Current trend

Shares of PayPal Holdings Inc., an American debit payment system, are corrected at 59.00.

Leading analysts do not expect growth in the quotes based on financial statistics. Thus, experts at Daiwa Securities Group Inc. downgraded the issuer’s securities rating from Outperform to Neutral and the target price – from 64.00 to 62.00. Economists made this decision after the publication of the corporation’s own forecast for 2024, which indicated a new expected profit on paper according to non-GAAP of 5.16 dollars, lower than 5.61 dollars previously, and for 2025 – 5.56 dollars relative to the previous value of 5.72 dollars.

According to the report, the Q4 revenue of PayPal Holdings Inc. amounted to 8.0B dollars, exceeding both expectations of 7.88B dollars and 7.42B dollars previously. Earnings per share (EPS) increased from 1.3 dollars to 1.48 dollars compared to preliminary estimates of 1.36 dollars. Management announced the appointment of Geoff Seeley as its new chief marketing officer, which could significantly improve its promotional campaign capabilities.

Support and resistance

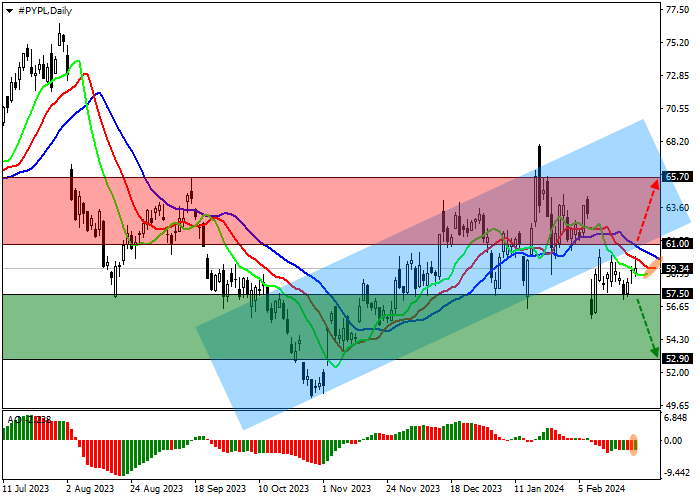

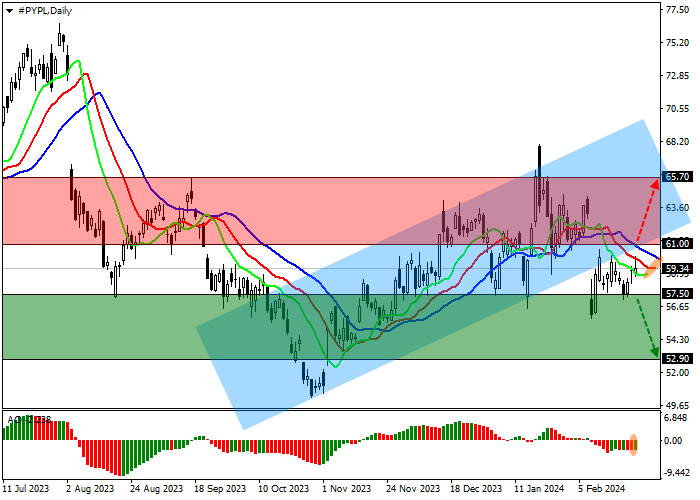

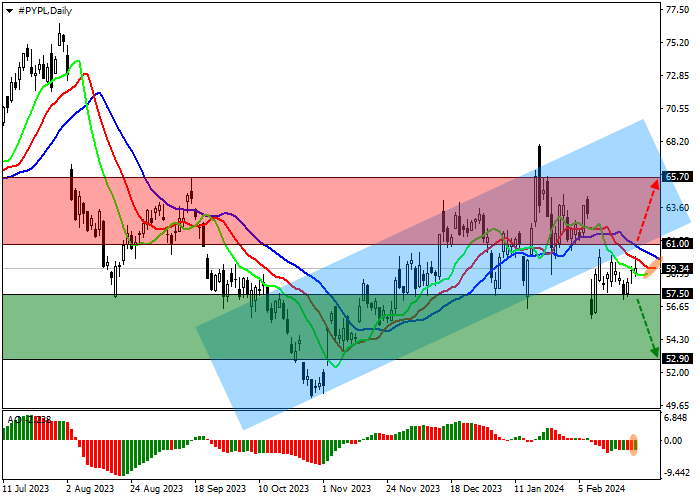

On the daily chart of the asset, the corrective trend continues, and the trading instrument is below the support line of the ascending channel with dynamic boundaries of 65.70–59.00.

Technical indicators maintain a sell signal: the EMA fluctuation range of the Alligator indicator is actively narrowing, and the AO histogram is forming corrective bars in the sales zone.

Resistance levels: 61.00, 65.70.

Support levels: 57.50, 52.90.

Trading tips

Short positions may be opened after the price declines and consolidates below 57.50, with the target at 52.90 and stop loss 60.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 61.00, with the target at 65.70. Stop loss is below 60.00.

Hot

No comment on record. Start new comment.