Current trend

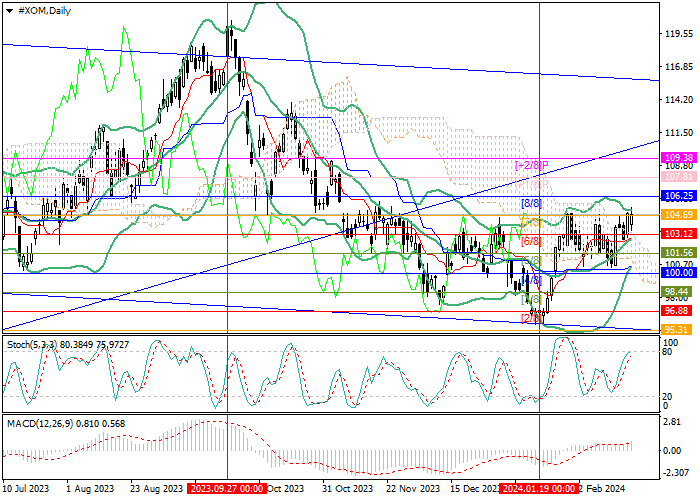

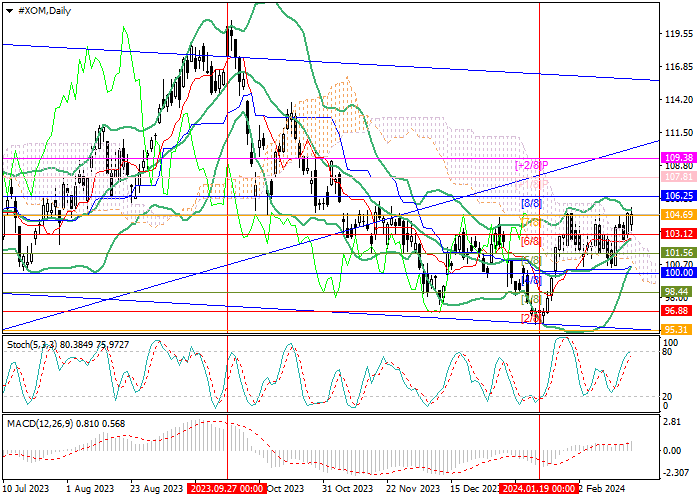

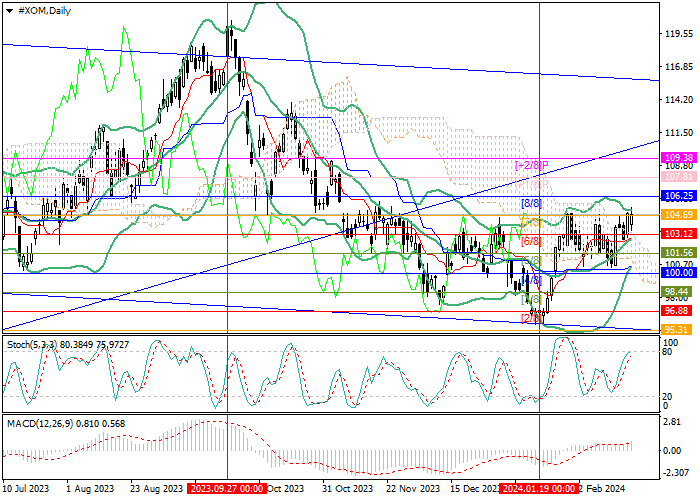

Shares of ExxonMobil Corp., an American oil company, are trading within a long-term downward channel: last month, quotes reached its lower border around 96.88 (Murrey level [2/8]) and have been rising for the fifth week in a row since then.

Currently, the price has moved into the positive part of the Murrey trading range and is now testing the 104.69 mark (Murrey level [7/8]), after consolidation above which the growth will continue to the targets of 106.25 (Murrey level [8/8]), 107.81 (Murrey level [ 1/8]) and 109.38 (Murrey level [ 2/8]). The key for the "bears" is the central level of the Murrey trading range of 100.00 (Murrey level [4/8]), at the breakdown of which the decline may resume to the targets of 96.88 (Murrey level [2/8]) and 95.31 (Murrey level [1/8], the lower border of the descending channel), but this scenario seems less likely.

Technical indicators confirm the formation of the short-term uptrend: Bollinger Bands and Stochastic are directed up, MACD is growing in the positive zone.

Support and resistance

Resistance levels: 104.69, 106.25, 107.81, 109.38.

Support levels: 100.00, 96.88, 95.31.

Trading tips

Long positions can be opened above 104.69 with targets of 106.25, 107.81, 109.38 and stop-loss around 103.70. Implementation period: 5–7 days.

Short positions can be opened below the 100.00 mark with targets of 96.88, 95.31 and stop-loss around 101.00.

Hot

No comment on record. Start new comment.