Current trend

The leading index of the Frankfurt Stock Exchange DAX 40 is traded at around 17580.0: quotes continue their upward movement against the background of a correction in the bond market, as well as macroeconomic data, among which the March forecast from the analytical portal Gfk Group on the German Business Climate index stands out, suggesting an improvement in the indicator to -29.0 points from -29.6 points previously.

In addition, investors are weighing the financial results of sports goods manufacturer PUMA SE, which recorded earnings per share of 0.01 euros, which was below the forecast of 0.12 euros, as well as 0.88 euros shown in the previous quarter. Revenue was 1.98 billion euros, below preliminary estimates of 2.08 billion euros and 2.31 billion euros in the prior period.

Despite the rather weak reports from industrial and financial corporations, the growth of the index is still supported by the situation on the bond market, where the sideways correction continues: the 10-year bonds are trading at 2.463%, almost identical to the last week's one, while the 20-year bonds yield is 2.657%, just above the 2.645% recorded last week.

The growth leaders in the index are Infineon AG ( 4.03%), BASF SE ( 2.43%), Continental AG ( 2.20%), RWE AG ( 2.14%).

Among the leaders of the decline are Rheinmetall AG (-1.66%), Symrise AG (-1.66%), Beiersdorf AG (-1.31%).

Support and resistance

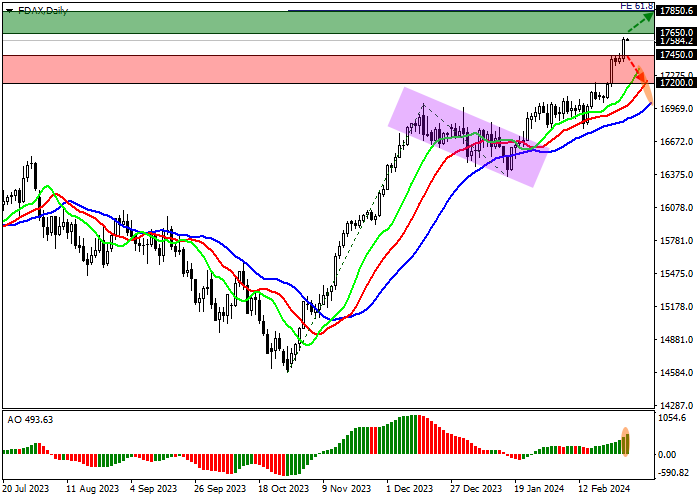

On the daily chart, the price is trading in a corrective trend, preparing to update the local high at 17650.0.

Technical indicators have completely reversed towards growth and are ready to strengthen the current buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram, being in the buy zone, is forming ascending bars.

Support levels: 17450.0, 17200.0.

Resistance levels: 17650.0, 17850.0.

Trading tips

If the asset continues to grow and consolidates above the resistance level of 17650.0, buy positions with a target of 17850.0 will be relevant. Stop-loss — 17600.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 17450.0, short positions can be opened with the target at 17200.0. Stop-loss — 17550.0.

Hot

No comment on record. Start new comment.