Current trend

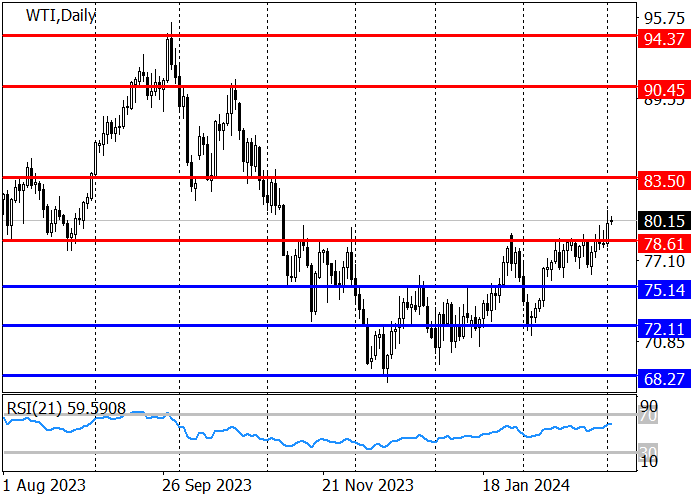

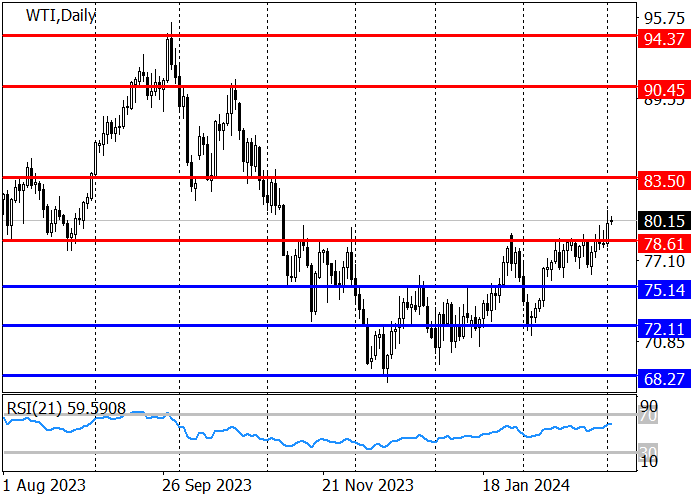

The price of WTI Crude Oil is trading at 80.18, preparing to continue rising to the area of 83.50 against the results of the OPEC meeting, during which participants announced their intention to continue reducing oil supplies until the middle of the year to prevent a global surplus and support oil prices.

The restrictions, which formally amount to approximately 2.0M barrels per day, will remain in force until the end of June. Kuwait, Algeria, Saudi Arabia, and Oman also plan to join the measures. The leader in production, Saudi Arabia, accounts for half of the promised limit, 1.0M barrels per day. In turn, Russia will implement an additional voluntary reduction in oil production and exports by a total of 471.0K barrels per day in the second quarter.

Meanwhile, the correction continues in the market: according to the latest report from the US Commodity Futures Trading Commission (CFTC), last week, the number of net speculative positions in WTI Crude Oil increased from 191.9K to 224.8K. As for the dynamics, the consolidation of the trading instrument continues without a clear directional movement: the balance of the “bulls” with swap dealers amounted to 19.708K against 32.992K for the “bears.” Last week, buyers reduced their positions by a symbolic 0.036K, while sellers liquidated 1.864K transactions.

Against this background, the long-term trend will reverse upwards, and the price will overcome the resistance level of 78.61. Now, the growth target is 83.50, and 78.61 becomes support. After the correction, purchases with a designated target are relevant: after a breakout, the growth will continue to 90.45.

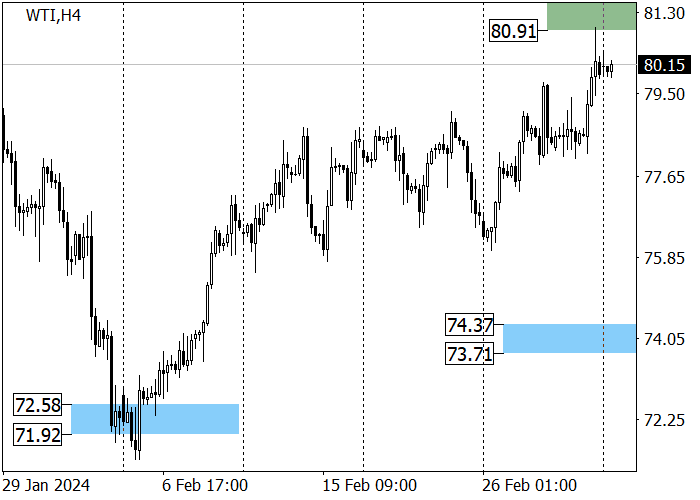

The medium-term trend is upward: last week, the quotes reached zone 2 (81.57–80.91) but could not break it. If this area is kept, a downward correction to the area of key trend support 74.37–73.71 will begin, after which long positions with the target at last week’s high of 80.91 are relevant. If, as part of the growth, the asset overcomes zone 2, the movement will continue to 88.17–87.51.

Support and resistance

Resistance levels: 83.50, 90.45.

Support levels: 78.61, 75.14.

Trading tips

Long positions may be opened from 78.61, with the target at 83.50 and stop loss around 77.50. Implementation time: 9–12 days.

Short positions may be opened below 77.50, with the target at 75.14 and stop loss around 78.61.

Hot

No comment on record. Start new comment.