Current trend

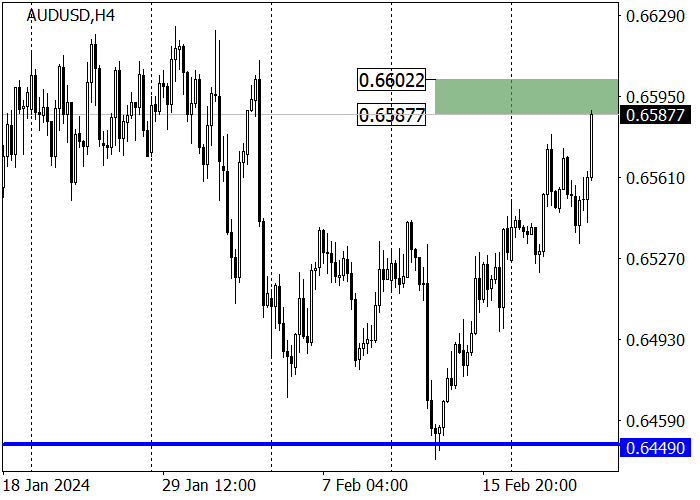

The AUD/USD pair is trading around 0.6580 and is preparing to continue strengthening to the target of 0.6616.

Positive dynamics are developing after the publication of the Fed meeting minutes: according to the document, to reduce the interest rate, officials need to see more progress in easing inflation. In addition, representatives of the regulator noted that the cost of borrowing has most likely reached its high, and further upward dynamics are not expected, which put pressure on the American dollar. Experts suggest committee members’ confidence in progress against rising consumer prices means a shift to the “dovish” rhetoric mid-year is inevitable.

Reports from the last meeting of the Reserve Bank of Australia (RBA) were also published this week: representatives of the regulator noted that to make a decision to begin reducing the interest rate from the current 4.35%, more time and data are needed, and it is necessary to ensure a stable decline in inflation to the target level of 2.0%. The Q4 wages increased by 0.9% QoQ, meeting expert expectations, and amounted to 4.2% YoY, exceeding 4.1% estimates. As a result, RBA officials can keep borrowing costs at high levels longer than traders had expected. However, most economists remain confident they will begin easing monetary policy this autumn.

Support and resistance

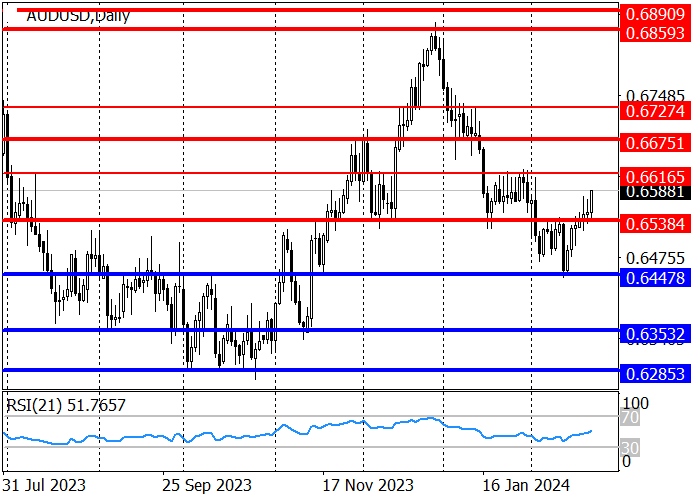

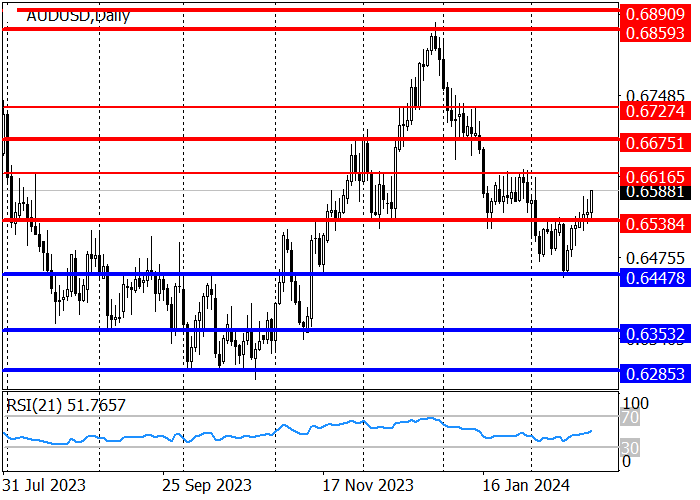

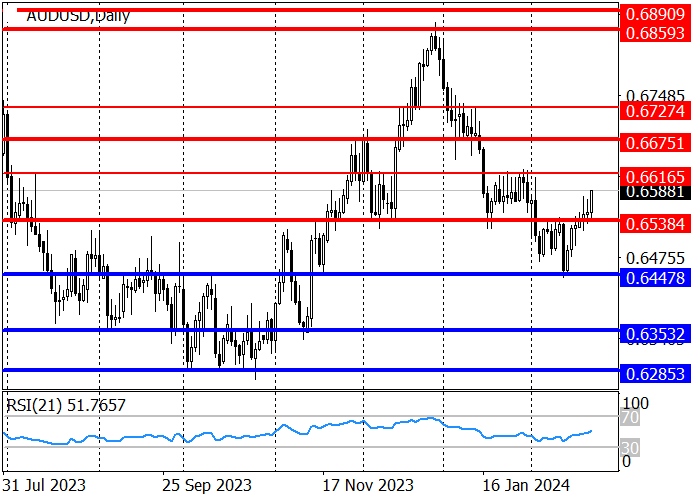

Within the downward trend from December 28 to February 13, the instrument reached the support level of 0.6447, where growth began, within which the price overcame the resistance level of 0.6538 and headed to the area of 0.6616. The consolidation above will be a catalyst for strengthening the asset’s position up to 0.6675.

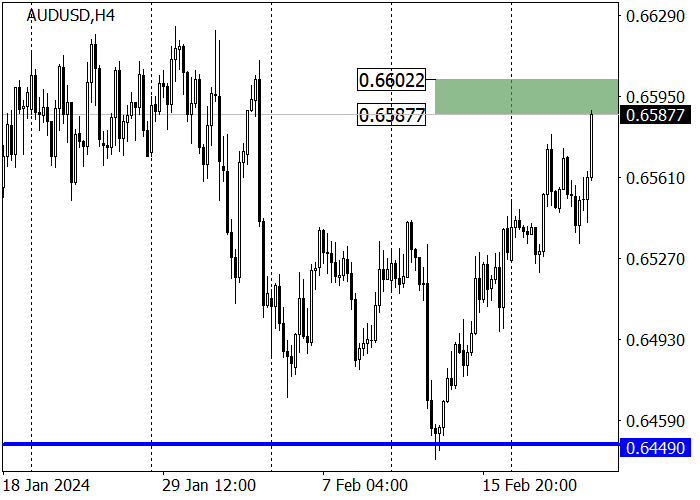

The medium-term trend is downward. Now, a correction is developing, within which the quotes have reached the key resistance area of 0.6602–0.6587. If it is held, short positions with the target at 0.6449 are relevant, and otherwise, the medium-term trend will reverse upwards with the target in zone 2 (0.6747–0.6732).

Resistance levels: 0.6616, 0.6675, 0.6727.

Support levels: 0.6538, 0.6447.

Trading tips

Long positions may be opened from 0.6538 with the target at 0.6616 and stop loss around 0.6508. Implementation time: 9–12 days.

Short positions may be opened below 0.6508 with the target at 0.6447 and stop loss around 0.6537.

Hot

No comment on record. Start new comment.