Current trend

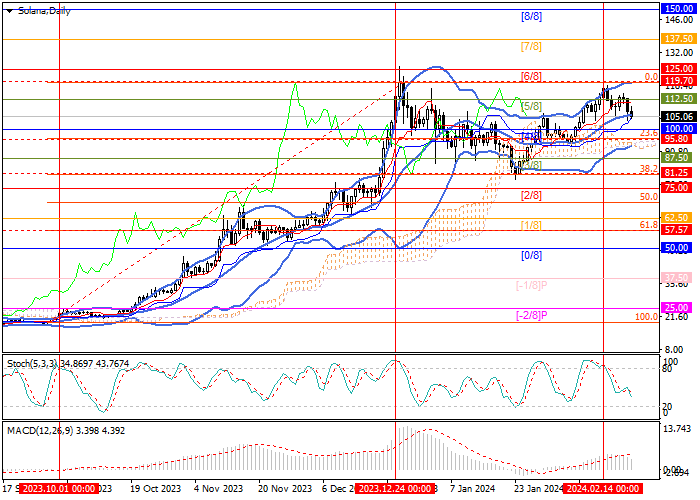

Last week, the SOL/USD pair began to correct downwards from the area of two-month highs and has reached the middle line of Bollinger bands at 105.40 now.

Experts do not have a consensus on the reasons for the current trend, noting that pressure on prices can be exerted by a wide range of factors, like partial profit-taking by investors after a long price growth, delayed consequences of a technical failure of the Solana network at the beginning of the month, as well as the activities of “whales” transferring their assets from altcoins to BTC, which is actively strengthening amid the launch of new exchange-traded funds.

Experts hope for a resumption of positive asset movement in the medium term, supported by news of Solana’s partnership with file storage company Filecoin, which became known last week: it will lead to increased scalability of the blockchain, strengthening the security and decentralization of the network. In addition, the growth of the coin may be facilitated by significant demand for mobile devices from Solana Mobile Saga Chapter2. The pre-order volume is now 100.0K, while the first model was purchased by only 20.0K users. It assumes the crypto-community’s attention to SOL, despite the current price decline.

Support and resistance

The trading instrument is trying to break the middle line of Bollinger bands downwards but the key for the “bearish” area is the support zone 100.00–95.80 (Murrey level [4/8], Fibonacci correction 23.6%), after the breakdown of which the quotes can reach the area of 81.25 (Fibonacci correction 38.2%) and 75.00 (Murrey level [2/8]). If it consolidates above the key “bullish” level of 119.70 (Fibonacci correction 0.0%), growth will resume to 137.50 (Murrey level [7/8]) and 150.00 (Murrey level [8/8]).

Technical indicators confirm the upward trend: Bollinger bands reverse upwards, and the MACD histogram is in the positive zone. However, Stochastic is directed downwards, which does not exclude the continuation of the correction.

Resistance levels: 119.70, 137.50, 150.00.

Support levels: 95.80, 81.25, 75.00.

Trading tips

Long positions may be opened above 119.70 or when the price turns around 95.80 with the targets at 137.50, 150.00 and stop losses at 109.50 and 87.50, respectively. Implementation time: 5–7 days.

Hot

No comment on record. Start new comment.