Current trend

During the Asian session, the EUR/GBP pair is growing, testing the level of 0.8570 for a breakout.

The positive dynamics are developing against the publication of the minutes of the January meeting of the US Federal Reserve, according to which regulator officials are more concerned about the risks of a premature reduction in interest rates than a later transition to “dovish” rhetoric, and many department representatives note uncertainty regarding the timing of the return of inflation to the target level of 2.0%.

In addition, yesterday, the euro was supported by February data on EU consumer confidence, which reflected an increase from –16.1 points to –15.5 points, better than market expectations of –15.6 points. On the other hand, the currency was put under pressure by the worsened growth forecast for the German economy: according to expert calculations, this year, Germany’s gross domestic product (GDP) will increase not by 1.3%, as previously expected, but by 0.2% against insufficient external demand for German goods, geopolitical uncertainty, and persistently high inflation. The government believes the consumer price index will be 2.8% this year and will not return to the European Central Bank’s (ECB) target of 2.0%. Today, the focus of investors’ attention is the February business activity statistics from S&P Global: service PMI may correct from 48.4 points to 48.8 points, and manufacturing PMI from 46.6 points to 47.0 points.

The UK reports suggest an increase in manufacturing PMI from 47.0 points to 47.5 points, but the services PMI may fall from 54.3 points to 54.1 points, leaving the S&P Global/CIPS composite value unchanged around 52.9 points. According to the government forecast, British GDP will increase by 0.4% this year, with inflation averaging 2.2% and unemployment at 4.6%. In 2025, the economy will adjust by 1.2%, and the consumer price index will be 2.1%, close to the target level.

Support and resistance

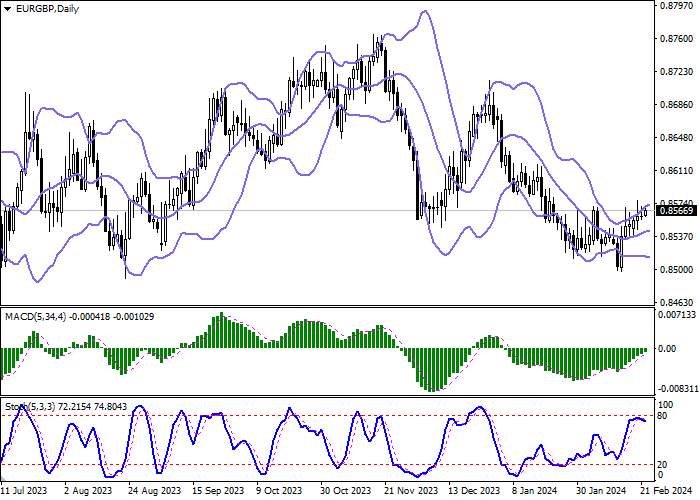

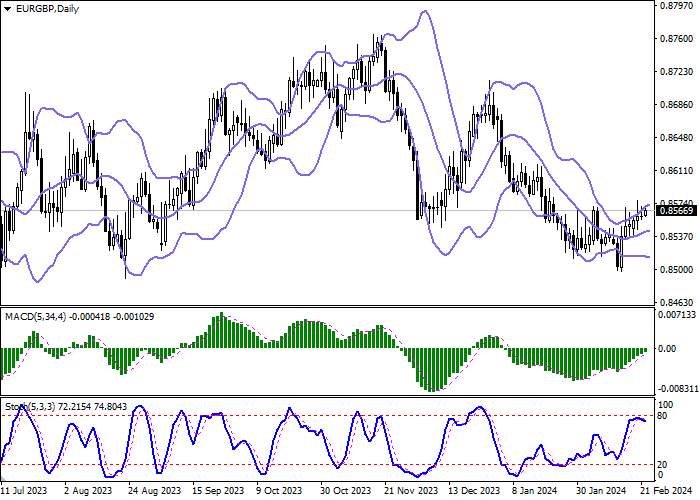

On the daily chart, Bollinger Bands are trying to reverse horizontally: the price range is expanding from above, letting the “bulls” renew local highs. The MACD indicator is growing, maintaining a strong buy signal (the histogram is above the signal line). Stochastic, approaching the level of “80”, reverses into a downward plane, signaling that the euro may become overbought in the ultra-short term.

Resistance levels: 0.8577, 0.8591, 0.8611, 0.8632.

Support levels: 0.8562, 0.8546, 0.8519, 0.8500.

Trading tips

Long positions may be opened after 0.8577 is broken upward with the target at 0.8611. Stop loss – 0.8562. Implementation time: 1–2 days.

Short positions may be opened after a decline and breakdown of 0.8546 downwards with the target at 0.8519. Stop loss – 0.8562.

Hot

No comment on record. Start new comment.