Current trend

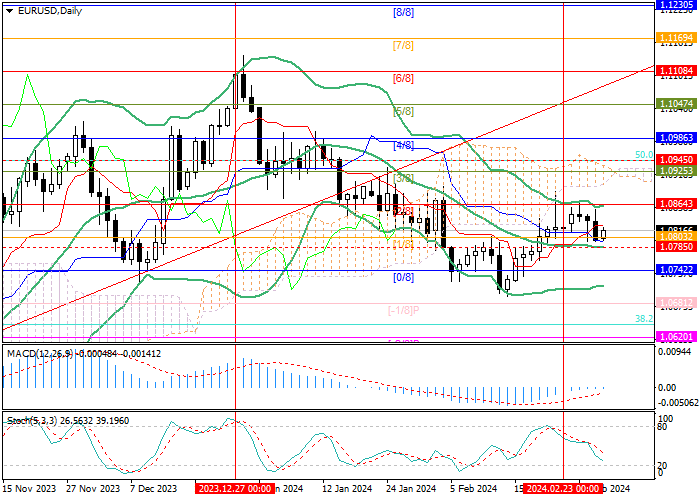

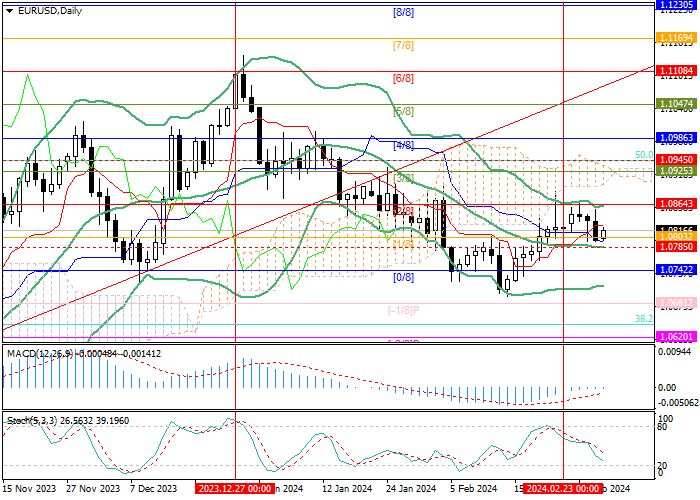

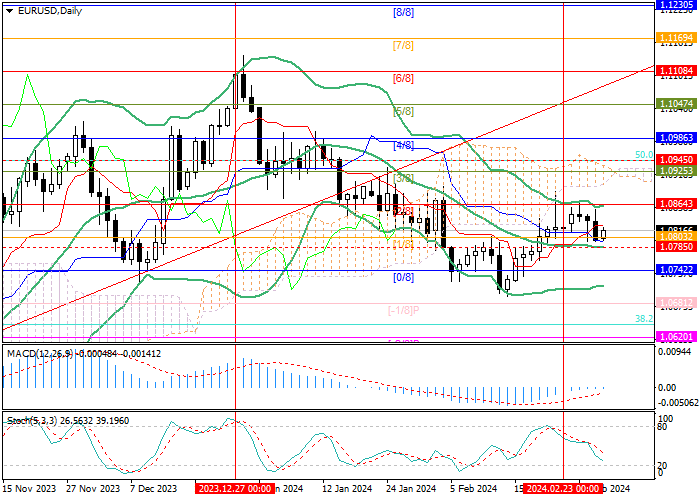

This week, the EUR/USD pair had ambiguous dynamics: at first, it tested the 1.0864 mark (Murrey level [2/8]), but could not consolidate above it and fell to the level of 1.0803 (Murrey level [1/8]).

The US currency is strengthening despite yesterday's release of positive January data on the basic index of private consumption expenditures in the United States: YoY, the indicator fell from 2.9% to 2.8%, reassuring investors who were worried about its growth. The previously published January consumer price index was 3.1%, exceeding the 2.9% expected by experts, which raised doubts in the market about the imminent easing of the US Federal Reserve's monetary policy, but now it is clear that the downtrend in inflationary pressure in the American economy remains.

Today, quotes resumed growth against the background of the publication of preliminary February inflation data in the Eurozone: the consumer price index amounted to 2.6% YoY, turning out to be higher than the projected 2.5%, and the base indicator turned out to be at 3.1%, also exceeding 2.9% expected by experts. Thus, inflation continued to slow down, but at a slower pace than expected, which increases the likelihood of postponing the start of interest rate cuts by the European Central Bank (ECB) to a later date and supports the euro.

Support and resistance

Technically, the price is located near the support zone of 1.0803–1.0785 (Murrey level [1/8], the central line of Bollinger Bands), at the breakdown of which the decline will continue to the levels of 1.0681 (Murrey level [-1/8]) and 1.0620 (Murrey level [-2/8]). The key mark for the "bulls" remains 1.0864 (Murrey level [2/8]), consolidating above which will allow the quotes to continue growing towards the targets of 1.0945 (50.0% Fibonacci retracement) and 1.0986 (Murrey level [4/8]).

Technical indicators do not give a clear signal: Bollinger Bands are horizontal, MACD is at the zero line, its volumes are insignificant, and Stochastic is pointing down.

Resistance levels: 1.0864, 1.0945, 1.0986.

Support levels: 1.0785, 1.0681, 1.0620.

Trading tips

Short positions should be opened below the 1.0785 mark with targets of 1.0681, 1.0620 and stop-loss around 1.0840. Implementation period: 5–7 days.

Long positions can be opened above 1.0864 with targets of 1.0945, 1.0986 and stop-loss around 1.0820.

Hot

No comment on record. Start new comment.