Current trend

During the Asian session, prices for WTI Crude Oil show ambiguous dynamics, remaining close to 77.50.

Experts believe that investors are including monetary risks in the quotes, fearing that the US Federal Reserve will maintain high interest rates for a long time. According to The Goldman Sachs Group Inc. analysts, the premium for the risks of delivering oil through the Red Sea is still low, around 2.0 dollars per barrel: the Yemeni Houthis influence is still relatively small and cannot significantly support the quotes. However, last night, the Ansar Allah movement tried to strike the American oil tanker Torm Thor in the Gulf of Aden. Also, the damaged bulk carrier Rubymar, which carries 41.0K tons of chemical fertilizers, may sink soon, causing an environmental disaster: an oil slick with a length of 29.0 km has already formed on the surface of the Red Sea.

Investors are awaiting the publication of American statistics on personal consumption expenditures, which the US Federal Reserve uses when calculating average inflation. According to preliminary estimates, the core price index in January will decrease from 2.9% to 2.8% YoY but increase from 0.2% to 0.4% MoM. Increased inflation pressure will support the dollar, allowing monetary authorities to delay the transition to the “dovish” rhetoric. However, the quotes are negatively affected by revised forecasts for demand growth amid a slower global economic recovery, as global regulators will delay the launch of interest rate reduction programs.

Today, experts will evaluate the report from the American Petroleum Institute (API) on the dynamics of commercial oil inventories for the week of February 23. Earlier, data reflected a sharp increase of 7.168M barrels.

Meanwhile, the market is in a global correction, and according to the latest report from the US Commodity Futures Trading Commission (CFTC), last week, net speculative positions in WTI Crude Oil increased from 171.0K to 191.9K. As for the dynamics, after last week’s reduction, the asset regained its losses, and the volumes remained unchanged: the swap dealers’ balance of the “bulls” amounted to 19.744K against 34.856K for the “bears.” Thus, buyers liquidated 1.581K contracts, and sellers liquidated 3.697K transactions, which reflects the fixation of part of the oil positions.

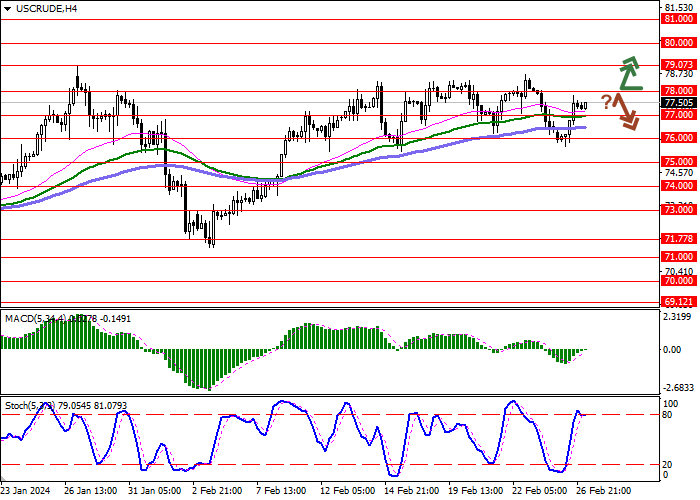

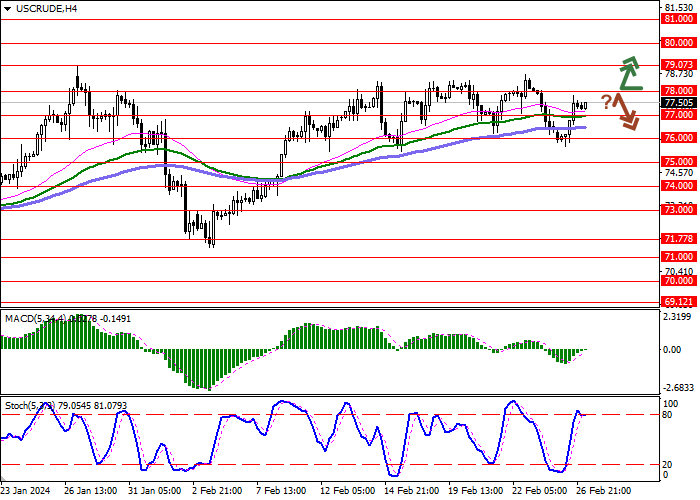

Support and resistance

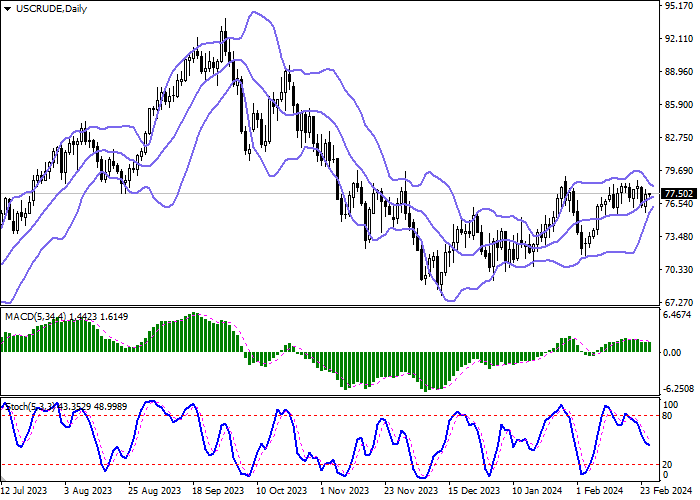

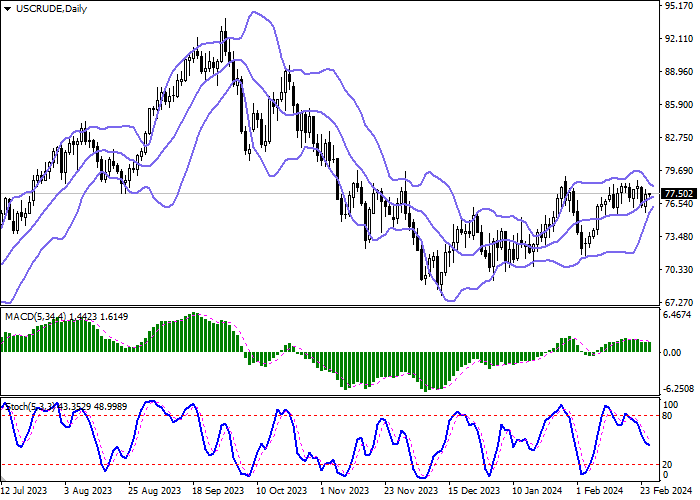

On the daily chart, Bollinger Bands are trying to reverse into a downward plane: the price range is actively narrowing, reflecting the ambiguous trading in the short term. The MACD indicator is declining, maintaining a strong sell signal (the histogram is below the signal line). Stochastic shows a more confident negative movement, signaling in favor of the “bearish” dynamics soon.

Resistance levels: 78.00, 79.07, 80.00, 81.00.

Support levels: 77.00, 76.00, 75.00, 74.00.

Trading tips

Long positions may be opened after a breakout of 78.00 with the target at 80.00. Stop loss – 77.00. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 78.00 and a breakdown of 77.00 with the target at 75.00. Stop loss – 78.00.

Hot

No comment on record. Start new comment.