We present a medium-term investment review of the USD/CHF pair.

Although the situation in the Swiss economy has stabilized in recent months, the main indicators remain close to negative values. Thus, in January, the producer price index adjusted by –0.5% MoM and –2.3% YoY, and the Q4 gross domestic product (GDP) amounted to 0.3%, reducing the rate to 0.3% YoY. However, the consumer price index fell into the target range of 1.0–2.0%, moving from 1.7% to 1.3%. The central forecast of the Swiss National Bank (SNB) for the first half of the year assumes slight economic growth amid poor demand for goods and services, as a result of which inflation could return to 1.7% by the end of the year, preventing regulator officials from easing monetary policy, and the interest rate is likely to remain at 1.75%.

Meanwhile, the US Fed is keeping borrowing costs at 5.25–5.50%. The consumer price index is at 3.1%, as a result of which regulator officials may postpone monetary policy adjustments. Also, even if the department does not switch to the “dovish” rhetoric this year, the national economy is far from the recession zone, which will ensure stable dynamics of the American dollar. The next meeting of the US Fed will take place on March 20, and according to the Chicago Mercantile Exchange (CME Group) instrument, 91.5% of experts are confident that interest rates will remain at current levels.

As a result, neutral dynamics of the franc and moderately positive dynamics of the American dollar are expected in the next quarter, which will support the growth of the USD/CHF pair.

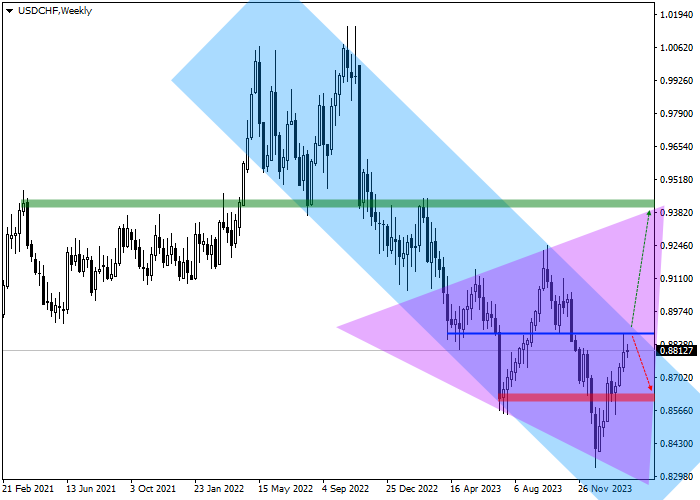

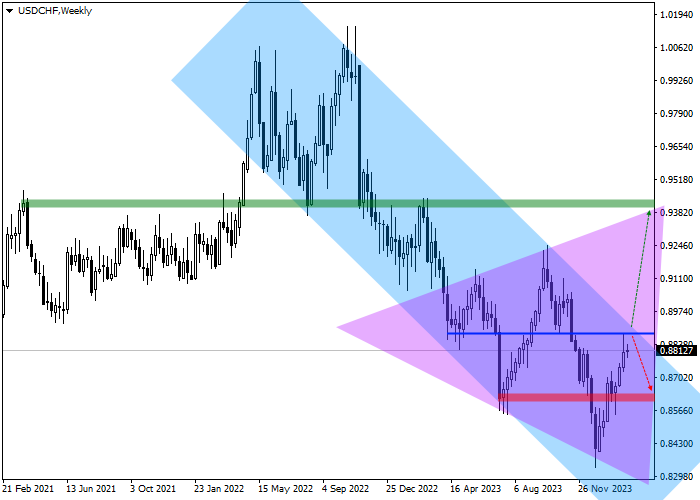

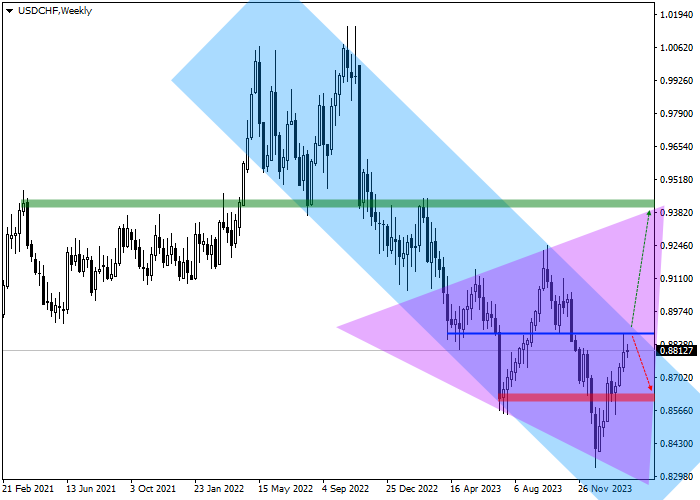

In addition to the core fundamental factors, the continued growth is confirmed by the technical indicators: on the weekly chart, the price is moving within the correction within the global channel with dynamic boundaries of 0.8850–0.8560.

At the moment, the quotes are trying to reach the resistance level of 0.8880, which is the main obstacle to further growth.

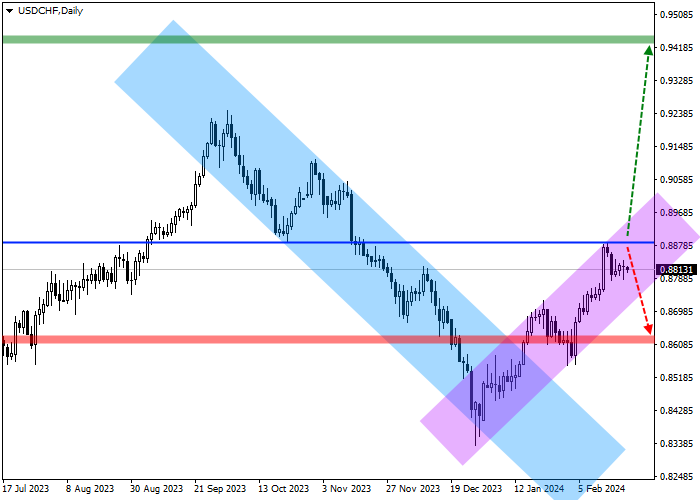

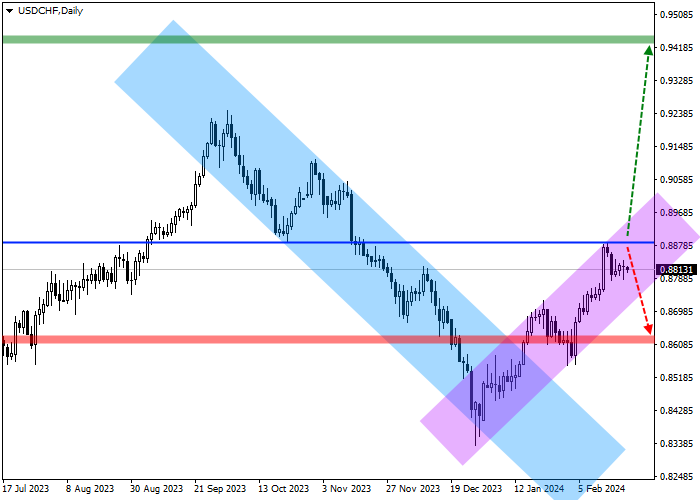

Let’s consider the levels on the daily chart.

As can be seen in the chart, positive dynamics are developing within the local ascending channel 0.8880–0.8770, where the fifth wave of growth is forming, and the asset only needs to consolidate above the local high of 0.8880, which could happen as early as this week. If the low of February 2 at 0.8620 is reached, it is better to liquidate open buy positions. Around the global high level of February 26, 0.9400, there is the target zone, after reaching which it is better to close profitable buy positions.

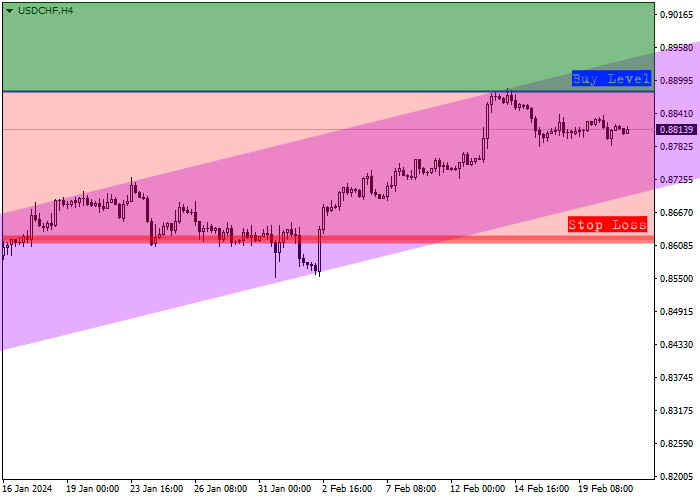

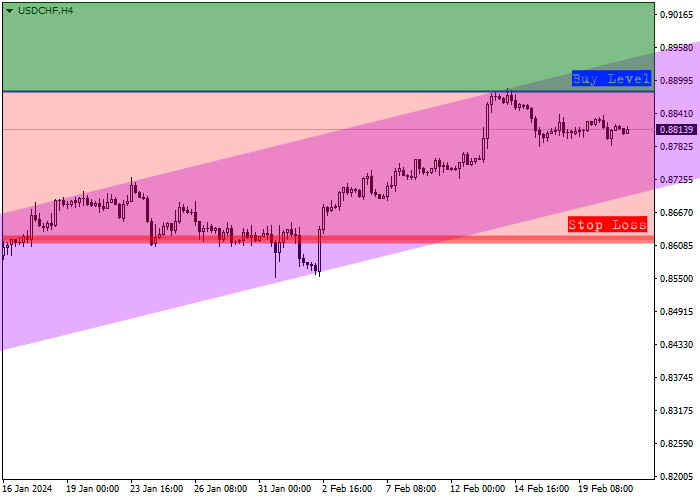

Let’s assess the trade entry levels on the four-hour chart.

The entry level for buy positions is at the year’s high of 0.8880, close to the current price. If the price consolidates above it, there will be practically no resistance left for further growth, and positions can be implemented.

Considering the average daily volatility of the trading instrument over the last month, which is 36.5 points, movement to the target zone of 0.9400 will take approximately 39 trading sessions but with an increase in the volatility of the American dollar, this time may reduce to 32 trading days.

Hot

No comment on record. Start new comment.