Current trend

Quotes of the CAC 40 index are maintained around 7907.0 against the backdrop of multidirectional investor expectations from the financial statements of component companies and a local increase in the bond market.

The quarterly results of Bouygues SA, Edenred SA and Eurofins Scientific SE will be published today. Analysts expect engineering group Bouygues SA's revenue to fall to 14.43 billion euros from 14.75 billion euros in the previous quarter, and earnings per share to fall to 1.12 euros from 1.15 euros. Payment services provider Edenred SA's revenue is forecast at 1.35 billion euros, up significantly from 0.575 billion euros previously, while earnings per share could rise to 1.16 euros from 0.96 euros. In addition, labs group Eurofins Scientific SE is expected to report revenue of 1.71 billion euros, up from 1.61 billion euros, and earnings per share could top the previous 1.14 euros at 1.16 euros.

Local pressure on the stock market is exerted by the situation on the domestic bond market, where an upward correction has been observed for more than a month: 10-year bonds are trading at a rate of 2.910% after 2.832% recorded on Friday, and the yield on 20-year bonds is 3.289%, which is higher than 3.205% at the end of last week.

The growth leaders in the index are Thales Group SA ( 2.32%), Eurofins Scientific SE ( 1.07%), Renault SA ( 0.59%).

Among the leaders of the decline are Carrefour SA (-3.87%), Veolia Environnement SA (-2.22%), Alstom SA (-1.95%), BNP Paribas (-1.86%).

Support and resistance

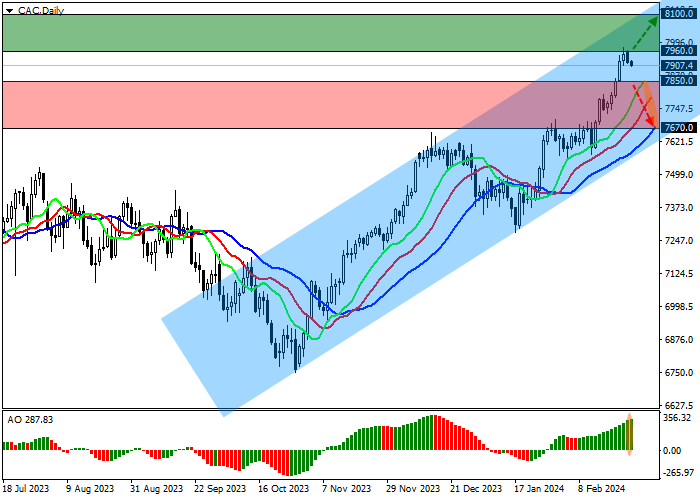

On the daily chart, quotes continue to grow globally, still heading towards the resistance line of the ascending channel with dynamic boundaries of 8000.0–7620.0.

Technical indicators maintain a steady buy signal: fast EMAs on the Alligator indicator are stably maintained above the signal line, and the AO histogram, being above the transition level, forms corrective bars.

Support levels: 7850.0, 7670.0.

Resistance levels: 7960.0, 8100.0.

Trading tips

If the asset continues growing, and the price consolidates above the local resistance at 7960.0, long positions with a target of 8100.0 and stop-loss of 7900.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining and the price consolidates below the local support level of 7850.0, short positions can be opened with the target at 7670.0. Stop-loss — 7950.0.

Hot

No comment on record. Start new comment.