Current trend

The USD/CHF pair shows slight growth, remaining close to 0.8810. Market activity remains quite low as investors expect new drivers to emerge.

Tomorrow the US will publish statistics on the dynamics of Durable Goods Orders, which will allow one to assess the level of domestic demand. It is predicted that the indicator excluding transportation may slow down from 0.5% to 0.2%, and the overall Durable Goods Orders may decline from 0.0% to -4.8%. On Wednesday, February 28, investors will focus on an important indicator for the US Federal Reserve in assessing inflation, Core Personal Consumption Expenditures. In addition, at 15:30 (GMT 2) data on Gross Domestic Product (GDP) will be presented: it is expected that in the fourth quarter of 2023 the GDP will be fixed at 3.3%, and the deflator at 1.5%.

Investors also continue to discuss the prospects for the American regulator to reduce borrowing costs in the near future. Last week, the minutes of the Fed's January meeting were published, which, as expected, reflected a more neutral position of officials. Many members of the US Federal Open Market Committee (FOMC) fear that a premature move to easing monetary policy could cause more damage to the economy than a prolonged period of high interest rates. The regulator also doubts that the current rate of decline in inflation will continue until prices reach the target range of 2.0-3.0%, so more and more of its representatives are calling not only to focus on formal compliance with the designated levels, but also to assess the situation in the national economy more comprehensive.

The franc received some support from Swiss labor market data published on Friday, February 23. The Employment Change in the fourth quarter of 2023 increased from 5.465 million to 5.488 million. On Thursday at 10:00 (GMT 2) investors will evaluate statistics on GDP dynamics for the same period: on a quarterly basis, the indicator is expected to decrease from 0.3% to 0.2% and on an annual basis, the indicator may increase from 0.3% to 0.5%, which will confirm the stability of the national economy.

Support and resistance

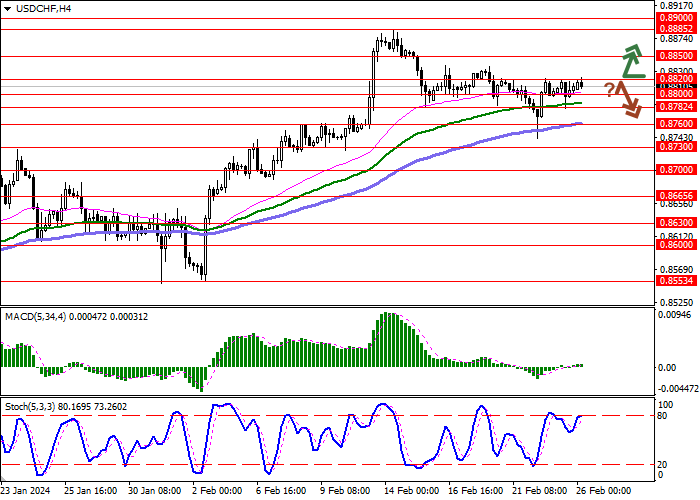

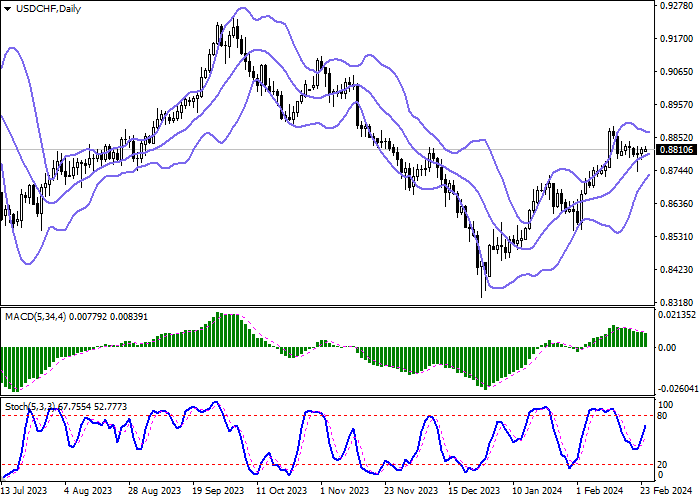

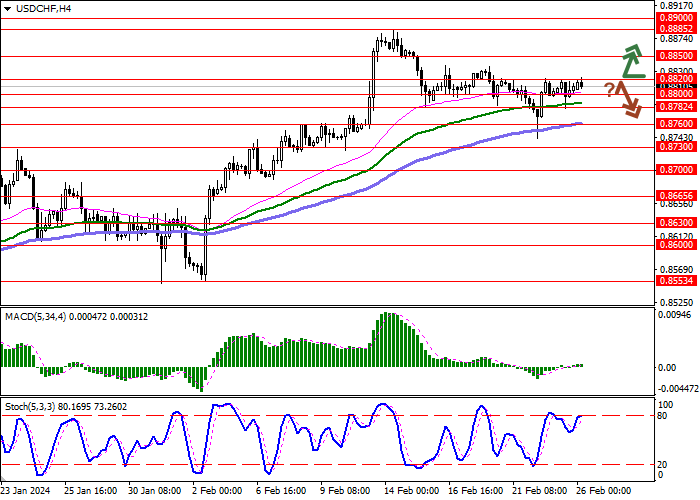

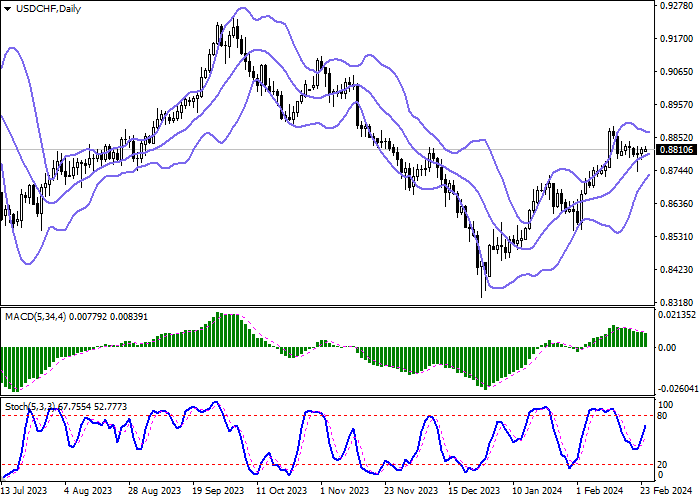

Bollinger Bands on the daily chart show moderate growth. The price range is narrowing, reflecting mixed trading in the short term. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic, on the contrary, maintains a fairly confident upward direction, quickly approaching its highs and signaling the risks of overbought US dollar in the ultra-short term.

Resistance levels: 0.8820, 0.8850, 0.8885, 0.8900.

Support levels: 0.8800, 0.8782, 0.8760, 0.8730.

Trading tips

Long positions can be opened after a breakout of 0.8820 with the target of 0.8885. Stop-loss — 0.8782. Implementation time: 2-3 days.

A rebound from 0.8820 as from resistance, followed by a breakdown of 0.8800 may become a signal for opening of new short positions with the target at 0.8760. Stop-loss — 0.8820.

Hot

No comment on record. Start new comment.