Current trend

The rhetoric of global financial regulators, namely, the US Fed, supports the upward movement of the XAU/USD pair, which has been keeping above the key level of 2000.0 for the second week.

On Thursday at 15:30 (GMT 2), American personal consumption expenditures core price index will be published. It is used in calculating average inflation, noticeable fluctuations of which may lead to a revision of forecasts regarding a possible transition to the “dovish” rhetoric. Analysts expect the figure to adjust from 2.9% to 2.8% YoY and from 0.2% to 0.4% MoM. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the probability of interest rates remaining unchanged in March is 97.5%, so the current sideways trend in the asset may continue.

The market is observing another factor in favor of global growth in gold prices in the future – demand for physical metal, exports of which from Switzerland increased by 86.0% to 216.0 tons, the highest since 2016, in January. However, open interest from investors on commodity exchanges has been waning, and the average over the past five trading sessions hit a five-year low of 401.5K positions, reflecting the low likelihood of near-term volatility, according to CME data.

Support and resistance

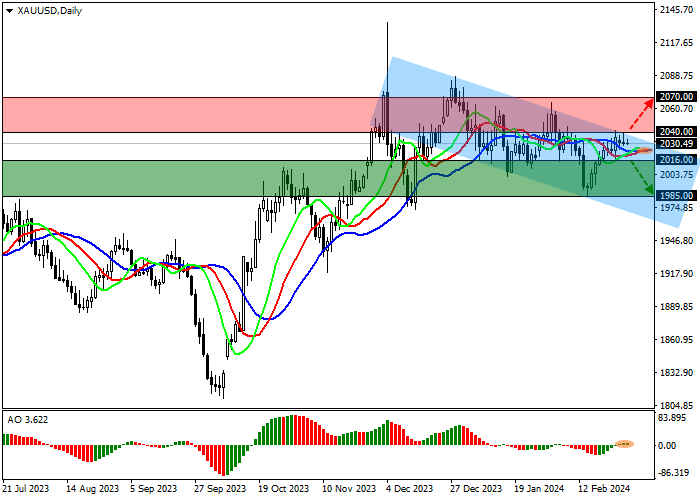

On the daily chart, the trading instrument is correcting below the resistance line of the local downward channel of 2050.0–1980.0.

Technical indicators maintain an unstable buy signal: fast EMA on the Alligator indicator are slightly above the signal line, narrowing the range of fluctuations, and the AO histogram forms corrective bars above the transition level.

Resistance levels: 2040.0, 2070.0.

Support levels: 2016.0, 1985.0.

Trading tips

Short positions may be opened after the price declines and consolidates below 2016.0, with the target at 1985.0. Stop loss – 2024.0. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 2040.0, with the target at 2070.0. Stop loss – 2030.0.

Hot

No comment on record. Start new comment.