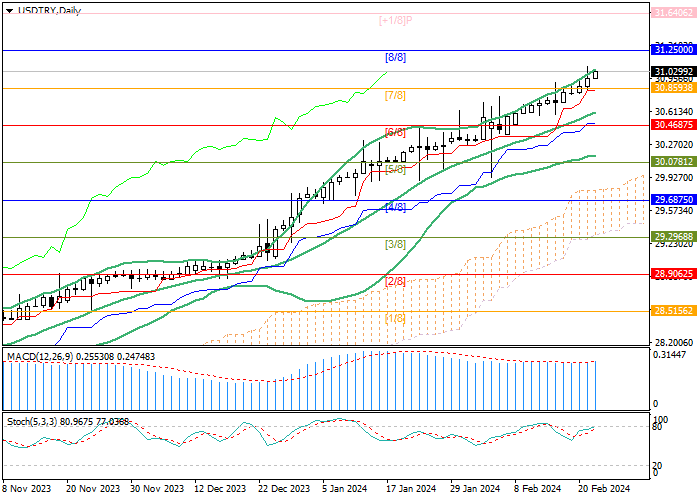

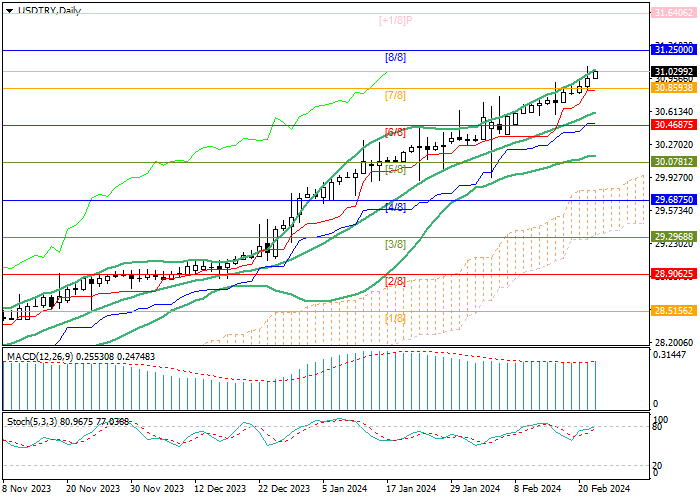

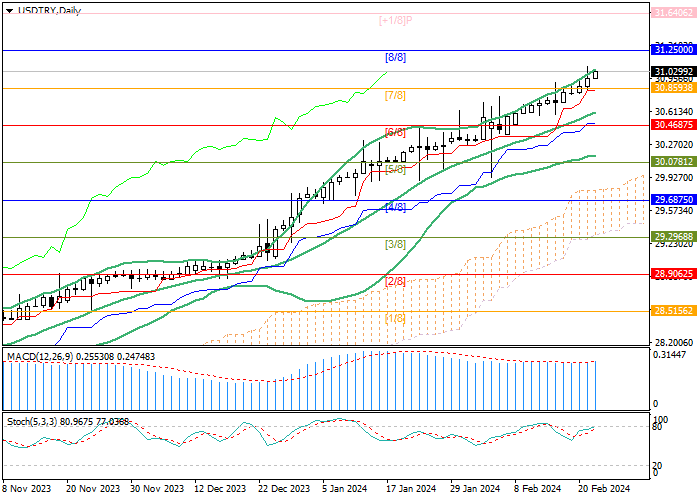

Current trend

The USD/TRY pair is moving as part of a long-term uptrend, reaching the 31.0300 area this week.

The lira is under pressure from rapid inflation and weakening economic indicators: in January, the consumer price index increased from 64.77% to 64.86% YoY instead of the expected decline to 64.52%, and the February consumer confidence index fell for the first time since then six months, correcting from 80.4 points to 79.3 points. Experts fear that against this background, officials of the Central Bank of the Republic of Turkey may continue to increase borrowing costs, which will negatively affect the weakened national economy. Today, there will be a meeting of the monetary policy regulator chaired by the new head, Fatih Karahan: experts believe that the officials will leave the interest rate at 45.00%, maintaining a “hawkish” tone.

The American dollar was supported after the publication of the Fed meeting minutes, which confirmed the cautious position of the officials regarding the transition to the “dovish” rhetoric. Representatives of the regulator expressed concern about the possibility of easing monetary policy too early, and some of them noted the risks of suspending progress in the fight against inflation if the economy continues its current growth. In general, the documents strengthened investors’ confidence that the monetary policy adjustment mught be postponed until the second half of the year, which strengthens the dollar’s position against its main competitors.

Support and resistance

The trading instrument rose above 30.8593 (Murrey level [7/8]), which will allow it to reach the area of 31.2500 (Murrey level [8/8]) and 31.6406 (Murrey level [ 1/8]). In case of consolidation below the key “bearish” level of 30.4687 (Murrey level [6/8]) under the middle line of Bollinger bands, a decline to the area of 30.0781 (Murrey level [5/8]) and 29.6875 (Murrey level [4/8] is expected, which is less likely.

Technical indicators reflect a continuation of the upward trend: Bollinger Bands and Stochastic are directed upward, and the MACD histogram is increasing in the positive zone.

Resistance levels: 31.2500, 31.6406.

Support levels: 30.4687, 30.0781, 29.6875.

Trading tips

Long positions may be opened from 31.0450 with the targets at 31.2500, and 31.6406 and stop loss around 30.8920. Implementation time: 5–7 days.

Short positions may be opened below 30.4687 with the targets at 30.0781, 29.6875 and stop loss around 30.7480.

Hot

No comment on record. Start new comment.