Current trend

The ETH/USD pair resumed the uptrend after consolidation last week: in three trading days, the price of ETH added 9.6% and today tested the mark of 3270.00 (61.8% Fibonacci retracement), reacting to the sharp increase in the price of the Bitcoin last Tuesday. Experts interviewed by CNBC channel noted that the strengthening of the world's first cryptocurrency was caused by the expiration of the settlement period for bitcoin futures, after which traders began to take "bullish" positions in anticipation of the April halving.

The uptrend in BTC has caused increased investor interest in altcoins, primarily in ETH, the value of which has peaked since April 2022. Market participants expect further strengthening of the token's position against the background of the launch of the Dencun update on March 13, designed to increase the scalability of the Ethereum network and reduce the cost of transactions within it, as well as the approval of the launch of an ETH-based ETF by the U.S. Securities and Exchange Commission (SEC), which is likely to occur after the deadline for making a decision on the first application from the VanEck company. However, the SEC may legalize new exchange-traded instruments earlier, as part of the documentation is duplicated from the already accepted bitcoin ETF.

The fundamental background currently contributes to the further growth of digital currencies, and serious changes in it can occur only after the halving of the Bitcoin network or in the case of a significant acceleration of inflation in the United States, which may cause an appropriate reaction from the American regulator, but in the medium term such a development seems unlikely.

Support and resistance

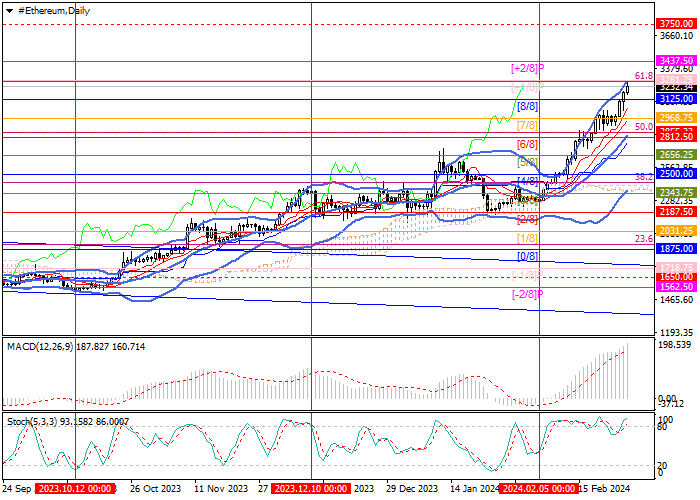

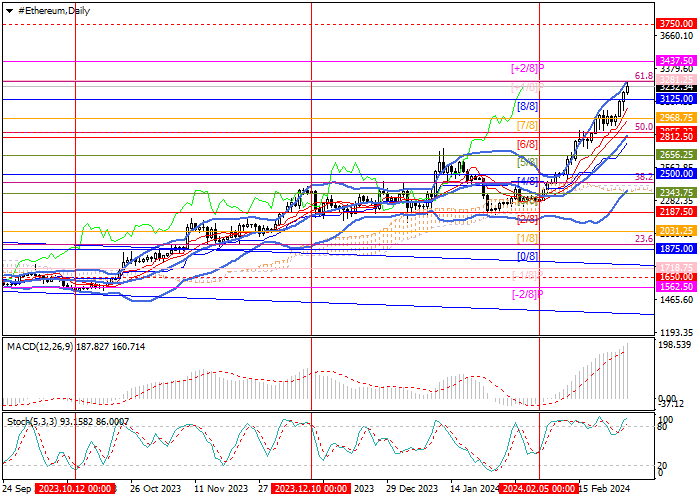

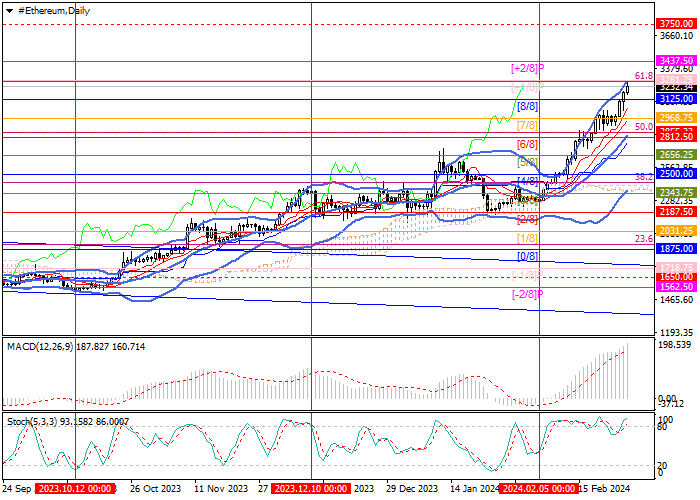

Technically, the price is close to the 3270.00 mark (61.8% Fibonacci retracement, Murrey level [ 1/8]), the breakout of which will cause further growth towards the targets of 3437.50 (Murrey level [6/8]), 3750.00 (Murrey level [8/8], W1). The key for the "bears" is the support zone 2855.00–2812.50 (50.0% Fibonacci retracement, Murray level [6/8], the central line of Bollinger Bands), consolidating below which will allow quotes to resume a decline to the level of 2500.00 (Murrey level [4/8]), but this scenario seems less likely.

Technical indicators confirm the continuation of the uptrend: Bollinger Bands and Stochastic are directed up, MACD is increasing in the positive zone.

Resistance levels: 3270.00, 3437.50, 3750.00.

Support levels: 2812.50, 2500.00.

Trading tips

Long positions can be opened above the 3270.00 mark with targets of 3437.50, 3750.00 and stop-loss around 3170.00. Implementation period: 5–7 days.

Short positions should be opened below the level of 2812.50 with the target of 2500.00 and stop-loss around 3000.00.

Hot

No comment on record. Start new comment.