Current trend

The Dow Jones index is correcting in the local trend at around 39086.0.

Accounting software maker Intuit Inc. released financial results late last week. The company was able to increase revenue to 3.40 billion dollars from 3.00 billion dollars previously, which exceeded analysts' expectations of 3.39 billion dollars. Earnings per share came in at 2.63 dollars, down from 2.47 dollars reported in the prior quarter and against preliminary estimates of 2.30 dollars.

This week, corporate reports from two retailers will be presented: Lowe’s Companies Inc. and eBay Inc. From Lowe's Companies Inc. experts expect revenue at 18.47 billion dollars, which is significantly lower than 20.47 billion dollars in the previous quarter, and earnings per share could drop to 1.68 dollars, also below the 3.27 dollars recorded earlier. eBay Inc. performance forecasts suggest revenue of 2.51 billion dollars, after 2.50 billion dollars in the prior period, and earnings per share could remain at 1.03 dollars.

In turn, bonds began to reverse downwards, providing local support to the index: 10-year bonds are trading at a rate of 4.225%, which is below last week's high (4.342%), and the yield on 20-year bonds is 4.489%, also falling below last week's peak at 4.608%.

The growth leaders in the index are Amgen Inc. ( 1.40%), Johnson & Johnson Co. ( 0.84%), IBM Corp. ( 0.81%).

Among the leaders of the decline are Apple Inc. (-1.00%), The Travelers Companies Inc. (-0.60%), Chevron Corp. (-0.48%).

Support and resistance

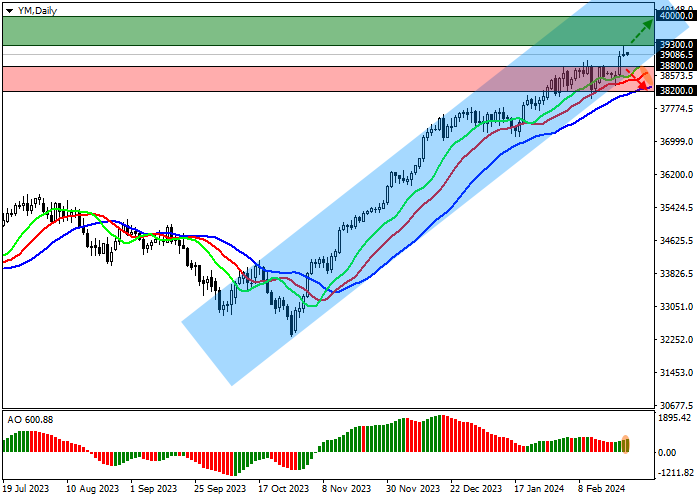

On the daily chart, quotes continue their upward trend, remaining within the ascending channel with boundaries of 39500.0–38500.0.

Technical indicators keep a stable buy signal: the range of EMA fluctuations on the Alligator indicator stays wide, and the AO histogram is forming new corrective bars, being above the transition level.

Support levels: 38800.0, 38200.0.

Resistance levels: 39300.0, 40000.0.

Trading tips

If the local growth continues, long positions that can be opened if the price overcomes the channel resistance at 39300.0 with a target at 40000.0 and stop-loss at 39000.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining and the price consolidates below the local support level of 38800.0, short positions can be opened with the target at 38200.0. Stop-loss — 39100.0.

Hot

No comment on record. Start new comment.