Current trend

The XAG/USD pair shows slight growth, testing 23.00. Activity in the market remains low, despite the fact that a sufficient amount of macroeconomic data is being released.

The instrument is supported by growing doubts that the US Federal Reserve will soon announce a move to easing monetary policy. According to the Chicago Mercantile Exchange (CME Group) FedWatch Tool, the probability of a decline in borrowing costs in May was previously estimated at about 60.0%, but now the figure has dropped to 35.0%. The day before, the minutes of the January meeting of the regulator were published in the United States, which only strengthened such expectations. Thus, members of the Federal Open Market Committee (FOMC) expressed concern about the dynamics of reducing inflation to the target 2.0%. Many are confident that forecasts regarding the timing of the easing of price pressure will not come true, so the Fed continues to closely monitor the situation. In addition, officials now see more risk in a premature decline in borrowing costs rather than a longer period of high interest rates.

Today, the focus of investors' attention, in addition to data on the dynamics of jobless claims, will be the February statistics on business activity from S&P Global. Forecasts suggest a reduction in the Services PMI from 52.5 points to 52.0 points, and in the Manufacturing PMI from 50.7 points to 50.5 points.

Meanwhile, the silver contract market is experiencing a correction. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal decreased to 12.4 thousand from 16.9 thousand a week earlier. The "bulls" are actively strengthening their positions in the asset: their balance with swap dealers is 36.738 thousand versus 32.215 thousand for the "bears". Last week, buyers increased the number of contracts by 2.021 thousand, and sellers decreased it by 0.996 thousand.

Support and resistance

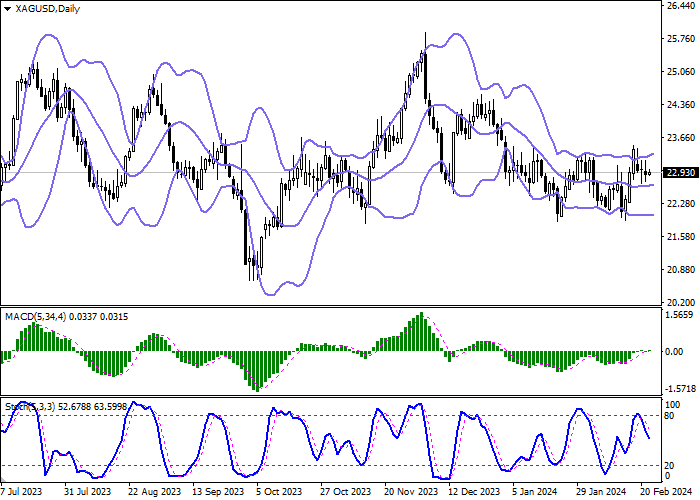

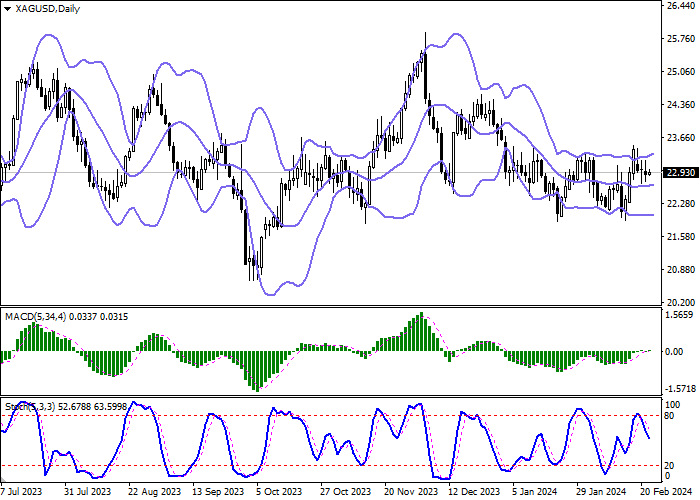

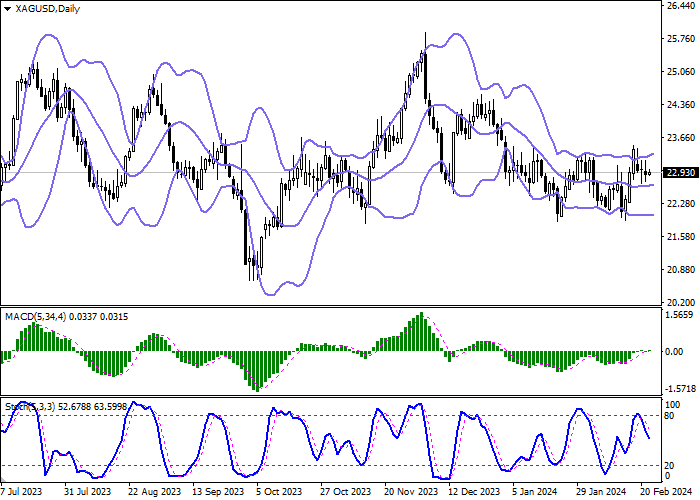

Bollinger Bands in D1 chart demonstrate mostly flat dynamics. The price range is expanding from above, being spacious enough for the current activity level in the market. MACD is growing preserving a weak buy signal (located above the signal line). In addition, the indicator is trying to consolidate above the zero level. Stochastic, on the contrary, maintains a rather active downward direction, located approximately in the center of its area, signaling in favor of the development of a corrective decline in the near future.

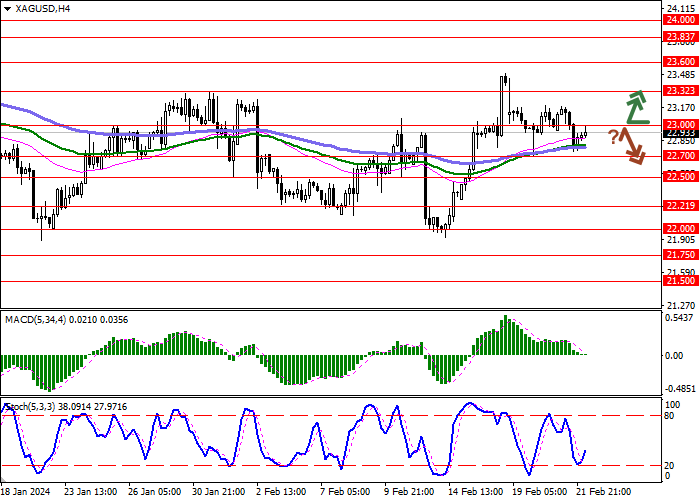

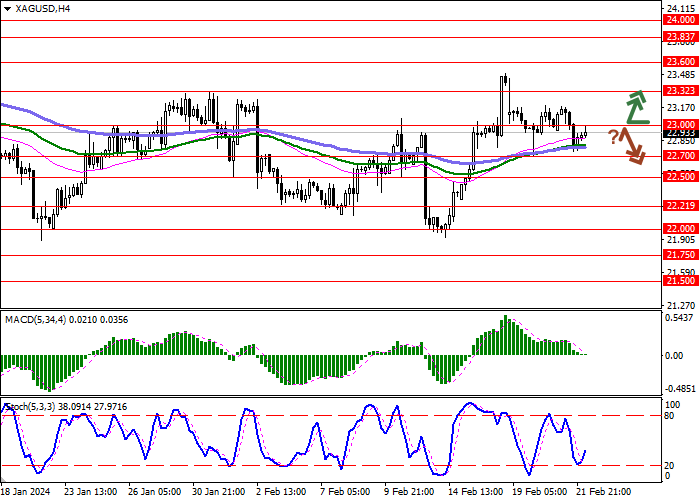

Resistance levels: 23.00, 23.32, 23.60, 23.83.

Support levels: 22.70, 22.50, 22.21, 22.00.

Trading tips

Long positions can be opened after a breakout of 23.00 with the target of 23.60. Stop-loss — 22.70. Implementation time: 2-3 days.

A rebound from 23.00 as from resistance, followed by a breakdown of 22.70 may become a signal for opening of new short positions with the target at 22.21. Stop-loss — 23.00.

Hot

No comment on record. Start new comment.