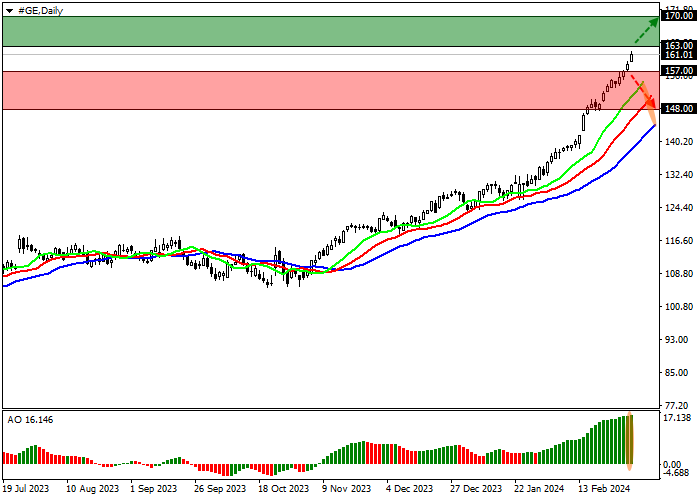

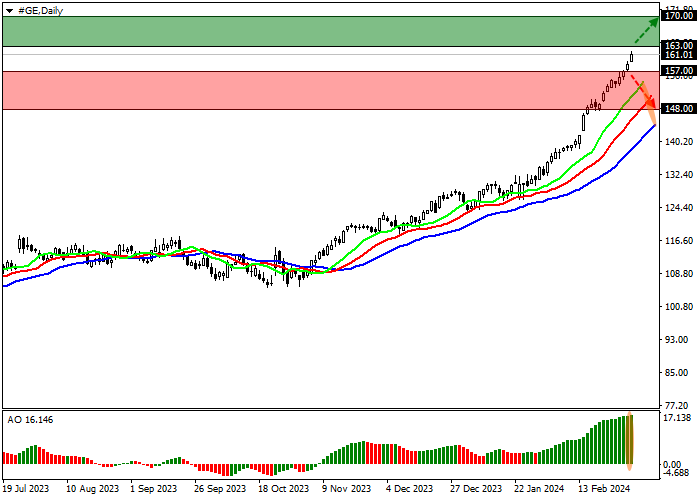

On the D1 chart, the asset is growing and holding in a global trend, having updated yesterday the annual maximum of 160.00.

Technical indicators show a stable buy signal, which is still strengthening: the fast EMAs of the Alligator indicator are held well above the signal line, and the AO histogram, being in the purchase zone, forms new ascending bars.

Support levels: 157.00, 148.00.

Resistance levels: 163.00, 170.00.

Trading tips

If the asset continues to grow and the price consolidates above the resistance level at 163.00, one may open long positions with the target of 170.00 and stop-loss of 160.00. Implementation time: 7 days and more.

In case of a reversal and continuation of the local decline of the asset, as well as price consolidation below the local support at 157.00, one can open short positions with the target of 148.00 and stop-loss of 160.00.

Hot

No comment on record. Start new comment.