Current trend

The USD/CAD pair is holding near 1.3570, showing multidirectional dynamics, which sharply contrasts with the active growth of the instrument the day before, as a result of which the US dollar managed to update local highs from December 13.

The American currency was again supported by expectations that the US Federal Reserve will maintain its "hawkish" policy for a longer period against the backdrop of macroeconomic statistics published the day before. The Personal Consumption Expenditures Prices in the fourth quarter of 2023 adjusted from 1.7% to 1.8%, and the Core Personal Consumption Expenditures adjusted from 2.0% to 2.1%. At the same time, analysts also drew attention to the revision of data on Gross Domestic Product (GDP) for the same period: the new estimate assumes growth of the American economy by 3.2% in annual terms, and not by 3.3%.

Today in the US, January statistics on the price index of personal consumption expenditures will be presented: the Core Personal Consumption Expenditures - Price Index is projected to slow down from 2.9% to 2.8% in annual terms and increase from 0.2% to 0.4% in monthly terms. Also, during the day, January data on the Pending Home Sales will be published and speeches will be given by representatives of the US Federal Reserve Loretta Mester, Raphael Bostic and Austan Goolsbee.

In turn, Canada will present data on GDP dynamics today. Analysts expect the domestic economy to grow 0.8% year-on-year in the fourth quarter of 2023, after contracting 1.1% in the previous quarter, with the figure expected to remain steady at 0.2% MoM in December.

Support and resistance

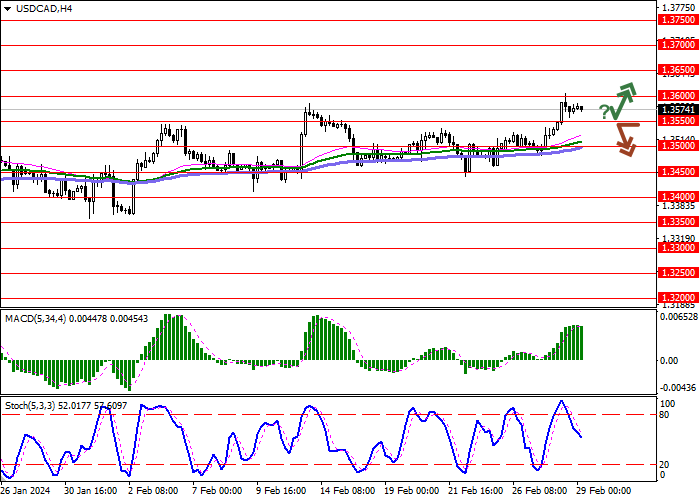

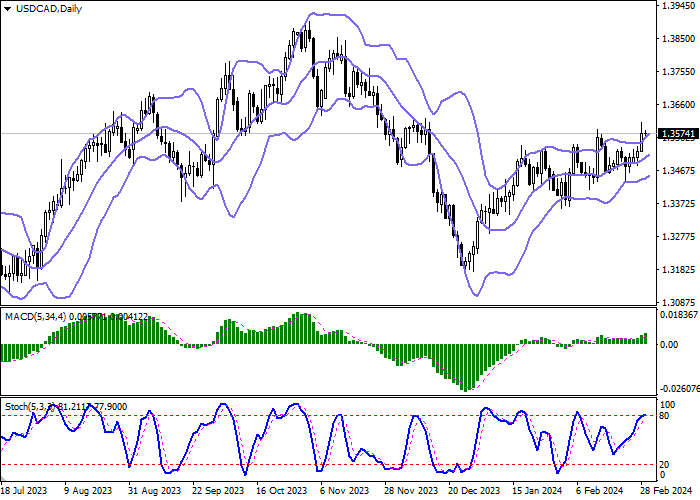

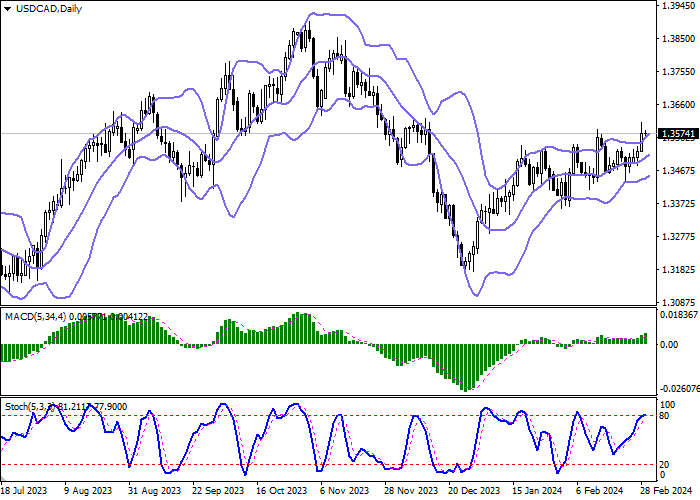

Bollinger Bands in D1 chart show quite active growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic is showing similar dynamics, but the line of the indicator is gradually approaching its highs, indicating the risks of overbought US dollar in the ultra-short term.

Resistance levels: 1.3600, 1.3650, 1.3700, 1.3750.

Support levels: 1.3550, 1.3500, 1.3450, 1.3400.

Trading tips

Short positions may be opened after a breakdown of 1.3550 with the target at 1.3450. Stop-loss — 1.3600. Implementation time: 2-3 days.

A rebound from 1.3550 as from support followed by a breakout of 1.3600 may become a signal for opening new long positions with the target at 1.3700. Stop-loss — 1.3550.

Hot

No comment on record. Start new comment.