Today, we present you a mid-term investment overview of the EUR/USD pair.

Weak macroeconomic statistics continue to hinder the development of the upward dynamics of the European currency. In mid-February, data on the state of the Eurozone economy for Q4 2023 were published: gross domestic product (GDP) was fixed at zero in quarterly terms and increased by a symbolic 0.1% YoY after zero dynamics earlier. Consumption is also at a very low level: retail sales fell by 1.1% in December after an increase of 0.3% earlier, which led to a slowdown in the annual rate from -0.4% to -0.8%.

The next meeting of the European Central Bank (ECB) will be held in early March, and it is highly likely that the regulator will keep the interest rate at 4.50% for the sixth time in a row. Despite the fact that consumer prices increased by 2.8% in January, the indicator will tend to accelerate in the spring, given the increase in oil prices. Thus, the current ECB policy has almost no effect on consumer prices, unlike the pressure on the economy, which is on the verge of recession.

The quotes of the US currency are relatively stable and have been slightly below 104.0 points for a long time. On March 20, the US Federal Reserve will hold a meeting on monetary policy and, according to the Chicago Mercantile Exchange (CME Group) FedWatch Tool, the probability of maintaining the key rate at 5.25–5.50% is 97.5%. The labor market is stable, but it is in a more difficult position than at the end of last year: then the average number of applications for unemployment benefits was 220.0–230.0 thousand, and now this value ranges within 200.0–210.0 thousand. At the same time, the consumer price index, despite the recent decline from 3.4% to 3.1%, is still higher than the same indicator in the EU.

Thus, there are practically no prospects for the growth of the European currency now, and the dollar is likely to remain at the same levels, which will be enough for downward pressure on the EUR/USD pair.

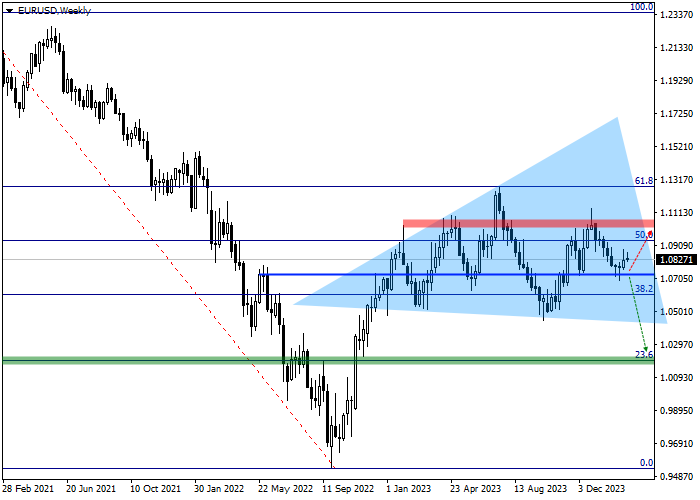

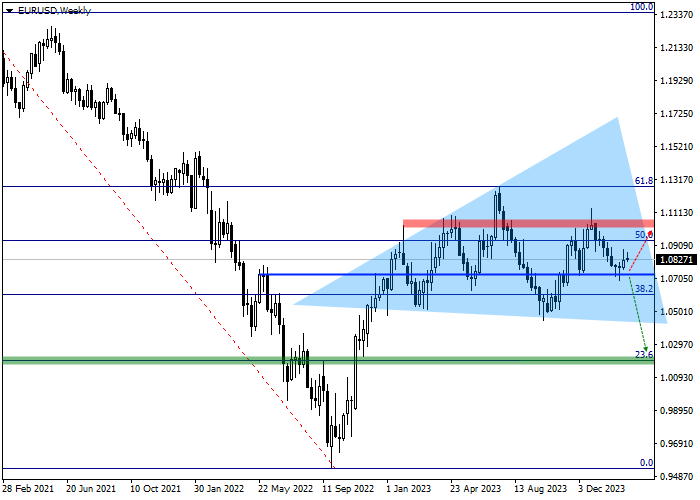

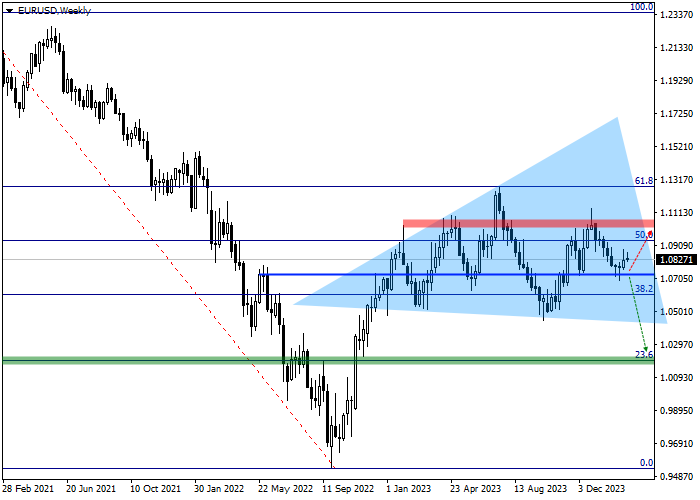

In addition to the underlying fundamental factors, the continued decline of the EUR/USD pair is confirmed by technical indicators: on the W1 chart, the instrument is trading within the next descending wave of the global "expanding formation" pattern with dynamically expanding borders of 1.1500–1.0300.

At the moment, the price is attempting to consolidate below the December 8 minimum at 1.0750. If successful, the downtrend can receive significant support and continue moving up to the level of the basic 38.2% Fibonacci retracement at 1.0609.

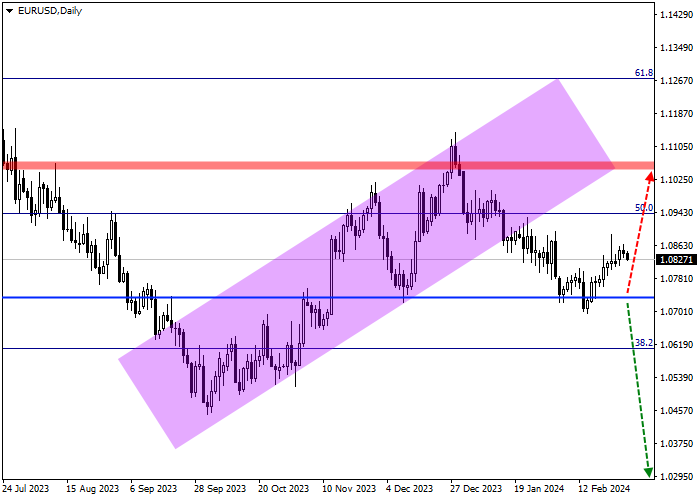

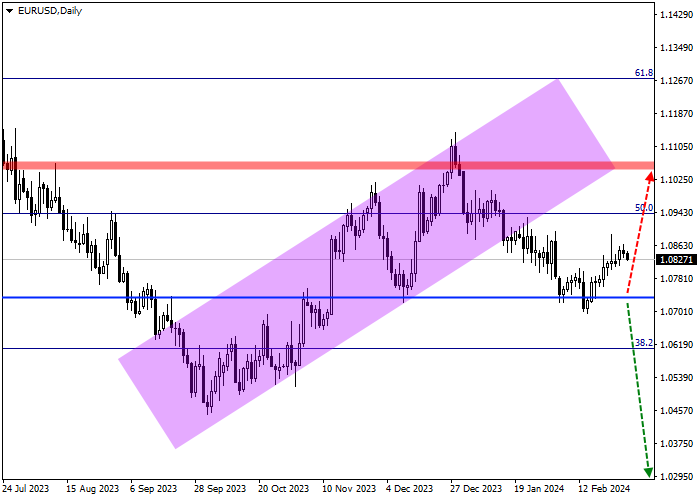

Key levels can be seen on the D1 chart.

As can be seen on the chart, after the first attempt to overcome the low of 1.0750, the price rolled back up and is gaining strength for a new attempt to test the level.

Around the local maximum of December 25 at 1.1070 there is a zone of global cancellation of the sell signal, in case of which the global downward scenario will be cancelled or significantly delayed in time, and short positions should be liquidated.

At the level of the initial correction of 23.6% Fibonacci at 1.0200, the target zone is located; if it is reached, profit should be taken on open short positions.

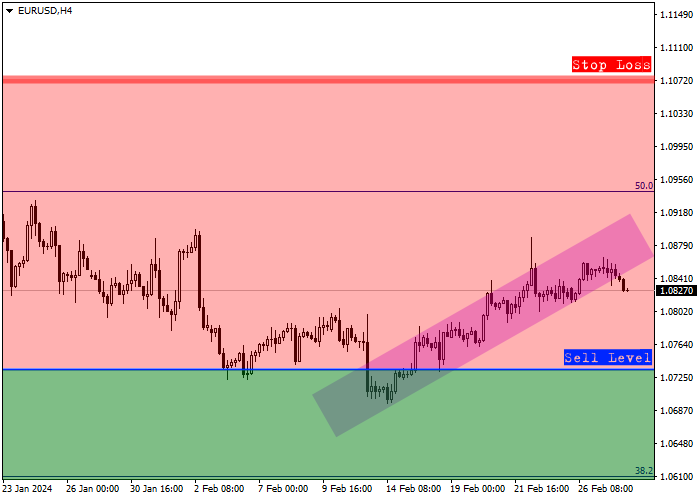

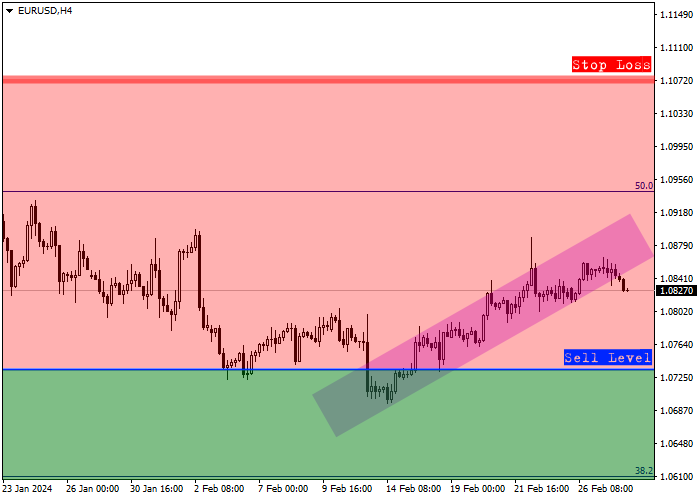

The entry level to sell transactions is located at 1.0740, which coincides with the minimum of February 14, and if the price overcomes it, there will be almost no barriers left, and positions can be implemented.

Given the average daily volatility of the currency pair over the past month, which is 43.3 points, the movement to the target zone of 1.0200 may take about 55 trading sessions, however, with increased dynamics, this time may be reduced to 46 trading days.

Hot

No comment on record. Start new comment.