Current trend

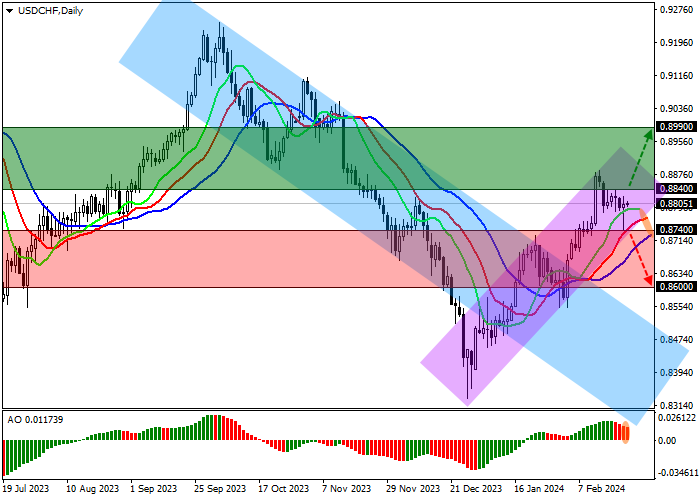

The USD/CHF pair is trading in a corrective trend at 0.8805 against the backdrop of the neutral dynamics of the US dollar.

According to statistics from the Federal Statistical Office (FSO), in the fourth quarter of 2023 the number of people employed in Switzerland increased by 2.2% to 5.362 million. Among young people aged 15 to 24, the Unemployment Rate increased from 6.7% to 7.4%, and among the working-age population aged 25 to 49, the rate adjusted from 4.2% to 3.8%. Overall, the country's Unemployment Rate fell from 4.1% to 3.9%, while in the EU it stood at 5.9%, down from 6.1%, according to the International Labor Organization (ILO).

US dollar quotes are holding at around 103.800 in USDX. Investors reacted neutrally to data on Initial Jobless Claims, the number of which decreased to 201.0 thousand from 213.0 thousand. Against this background, Continuing Jobless Claims reached 1.862 million from 1.889 million previously, and Initial Jobless Claims 4-week average was 215.25 thousand compared to previous statistics of 218.75 thousand.

Support and resistance

On the daily chart, the price is correcting, trading significantly above the level of the resistance line of the descending channel with boundaries of 0.8740–0.8470.

Technical indicators maintain a global buy signal, which remains stable: the fast EMAs of the Alligator indicator are above the signal line, and the AO histogram, being in the buy zone, is forming correction bars.

Support levels: 0.8740, 0.8600.

Resistance levels: 0.8840, 0.8990.

Trading tips

If the asset continues growing locally and the price consolidates above the local resistance level of 0.8840, long positions will be relevant with target at 0.8990. Stop-loss — 0.8800. Implementation time: 7 days and more.

If the asset reverses and continues to decline and the price consolidates below the support level at 0.8740, short positions can be opened with the target at 0.8600. Stop-loss — 0.8800.

Hot

No comment on record. Start new comment.