Current trend

The stock of Wells Fargo & Co., one of the leading banking and insurance companies in the United States, are adjusting at 53.00.

The main positive news for the company is the statement by the Office of the Comptroller of the Currency of the US Treasury Department (OCC) on the termination of the "consent decree" introduced in 2016, which imposed restrictions on the bank due to the illegal practice of selling assets from fake accounts. Over the years, Wells Fargo & Co. has already sent a significant amount of compensation, and up to this point, five such orders have been canceled. Despite the termination of the latter, there are still eight remaining, which in total limit the movement of the company's assets by 1.95 trillion dollars. According to experts, all sanctions against the bank can be lifted by 2025, and when this happens, Wells Fargo & Co. may return to the leading group of US financial institutions, which will allow it to attract new customers more actively.

In addition, in an effort to follow competitors such as JPMorgan Chase & Co. and Morgan Stanley, Wells Fargo & Co. increased the annual compensation for its CEO Charles Scharf by 18.0% to 29.0 million dollars from 24.5 million dollars in 2022. For comparison, the compensation of the head of JPMorgan Chase & Co. Jamie Dimon was increased by 4.0%, and Morgan Stanley's CEO James Gorman — by 17.0%.

Support and resistance

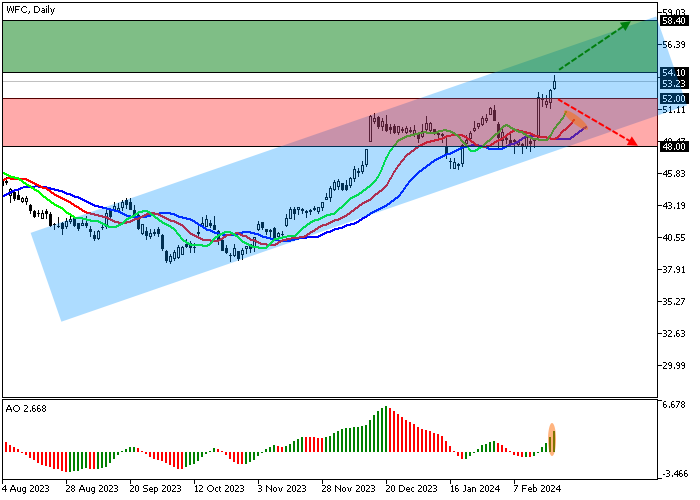

On the D1 chart, the price is trading in a corrective trend, trying to get closer to the resistance line of the ascending channel with the borders of 56.30–48.00.

Technical indicators, after a short slowdown, again strengthen the global buy signal: the range of fluctuations of the EMAs of the Alligator indicator is actively expanding, and the AO histogram forms ascending bars, being significantly above the transition level.

Support levels: 52.00, 48.00.

Resistance levels: 54.10, 58.40.

Trading tips

In case of continued growth of the asset and its consolidation above the local resistance level of 54.10, buy positions with the target of 58.40 may be opened. Stop-loss – 52.00. Implementation time: 7 days and more.

If the asset continues to decline and the price consolidates below the local support level of 52.00, one can open sell positions with the target of 48.00. Stop-loss – 53.00.

Hot

No comment on record. Start new comment.