Current trend

The NZD/USD pair is showing a moderate decline, correcting after an attempt to rise last Friday, when the instrument managed to retreat from the local lows of February 14. Quotes are testing 0.6100 for a breakdown, while traders are in no hurry to open positions in anticipation of the emergence of new drivers on the market.

Today investors paid attention to statistics from New Zealand and Australia. The New Zealand Terms of Trade index fell sharply by 7.8% in the fourth quarter of 2023 after -0.6% in the previous period, while analysts had expected -0.2%. Australian data from TD Securities showed a further easing in price pressures, with the Consumer Price Index slowing down from 4.6% to 4.0% year-on-year in February, and falling 0.1% month-on-month after rising 0.3% in January.

In addition, trading participants are still analyzing the statistics published on Friday, March 1. ANZ Banking Group's New Zealand Consumer Confidence Index rose to 94.5 from 93.6 in January, with Building Permits down sharply by 8.8% after rising 3.6% the month before. Experts believe that the national economy is still heterogeneous, but positive trends in some sectors can still be seen, in particular in the services and agriculture sectors. However, the situation remains difficult in the manufacturing industry. Analysts highlight that the increase in investment interest in most sectors has been noticeable, in addition, about 74.0% of businesses expect their costs to increase in the next three years.

On Tuesday, March 5, the US will present data on business activity in the services sector: forecasts suggest a reduction in the February indicator from 53.4 points to 53.0 points.

Support and resistance

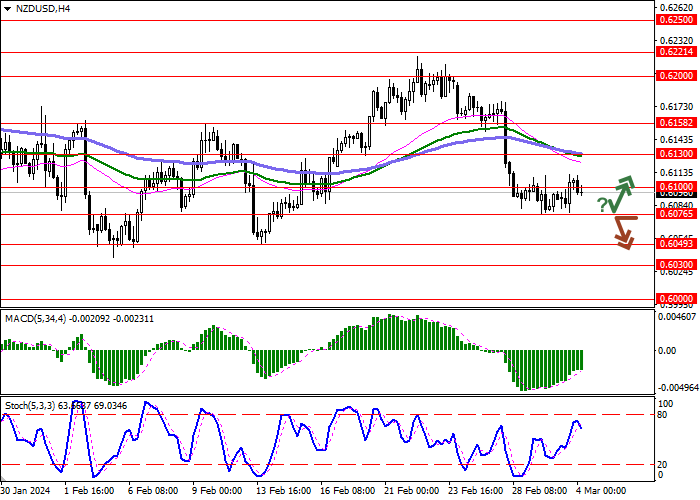

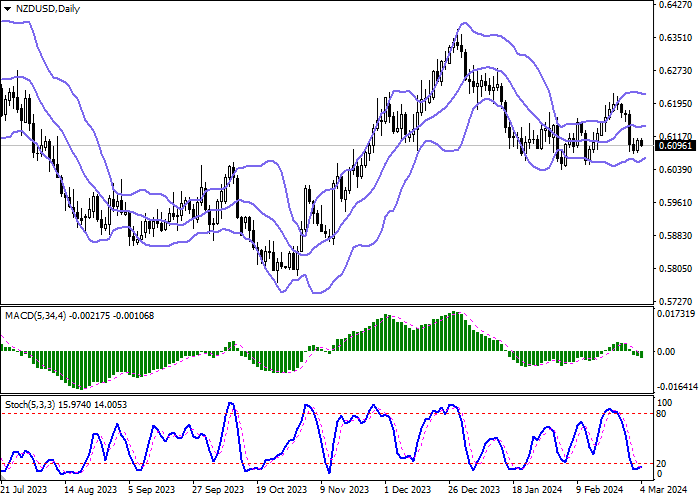

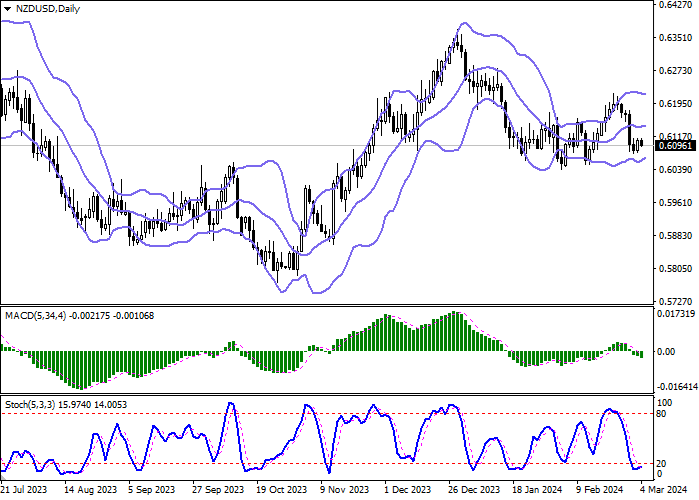

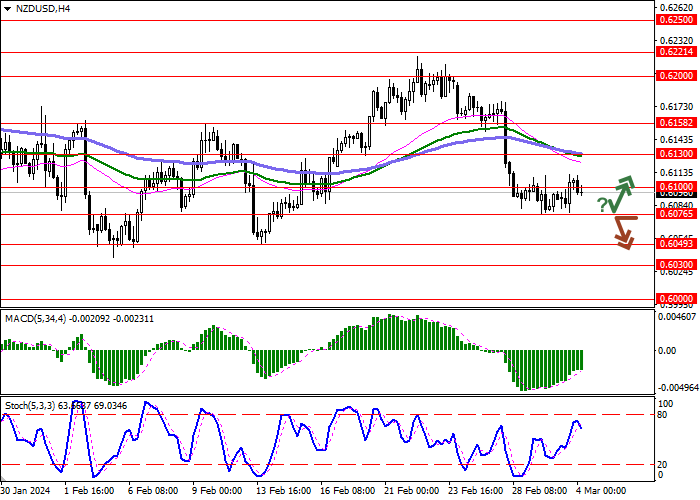

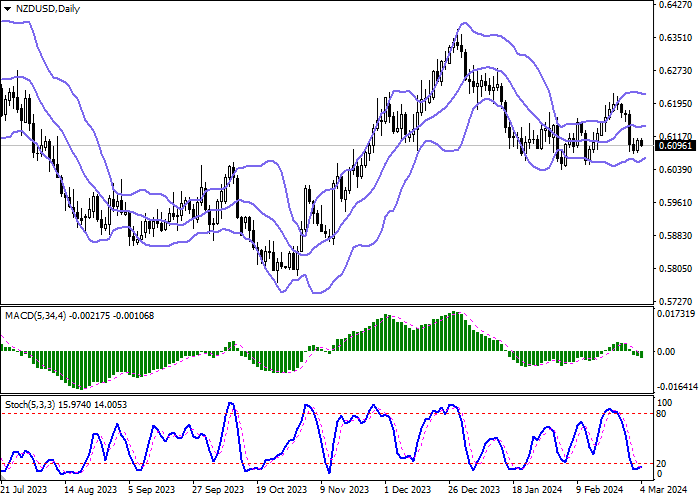

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowed from below, remaining spacious enough for the current market activity. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic, having reached its lows, is trying to reverse into an upward plane, indicating the risks of the instrument being oversold in the near future.

Resistance levels: 0.6100, 0.6130, 0.6158, 0.6200.

Support levels: 0.6076, 0.6049, 0.6030, 0.6000.

Trading tips

Short positions may be opened after a breakdown of 0.6076 with the target at 0.6030. Stop-loss — 0.6100. Implementation time: 1-2 days.

A rebound from 0.6076 as from support followed by a breakout of 0.6100 may become a signal for opening new long positions with the target at 0.6158. Stop-loss — 0.6076.

Hot

No comment on record. Start new comment.