Current trend

The USD/CHF pair is trading near zero, consolidating near 0.8785. Market activity remains subdued ahead of the publication of macroeconomic statistics in the US and EU. Among other things, investors will evaluate inflation data.

In Germany, the annual dynamics of the Consumer Price Index is expected to slow down in February from 2.9% to 2.6%, while in monthly terms the indicator is expected to increase from 0.2% to 0.5%. The Harmonized CPI in annual terms may decrease from 3.1% to 2.7%, and in monthly terms it may amount to 0.6% after -0.2% in the previous month. Finalized statistics on inflation in the eurozone will be published tomorrow: the Core CPI is projected to fall from 3.3% to 2.9%.

Today the market will receive data on the Core Personal Consumption Expenditures - Price Index in the United States: the indicator is expected to decrease in January from 2.9% to 2.8% on an annual basis and increase from 0.2% to 0.4% on a monthly basis.

In turn, in Switzerland during the day KOF Leading Indicator will be presented. The indicator is expected to rise from 101.5 points to 102.0 points in February. Investors will also evaluate statistics on Gross Domestic Product (GDP) for the fourth quarter of 2023: analysts expect that in quarterly terms the national economy will slow down from 0.3% to 0.1%, and in annual terms it will accelerate from 0.3% to 0.7%.

Support and resistance

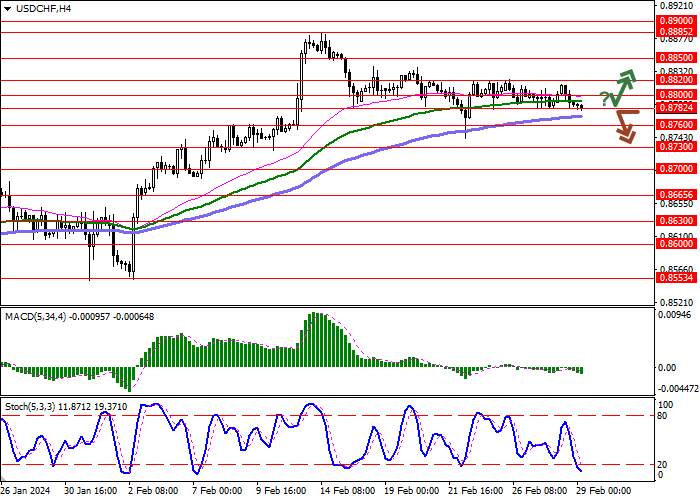

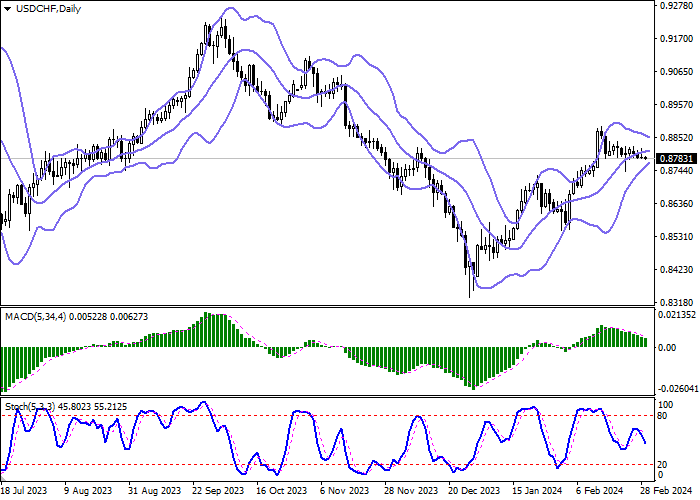

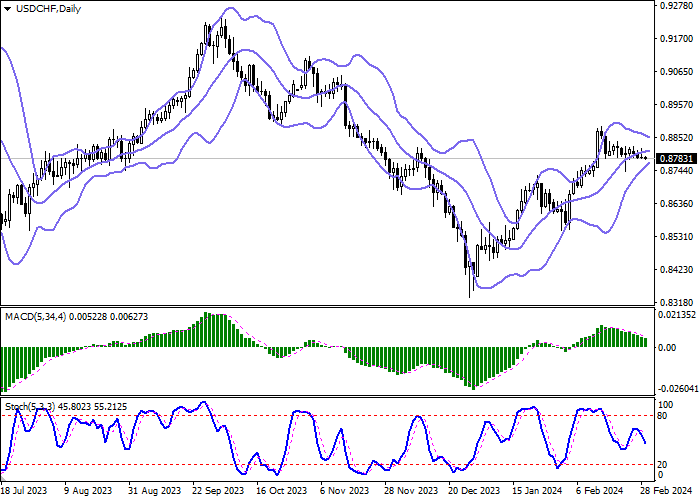

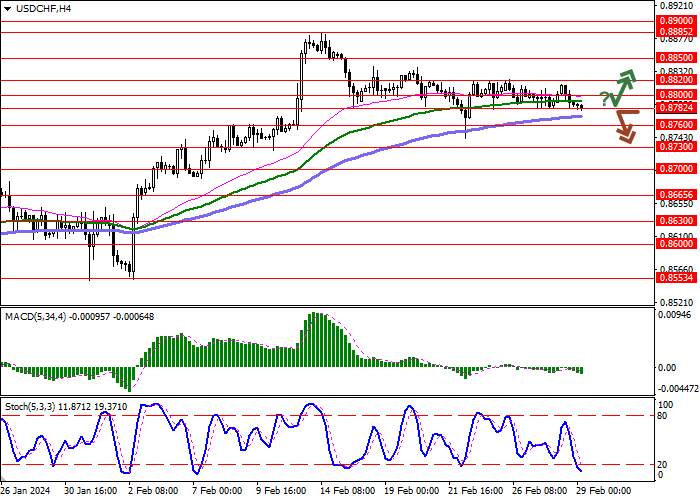

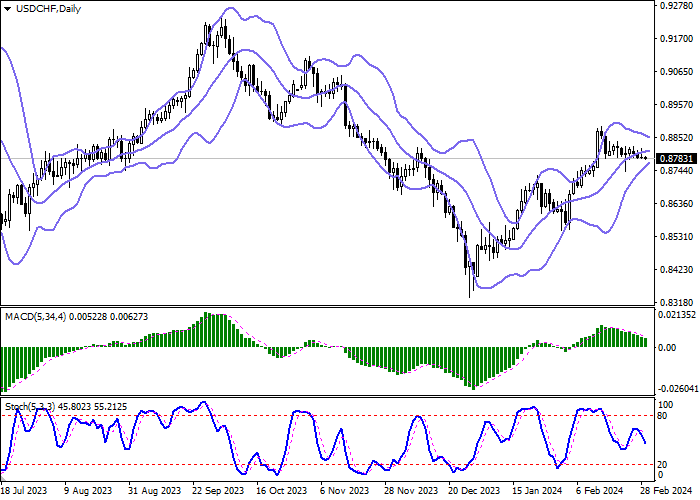

On the D1 chart Bollinger Bands are trying to reverse horizontally. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic, having shown a downward reversal at the beginning of the week, maintains a downward direction and is located approximately in the center of its area.

Resistance levels: 0.8800, 0.8820, 0.8850, 0.8885.

Support levels: 0.8782, 0.8760, 0.8730, 0.8700.

Trading tips

Short positions may be opened after a breakdown of 0.8782 with the target at 0.8730. Stop-loss — 0.8820. Implementation time: 1-2 days.

A rebound from 0.8782 as from support followed by a breakout of 0.8820 may become a signal for opening new long positions with the target at 0.8885. Stop-loss — 0.8782.

Hot

No comment on record. Start new comment.