Current trend

The USD/JPY pair is consolidating near the resistance at 150.50, preparing to end the weekly session with a slight increase. Trading participants are analyzing statistics on business activity in the US, EU and Japan published the day before, which turned out to be ambiguous. At the same time, traders are trying to assess all the factors that influence the choice of further monetary policy by global central banks.

The likelihood of a decline in borrowing costs during the May US Federal Reserve meeting has been gradually declining since the beginning of the month, and currently stands at just over 30.0%, according to the Chicago Mercantile Exchange (CME Group) FedWatch Tool. This was facilitated by the minutes of the January meeting of the American regulator presented earlier in the week, where members of the US Federal Reserve Open Market Committee (FOMC) expressed concerns about persistent negative inflation dynamics towards the target level of 2.0%. Overall, officials insist that premature easing of monetary conditions could have a more negative impact on the economy than a prolonged period of high interest rates.

In turn, the Japanese Jibun Bank Manufacturing PMI decreased from 48.0 points to 47.2 points, while analysts expected 48.2 points. In the US, data reflected a slowdown in Services PMI from 52.5 points to 51.3 points with a forecast of 52.0 points, and the Manufacturing PMI rose from 50.7 points to 51.5 points, while experts expected 50.5 points.

Japan's industrial sector remains under pressure from weak external demand, but the services sector is recovering, albeit more slowly than previously, amid tourism influx into the country. It is also worth noting the comments of the Governor of the Bank of Japan, Kazuo Ueda, who said the day before that the rise in inflation does not look short-term, but rather a trend, since a strong labor market leads to an increase in wages, and against this background, the regulator is increasingly convinced that there are conditions for abandoning negative interest rates.

Support and resistance

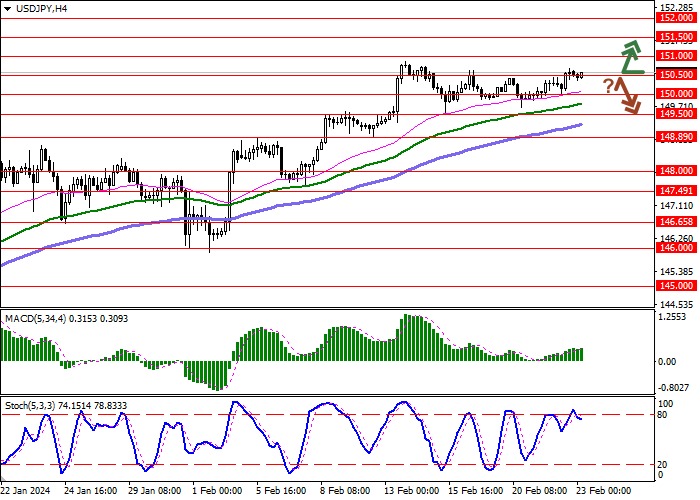

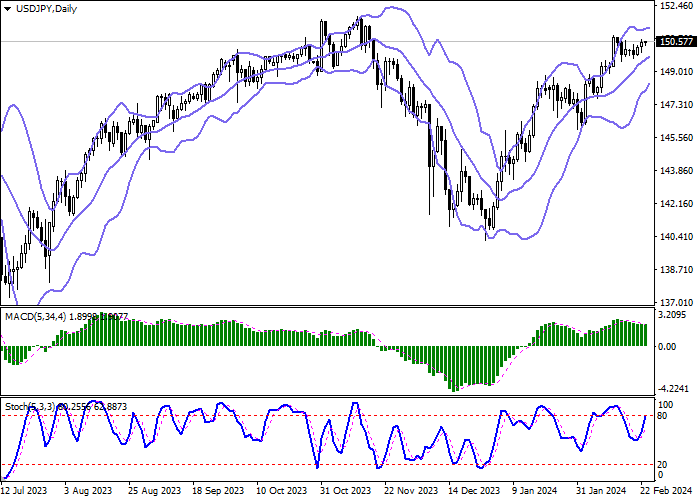

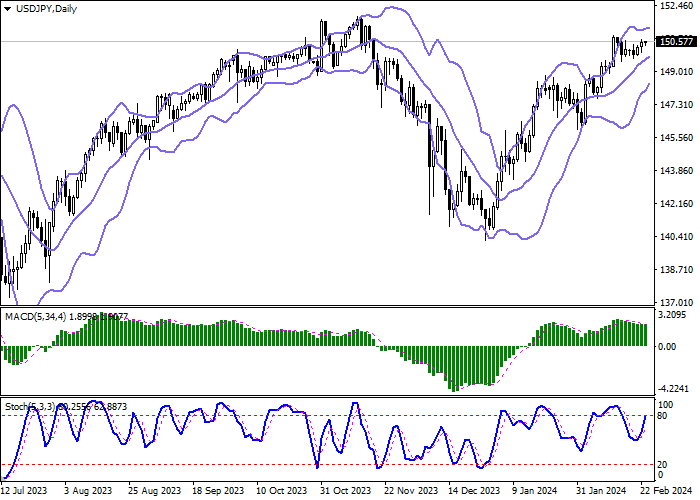

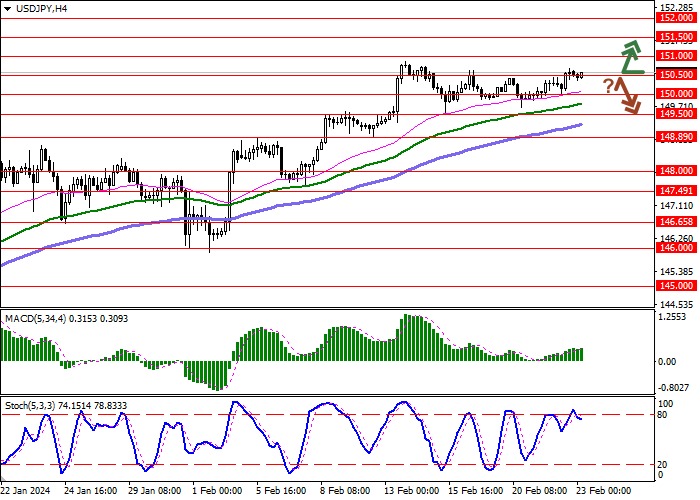

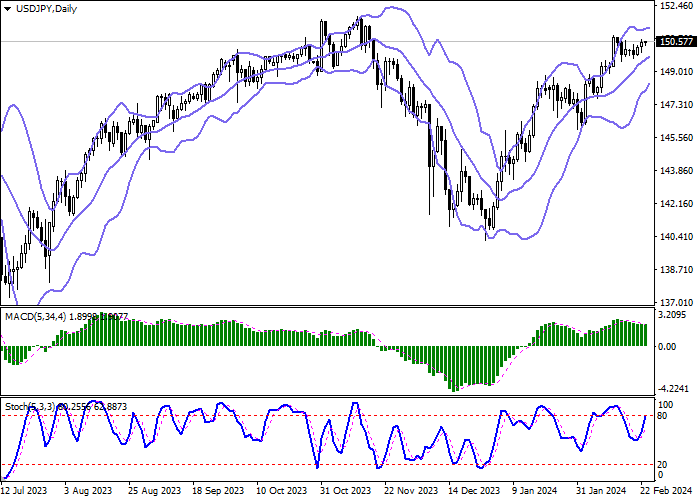

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD indicator is gradually reversing upwards trying to form a new buy signal (the histogram is about to consolidate above the signal line). Stochastic has shown more consistent growth in recent trading sessions, but is quickly approaching its highs, indicating risks of overbought US dollar in the ultra-short term.

Resistance levels: 150.50, 151.00, 151.50, 152.00.

Support levels: 150.00, 149.50, 148.89, 148.00.

Trading tips

Long positions can be opened after a breakout of 150.50 with the target of 151.50. Stop-loss — 150.00. Implementation time: 1-2 days.

A rebound from 150.50 as from resistance, followed by a breakdown of 150.00 may become a signal for opening of new short positions with the target at 148.89. Stop-loss — 150.50.

Hot

No comment on record. Start new comment.