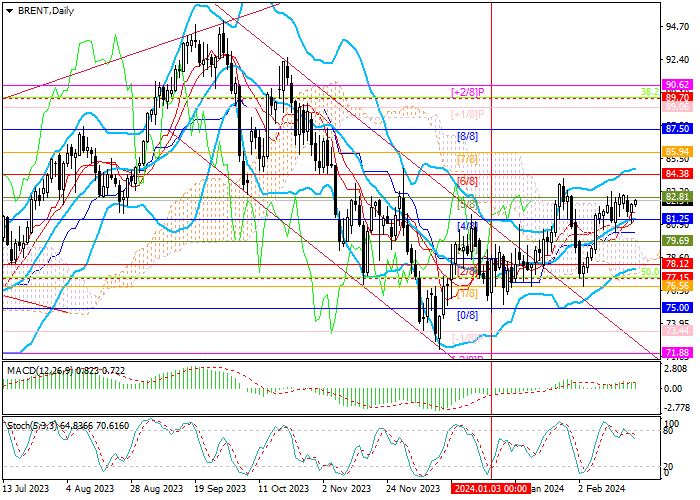

Current trend

Brent Crude Oil quotes are rising within the medium-term uptrend and are now close to 82.81 (Murrey level [2/8]).

The military conflict between Israel and the Palestinian Hamas movement continues, affecting, among other things, the safety of navigation on the Red Sea. In the last five days alone, the Houthis have attacked four cargo ships, one of which sank, which confirms the increase in transportation costs due to changes in routes and interruptions in oil supplies. At the same time, energy demand in the United States may grow in the near future, as a number of large processing plants resume operations after interruptions. According to Reuters sources, BP Plc plant in Indiana with a capacity of 435.0 thousand barrels per day and TotalEnergies plant in Texas with a capacity of 238.0 thousand barrels per day will return to full production in the near future. All this should lead to a reduction in reserves, which last week, according to the American Petroleum Institute (API), increased by 7,168 million barrels, and strengthen the upward dynamics of quotations.

The trading instrument is restrained by the uncertainty of the further policy of the US Federal Reserve, which may once again postpone the start of the correction of monetary policy, but so far fundamental factors that contribute to price growth are dominating.

Support and resistance

Technically, the price is close to 82.81 (Murrey level [2/8]), which it has been unsuccessfully testing during this month. Consolidating above it will allow quotes to continue rising to the levels of 84.38 (Murrey level [6/8]) and 85.94 (Murrey level [7/8]), and such a scenario looks more likely in the near future.

Technical indicators confirm the continuation of the uptrend: the Bollinger Bands are reversing up, MACD is stable in the positive zone. A Stochastic reversing down from the overbought zone does not exclude a pullback in prices to the area of 81.25 (Murrey level [4/8], the central line of Bollinger Bands), 79.69 (Murrey level [3/8]), but it is unlikely to lead to a change in the current trend.

Resistance levels: 82.81, 84.38, 85.94.

Support levels: 81.25, 79.69.

Trading tips

Long positions can be opened above 82.81 or after a price reversal around 79.69 with targets of 84.38, 85.94 and stop-losses around 81.80 and 78.70, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.