Current trend

Last week, the BTC/USD pair resumed active growth after temporary consolidation and reached its highest values since November 2021 in the area of 64300.00.

The strengthening of BTC is facilitated by existing factors — the influx of investments into recently opened bitcoin ETFs and the expectation of the Bitcoin network halving, scheduled for April. It should be noted that as of March 1, the volume of investor funds managed by the iShares Bitcoin Trust (IBIT) fund from BlackRock Inc. amounted to 10.0 billion dollars. Experts note that this result was achieved in just 39 trading days, while the first American gold-based ETF took about two years to raise a similar amount.

The demand for crypto assets continues on the part of retail investors, as evidenced by the increase in the number of transactions on the Block, Robinhood, and Coinbase platforms (which recently experienced a failure caused by excessive customer interest in BTC).

In anticipation of halving, investors' need for new coins is growing, and the volume of supply is falling, as miners hold the tokens, and buyers who have already purchased BTC withdraw them from exchanges, awaiting further price strengthening. According to the CryptoSlate analytical company, at the beginning of the month, coins worth 2.3 billion dollars were withdrawn from digital platforms alone, which is the highest figure in the last 5 years. In these conditions, further growth of the BTC/USD pair is seen as preferable, although some price correction in the case of partial profit-taking by investors is not excluded.

Support and resistance

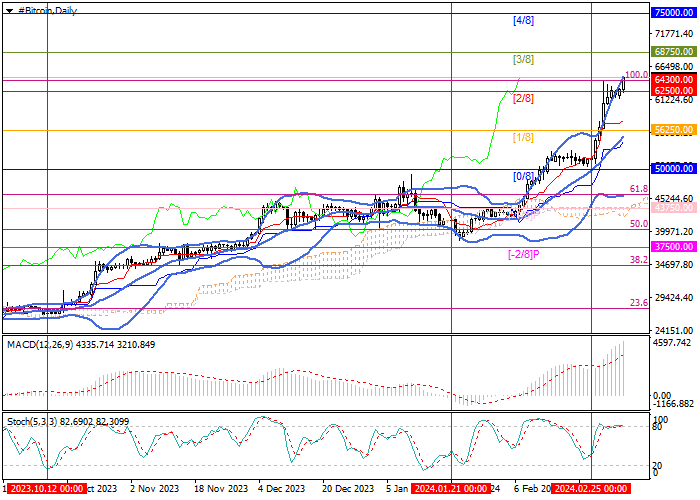

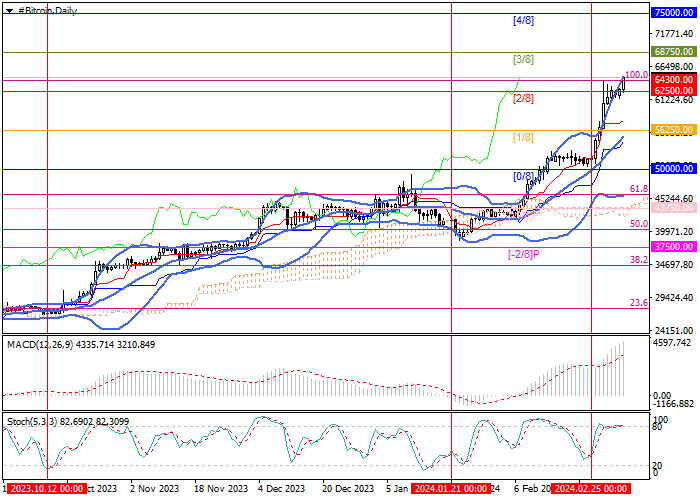

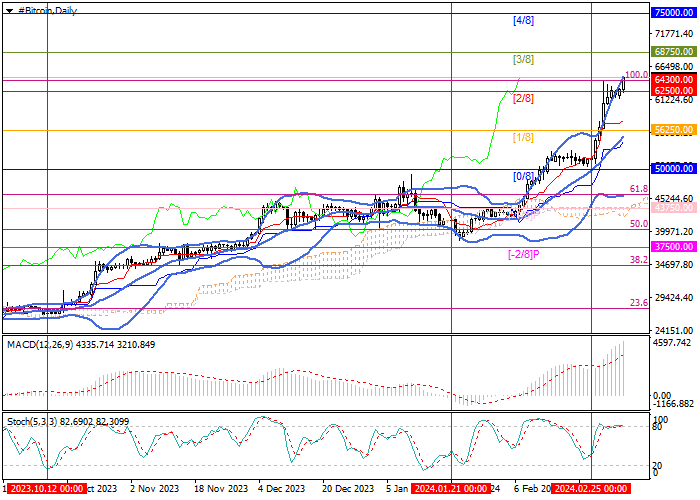

The price is testing the 64300.00 mark (100.0% Fibonacci retracement), consolidation above which will lead to continued growth to the levels of 68750.00 (Murrey level [3/8]) and 75000.00 (Murrey level [4/8]).

The uptrend continues, which is confirmed by technical indicators: Bollinger Bands are directed upwards, MACD is increasing in the positive zone, and Stochastic has reversed horizontally at the overbought zone, which does not exclude a corrective pullback of quotes to the area of 56250.00 (Murrey level [1/8], the central line of Bollinger Bands), however, it is unlikely to lead to a change in the current uptrend.

Resistance levels: 64300.00, 68750.00, 75000.00.

Support levels: 56250.00, 50000.00.

Trading tips

Long positions can be opened above the 64300.00 mark or after the price reversal around 56250.00 with targets of 68750.00, 75000.00 and stop-losses of 62500.00 and 52300.00, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.