Current trend

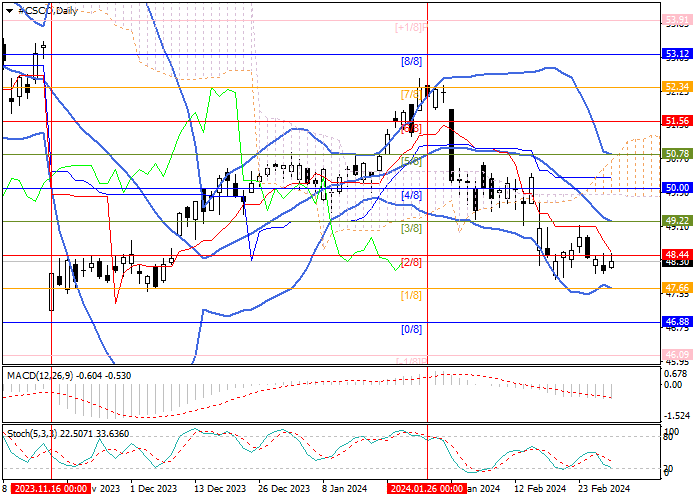

Shares of Cisco Systems Inc., an American manufacturer and supplier of network equipment for large holdings and telecommunications companies, resumed their decline within the medium-term downtrend that has been going on for more than a month: during this time, the price reversed from 52.34 (Murrey level [7/8]), moved into the negative part of the Murrey trading range and is trying to consolidate below the reversal mark of 48.44 (Murrey level [2/8]).

If successful, the decline in quotes will continue to the lower border of the trading range at 46.88 (Murrey level [0/8]) and further into the reversal zone to the 46.09 mark (Murrey level [-1/8]). The key mark for the "bulls" is 49.22 (Murrey level [3/8]), the breakout of which will allow the quotes to continue growing within the central Murrey channel to the levels of 50.00 (Murrey level [4/8]) and 50.78 (Murrey level [5/8]), but such a scenario seems less likely in the near future.

Technical indicators confirm the continuation of the downtrend: Bollinger Bands and Stochastic are pointing downwards, while MACD is increasing in the negative zone.

Support and resistance

Resistance levels: 49.22, 50.00, 50.78.

Support levels: 48.44, 46.88, 46.09.

Trading tips

Short positions should be opened from the 47.95 mark with targets of 46.88, 46.09 and stop-loss around 48.70. Implementation period: 5–7 days.

Long positions can be opened above the level of 49.22 with targets of 50.00, 50.78 and stop-loss around 48.55.

Hot

No comment on record. Start new comment.