Current trend

This week, the GBP/USD pair is making attempts to grow, correcting around 1.2615: the pound is supported by comments from the head of the Bank of England, Andrew Bailey, as well as the publication of data on government borrowing for January.

Yesterday, the official said that the expectation of a reduction in interest rates this year is quite reasonable, but additional evidence of a stable decline in inflation is needed. Nevertheless, in order to correct the monetary policy, the regulator will not necessarily wait for the consumer price index (CPI) to reach the target level of 2.0%. In addition, Bailey expressed confidence that the recession will be overcome, as the labor market remains strong and household spending remains stable. According to experts, these statements were very cautious, which means the possibility of further postponement of the start of the reduction in borrowing costs.

According to government data published today, the UK budget received 16.7 billion pounds in January, double the figures of last year. According to analysts, this will allow Chancellor of the Exchequer Jeremy Hunt to make partial tax cuts, which will serve as an additional incentive for economic growth and strengthen the position of the national currency in the medium term.

Today, the growth of the GBP/USD pair is somewhat restrained, as investors are waiting for the publication of the punctures of the last meeting of the US Federal Reserve. Most likely, the American regulator will confirm its cautious position and forecast 2–3 key rate cuts by the end of the year.

Support and resistance

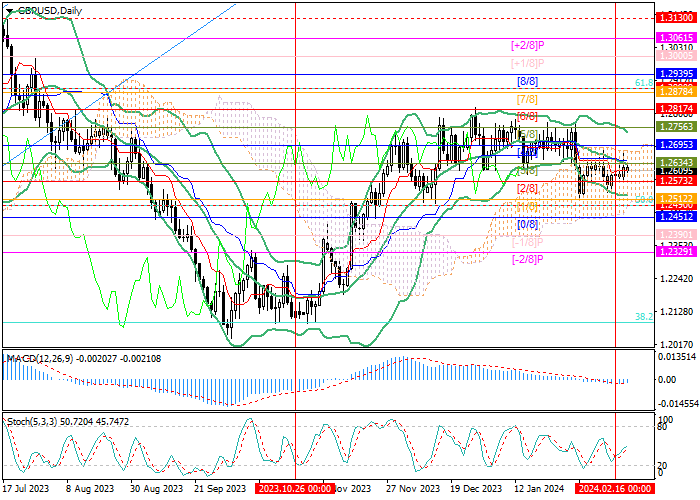

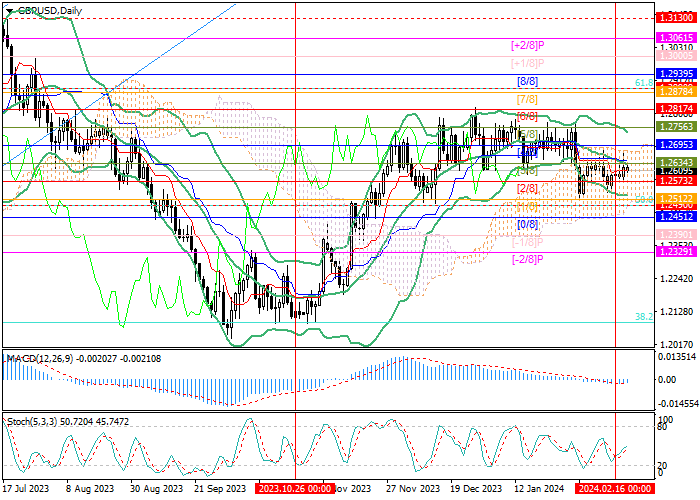

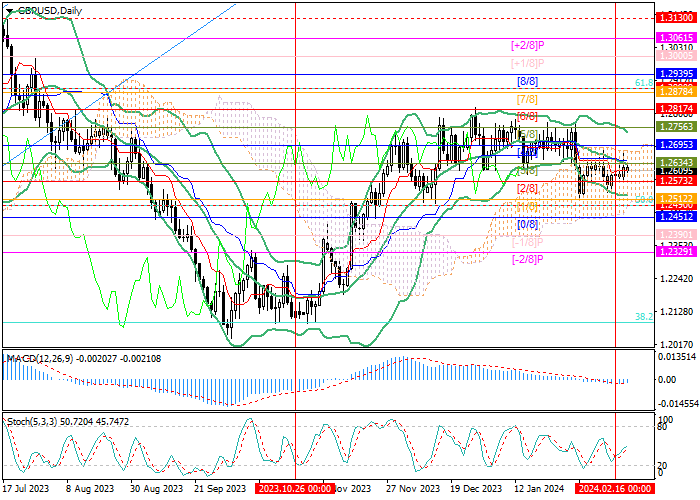

The instrument is testing the 1.2634 mark (Murrey level [3/8]), supported by the central line of Bollinger bands, the breakout of which will open up the possibility for continued growth to the levels of 1.2756 (Murrey level [5/8]) and 1.2817 (Murrey level [6/8]). The key for the "bears" remains the 1.2573 mark (Murrey level [2/8]), at the breakdown of which the decline will resume to 1.2490 (50.0% Fibonacci retracement) and 1.2451 (Murrey level [0/8]).

Technical indicators confirm the continuation of the downtrend: Bollinger Bands are reversing down, MACD histogram is stable in the negative zone, but Stochastic is directed upwards, which does not exclude the development of an upward correction.

Resistance levels: 1.2634, 1.2756, 1.2817.

Support levels: 1.2573, 1.2490, 1.2451.

Trading tips

Short positions should be opened below the level of 1.2573 with targets of 1.2490, 1.2451 and stop-loss around 1.2630. Implementation period: 5–7 days.

Long positions can be opened above 1.2634 with targets of 1.2756, 1.2817 and stop-loss of 1.2580.

Hot

No comment on record. Start new comment.