Current trend

The USD/JPY pair is showing moderate growth, developing the "bullish" signal formed on Friday, March 1. The instrument is testing 150.25 for a breakout, and trading participants continue to analyze macroeconomic statistics from the US and Japan published at the end of last week. American data disappointed investors with a reduction in the Manufacturing PMI from the Institute for Supply Management (ISM) in February from 49.1 points to 47.8 points, while analysts had expected 49.5 points. At the same time, the indicator from S&P Global showed an increase from 51.5 points to 52.2 points, ahead of neutral forecasts.

In turn, the Japanese Jibun Bank Manufacturing PMI remained at 47.2 points in February, and Consumer Confidence rose from 38.0 points to 39.1 points. The Unemployment Rate in January corrected from 2.5% to 2.4%, and the Jobs/Applicants Ratio was again 1.00:1.27. Bank of Japan Governor Kazuo Ueda, at a meeting of G20 financial leaders in Sao Paulo, urged market participants not to jump to conclusions that inflation is close to the 2.0% target, and stressed the need to carefully study additional data on wage dynamics, as well as the importance of negotiations between companies and trade unions, which will have a key influence on the Bank's decision to adjust the interest rate. With the Consumer Price Index above 2.0% for more than a year, investors are confident that the regulator will end its ultra-loose monetary policy by April and raise borrowing costs from the -0.10% level where it has been held since 2016.

On Tuesday, March 5, February statistics on consumer inflation in the Tokyo region will be published: the CPI excluding Fresh Food is projected to increase from 1.6% to 2.5%.

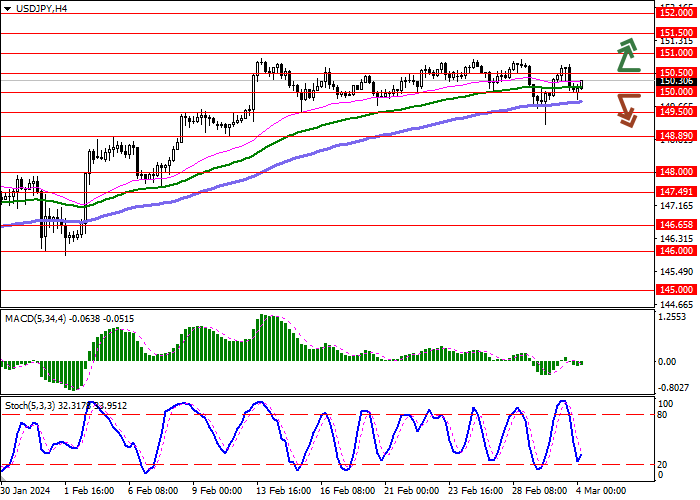

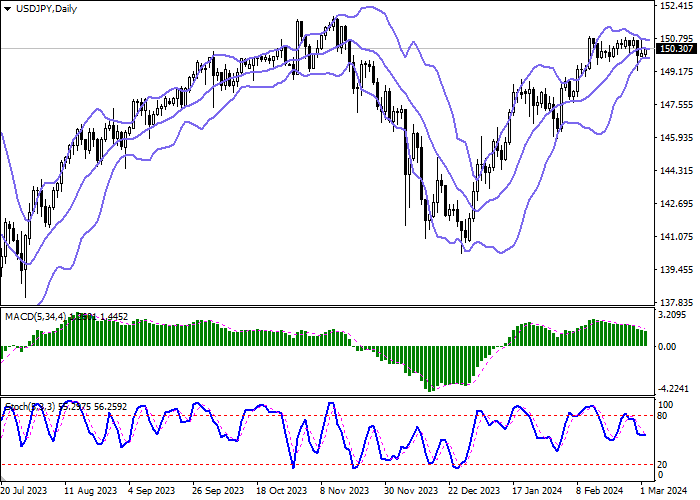

Support and resistance

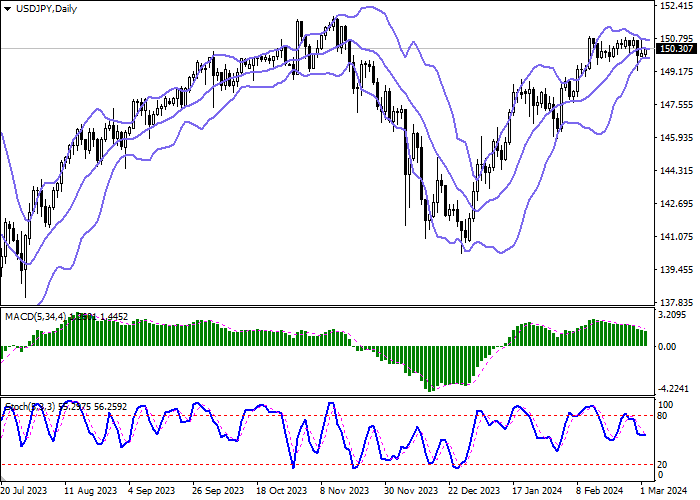

On the D1 chart Bollinger Bands are trying to reverse horisontally. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic, having retreated from its highs, reversed to the horizontal plane, indicating an approximate balance in the ultra-short term.

Resistance levels: 150.50, 151.00, 151.50, 152.00.

Support levels: 150.00, 149.50, 148.89, 148.00.

Trading tips

Long positions can be opened after a breakout of 150.50 with the target of 151.50. Stop-loss — 150.00. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 150.00 may become a signal for new short positions with the target at 148.89. Stop-loss — 150.50.

Hot

No comment on record. Start new comment.