Current trend

The XAU/USD pair is showing a weak corrective decline, consolidating near 2080.00 and retreating from new local highs from December 4. The instrument showed the most active growth last Friday in response to the publication of macroeconomic data in the United States, as well as against the backdrop of increased demand for physical gold from global central banks.

Among other things, trading participants drew attention to the deterioration in consumer sentiment in February, which increased the risks of the possible launch of a program to reduce borrowing costs by the US Federal Reserve in the near future. The Consumer Confidence Index from the University of Michigan dropped from 79.6 points to 76.9 points with neutral forecasts. In addition, the Manufacturing PMI from the Institute for Supply Management (ISM) in February fell from 49.1 points to 47.8 points, while analysts expected 49.5 points. Construction Spending in January was -0.2% after a sharp increase of 1.1% in the previous month, while experts had expected 0.2%.

On Tuesday, investors will evaluate statistics on business activity in the services sector from the ISM, and on Wednesday, March 6, the focus will shift to a report from Automatic Data Processing (ADP) on private sector employment, as well as the publication of the monthly economic review from the Federal Reserve USA, the Beige Book.

Meanwhile, the correction continues on the gold contracts market. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal increased to 141.6 thousand from 140.3 thousand a week earlier. For the fourth week in a row, the liquidation of contracts by the "bears" continues: their balance in positions secured by real money amounted to 47.001 thousand versus 115.043 thousand for the "bulls". Last week, buyers opened 4.956 thousand new transactions, and sellers opened 1.262 thousand, which helped maintain the balance and interrupted the outflow of short positions from the asset.

Support and resistance

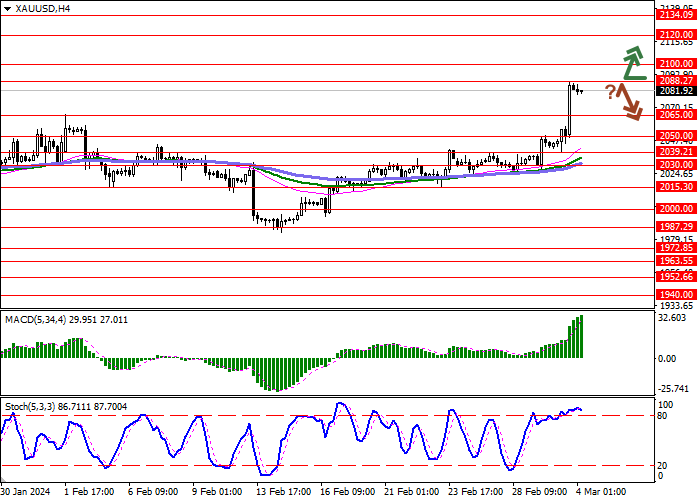

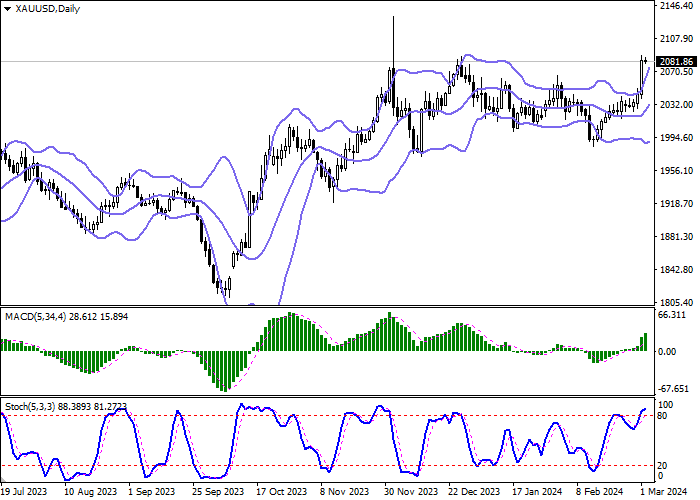

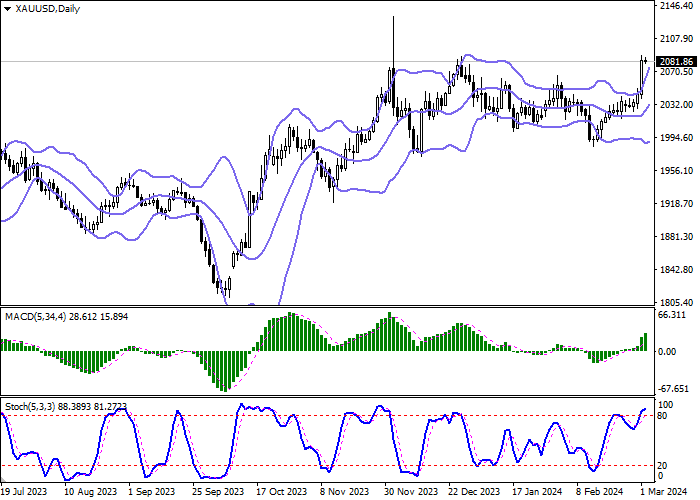

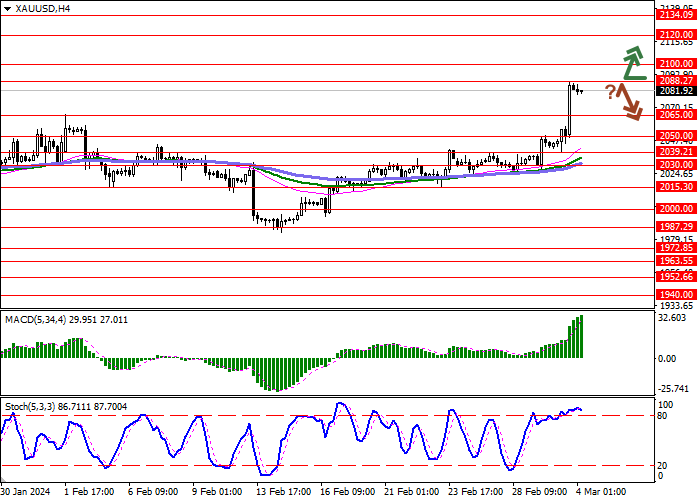

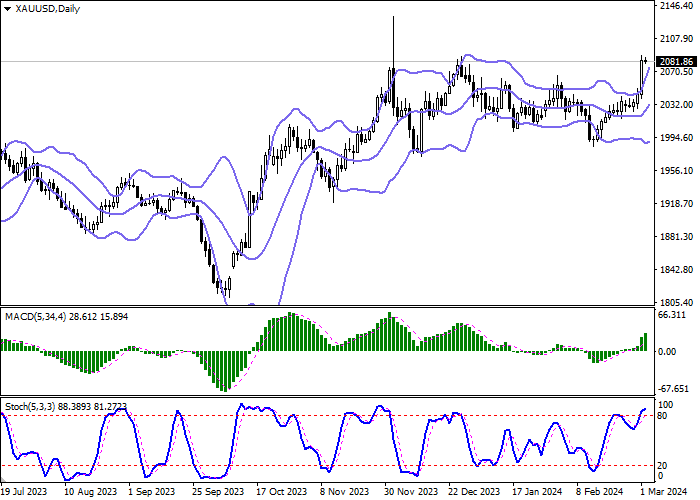

Bollinger Bands in D1 chart show active growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic retains an uptrend, but is located in close proximity to its highs, which points to the risk of overbought instrument in the ultra-short term.

Resistance levels: 2088.27, 2100.00, 2120.00, 2134.09.

Support levels: 2065.00, 2050.00, 2039.21, 2030.00.

Trading tips

Long positions can be opened after a breakout of 2088.27 with the target of 2120.00. Stop-loss — 2075.00. Implementation time: 2-3 days.

A rebound from 2088.27 as from resistance, followed by a breakdown of 2065.00 may become a signal for opening of new short positions with the target at 2030.00. Stop-loss — 2080.00.

Hot

No comment on record. Start new comment.