Current trend

The NZD/USD pair has been developing corrective dynamics in recent days, retreating from the local highs of January 15, updated last week. During the Asian session, quotes are testing the level of 0.6110 for a breakdown, and the focus of investors' attention is on the results of the meeting of the Reserve Bank of New Zealand (RBNZ).

As analysts expected, the regulator kept the key interest rate unchanged at 5.50% for the fifth time in a row, noting that the country still faces significant risks of renewed inflation growth. That is why officials are confident in the need to keep borrowing costs at restrictive levels to further control demand. The RBNZ also spoke about the mixed prospects for economic growth in China, which remains one of New Zealand's main trading partners in the region.

Meanwhile, the US currency was put under some pressure by data on the dynamics of Durable Goods Orders published the day before. In January, Durable Goods Orders excluding Transportation lost 0.3% after -0.1% in the previous month, while analysts expected growth of 0.2%, and Nondefense Capital Goods Orders excluding Aircraft added 0.1% after -0.6% a month earlier.

Today, the United States will present January statistics on Personal Income and Spending, as well as updated data on Gross Domestic Product (GDP) for the fourth quarter of 2023: the American economy is projected to grow by 3.3%.

Support and resistance

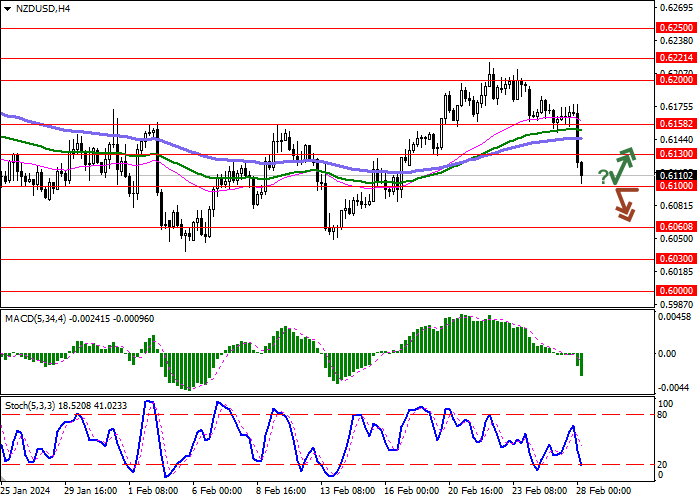

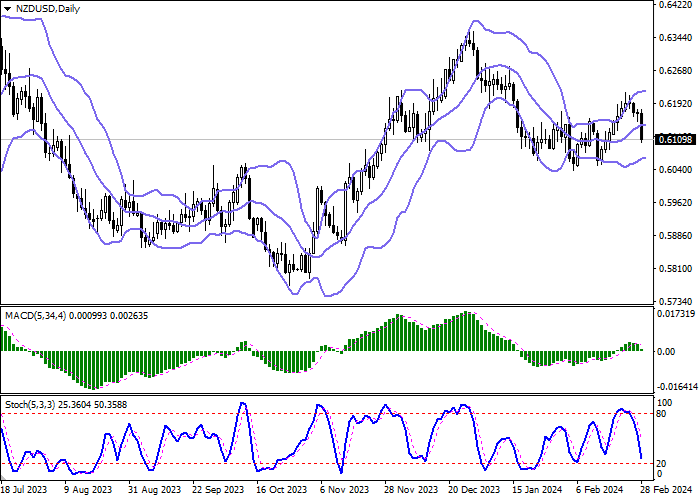

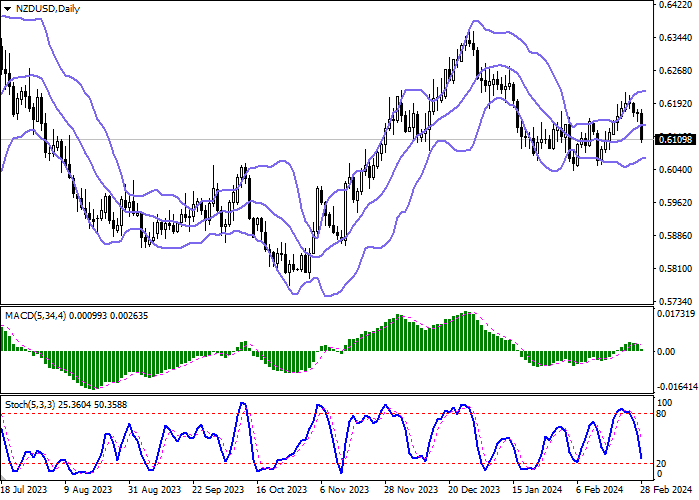

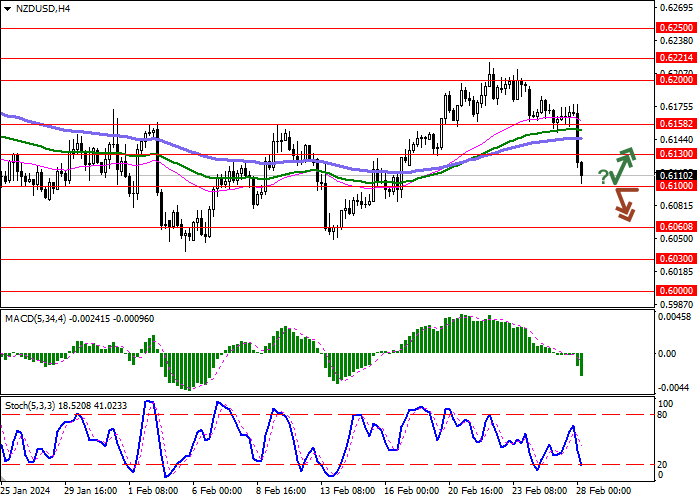

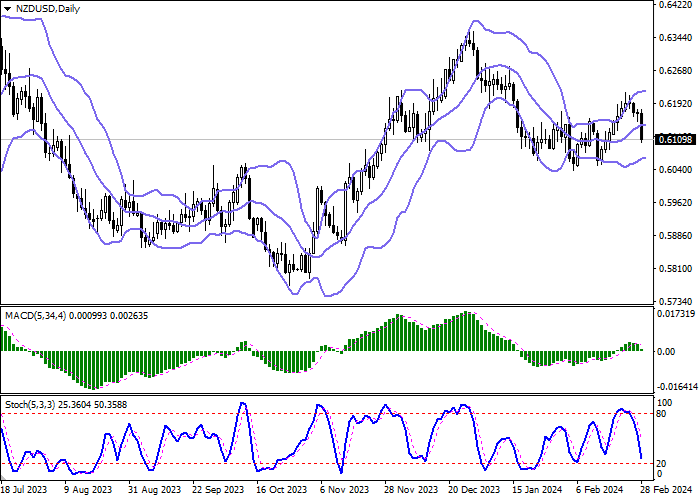

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD reversed towards declining, having formed a new sell signal (located below the signal line). Stochastic is showing a more active decline and is currently approaching its lows, indicating the risks of the New Zealand dollar being oversold in the ultra-short term.

Resistance levels: 0.6130, 0.6158, 0.6200, 0.6221.

Support levels: 0.6100, 0.6060, 0.6030, 0.6000.

Trading tips

Short positions may be opened after a breakdown of 0.6100 with the target at 0.6030. Stop-loss — 0.6130. Implementation time: 2-3 days.

A rebound from 0.6100 as from support followed by a breakout of 0.6130 may become a signal for opening new long positions with the target at 0.6190. Stop-loss — 0.6100.

Hot

No comment on record. Start new comment.