Current trend

The GBP/USD pair is consolidating around 1.2660 after last week's moderate upward dynamics, while trading participants continue to assess the prospects for a change in the US Federal Reserve's monetary policy amid the publication of the minutes of the January meeting. Officials reiterated their cautious stance regarding lower borrowing costs and, moreover, expressed concern about the possibility of switching to "dovish" rhetoric too early. The minutes strengthened investor confidence that the adjustment of parameters could be postponed until the second half of the year, which strengthens the US dollar’s position against its main competitors: at the moment, more and more investors are counting on the first adjustment to borrowing costs in June, but these expectations are also regularly revised.

Macroeconomic statistics from the UK published on Friday put slight pressure on the pound. The Consumer Confidence index from the Gfk Group analytical portal dropped from -19.0 points to -21.0 points in February, demonstrating negative dynamics for the first time in four months, while analysts expected -18.0 points. National households are concerned about their personal finances and economic prospects due to continued high inflation. In addition, private consumption in the country has still not returned to the level it was at before the COVID-19 epidemic.

At the beginning of the week there will be speeches from representatives of the Bank of England, including Huw Pill and David Ramsden. On Tuesday, February 27, the US will release February statistics on Durable Goods Orders and Consumer Confidence. Forecasts suggest a slowdown in the dynamics of orders for Durable Goods Orders excluding Transportation from 0.5% to 0.2%.

Support and resistance

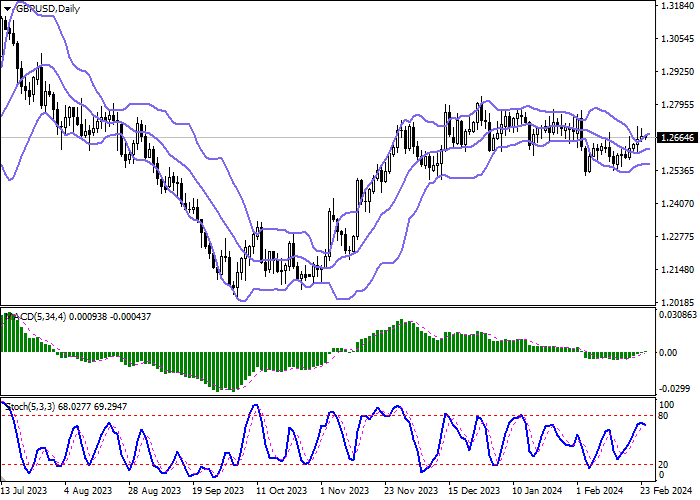

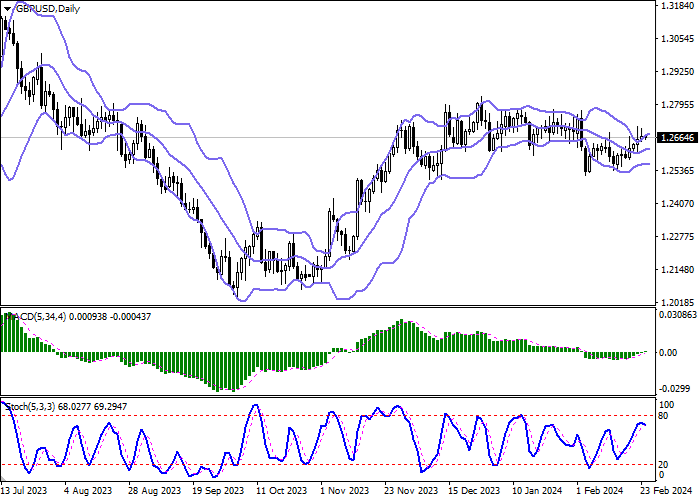

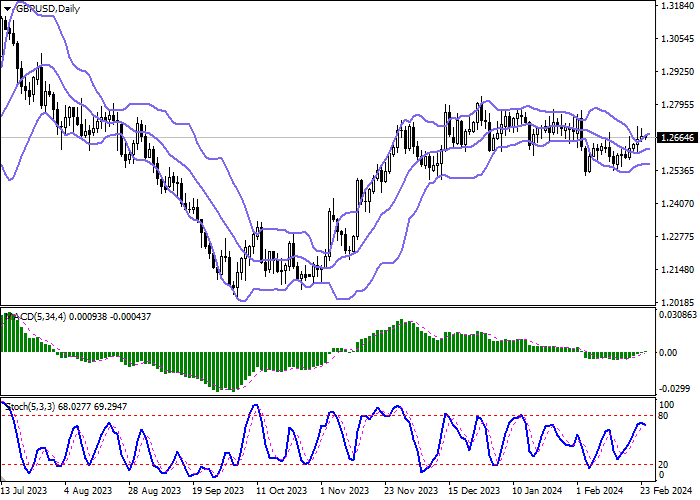

In the D1 chart, Bollinger Bands are reversing horizontally. The price range expands from above, freeing a path to new local highs for the "bulls". MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic has approached the level of "80" and is trying to reverse into a downward plane, signaling in favor of the development of a "bearish" trend in the ultra-short term.

Resistance levels: 1.2700, 1.2746, 1.2800, 1.2850.

Support levels: 1.2650, 1.2600, 1.2550, 1.2500.

Trading tips

Short positions may be opened after a breakdown of 1.2650 with the target at 1.2550. Stop-loss — 1.2700. Implementation time: 1-2 days.

A rebound from 1.2650 as from support followed by a breakout of 1.2700 may become a signal for opening new long positions with the target at 1.2800. Stop-loss — 1.2650.

Hot

No comment on record. Start new comment.