Current trend

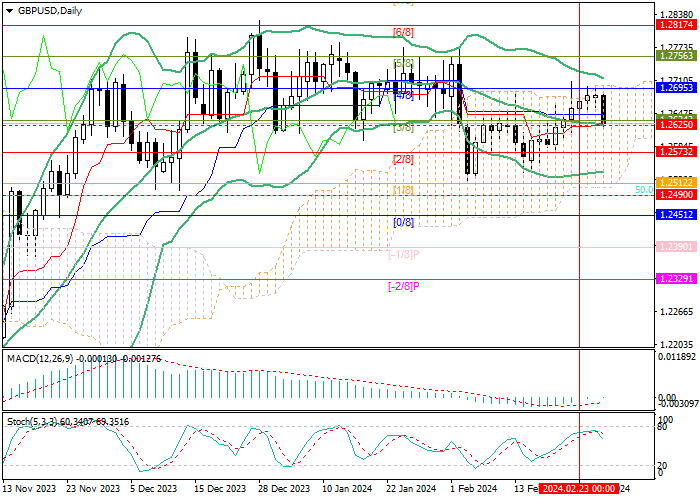

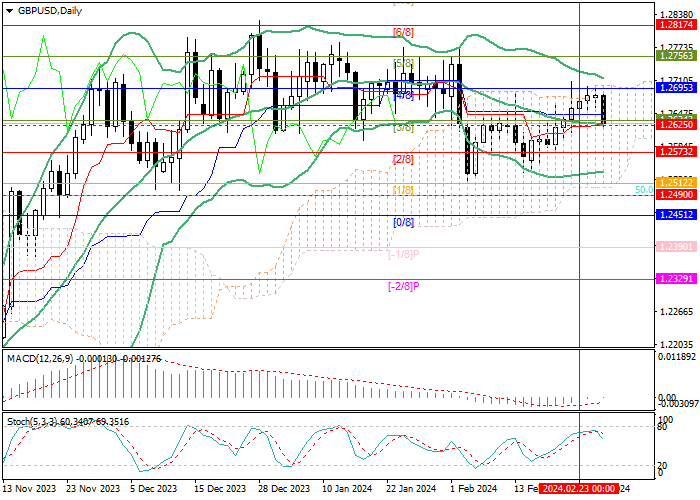

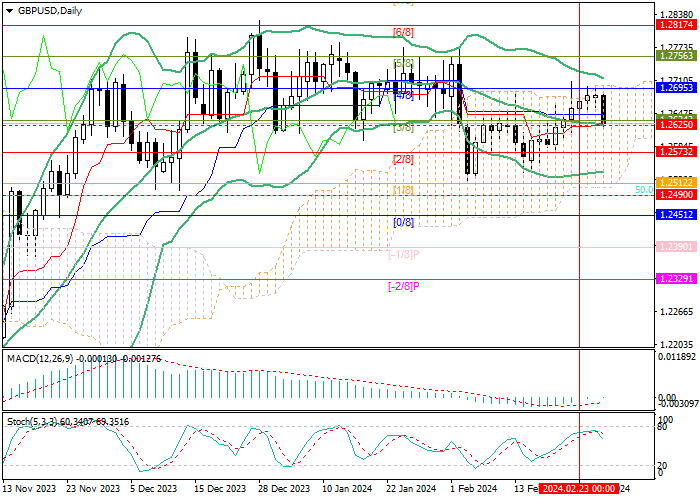

This week, the GBP/USD pair failed to overcome 1.2695 (Murrey level [4/8]) and corrected downwards to 1.2634 (Murrey level [3/8]), supported by the middle line of Bollinger bands.

The market remains uncertain before the macroeconomic data release, which could affect the actions of the US Federal Reserve and the Bank of England. Within a year, both regulators are expected to switch to the “dovish” rhetoric but the timing of it is still unknown. Today and on Thursday, investor reaction may be triggered by data on the US Q4 gross domestic product (GDP) and the January core price index of personal consumption expenditures. The second preliminary report is expected to record an increase in the country’s economy by 3.3% but it is possible that that growth will exceed forecasts, as was already when the first preliminary data were published (3.3% instead of 2.0%). In this case, US Fed officials will receive a new argument in favor of maintaining interest rates at high levels, which will support the American dollar. Likewise, if consumption does not fall from 2.9% to 2.8%, according to preliminary estimates but remains the same or registers an upward trend, the likelihood of delaying the timing of monetary policy adjustment will increase significantly.

The situation in the British economy contributes to a faster start of the borrowing costs decrease. In January, inflation remained at 4.0% and showed no signs of a new acceleration, and in February, large retailers raised prices by only 2.5%, while GDP fell by 0.3%. Although Bank of England Deputy Governor Dave Ramsden said the consumer price index remains too high, the likelihood that British officials will begin to ease monetary policy before the US remains. So, the pound is expected to weaken against its main competitors in the medium term.

Support and resistance

The trading instrument is testing 1.2634 (Murrey level [3/8]), consolidation below which will allow it to decline to the area of 1.2573 (Murrey level [2/8]) and 1.2490 (Fibonacci correction 50.0%). Consolidation above the key “bullish” level of 1.2695 (Murrey level [4/8]) will cause growth to the area of 1.2756 (Murrey level [5/8]) and 1.2817 (Murrey level [6/8]).

Technical indicators do not give a single signal: Bollinger Bands are horizontal, the MACD histogram is at the zero line, maintaining insignificant volumes, and Stochastic reversed downwards.

Resistance levels: 1.2695, 1.2756, 1.2817.

Support levels: 1.2634, 1.2573, 1.2490.

Trading tips

Short positions may be opened from 1.2620, with the targets at 1.2573, 1.2490, and stop loss 1.2660. Implementation time: 5–7 days.

Long positions may be opened from 1.2695, with the targets at 1.2756, 1.2817, and stop loss 1.2650.

Hot

No comment on record. Start new comment.