Current trend

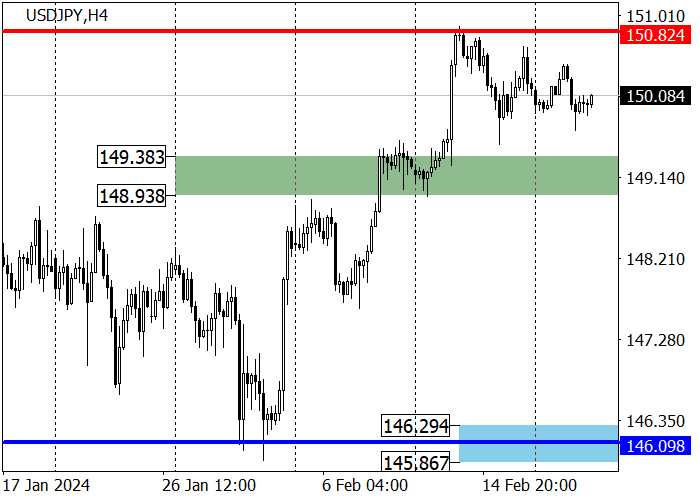

The USD/JPY pair is preparing to update the maximum of 2023, holding in the area of 150.08.

The minutes of the last US Federal Reserve monetary policy meeting will be published today at 21:00 (GMT 2). The dollar is also supported by the fact that investors are reconsidering their expectations regarding the policy of the American regulator for 2024: in mid-January, analysts were confident that the interest rate would be reduced by 2.0% during the year, but now this figure doesn't exceed even the 1.0% mark, and the trend towards correcting forecasts can be continued. At the moment, the decrease in the cost of borrowing in March is estimated by the Chicago Mercantile Exchange (CME) FedWatch Tool with a probability of 8.5%, and the likelihood of monetary policy easing in May was adjusted from 50.9% to 32.5%. Against this background, the dollar may continue to grow in the long term.

The Tankan index of business sentiment of Japanese enterprises for February was published today. The indicator was -1.0 points, being much lower than both the forecast of 7.0 points and the previous value of 6.0 points. Thus, the Bank of Japan's interest rate is likely to remain negative at -0.10% for a long time, which will weaken the yen against its main competitors. The Japanese currency is moderately supported by statistics on exports, which increased by 11.9% YoY in January, with a forecast of 9.5% and an increase of 9.7% last month. Imports for the same period decreased by 9.6% after a decline of 6.9% in December, with expectations of 8.4%.

Support and resistance

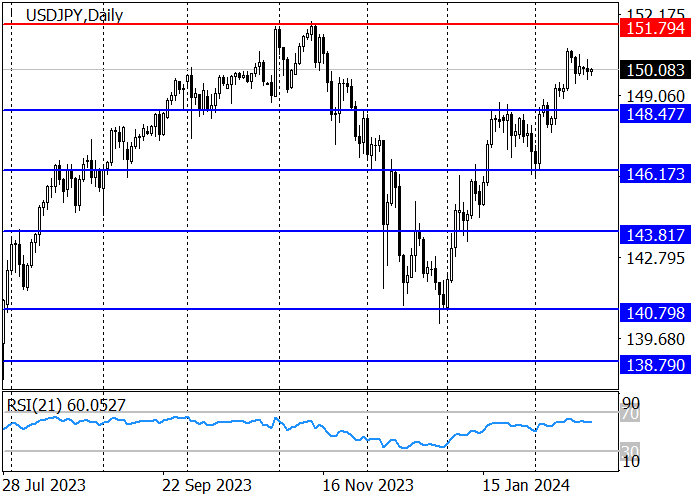

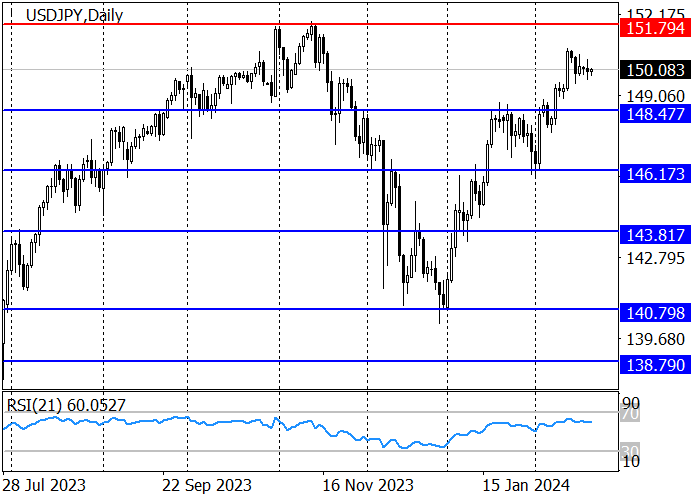

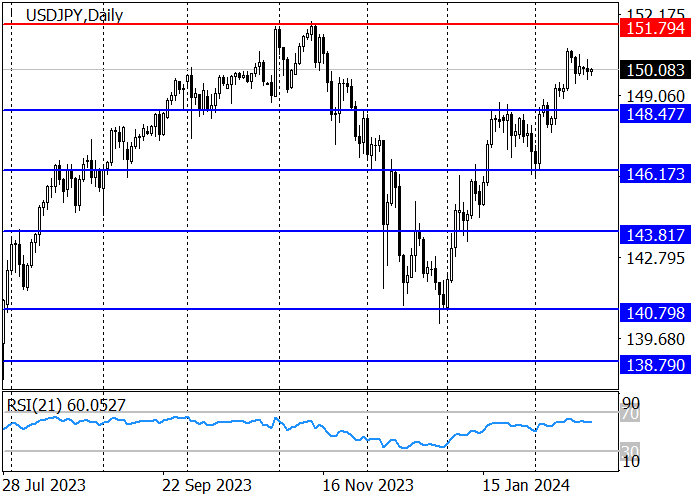

The long-term trend is upward. After the breakdown of the resistance level of 148.47, the instrument continued to move towards the maximum of last year at 151.79, after consolidation above which the next target will be the 155.50 mark.

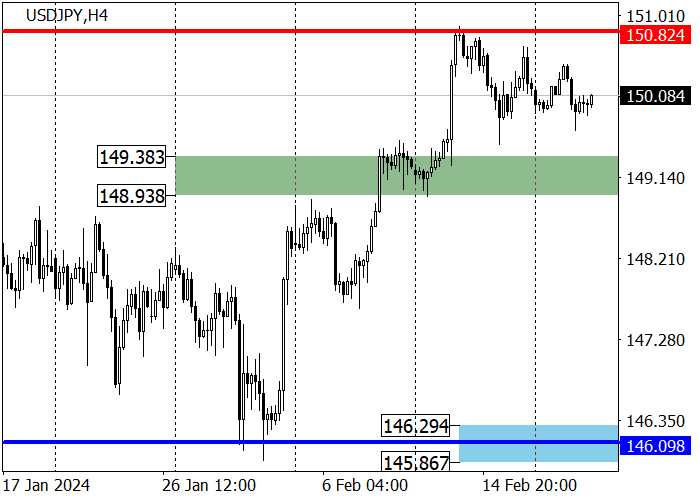

The medium-term trend is upward. The traders broke through the target zone 2 (149.38–148.93), allowing quotes to grow towards the target zone 3 (154.17–153.69), but now the asset is correcting downwards. With the strengthening of the downward dynamics, it is likely to reach the key support of the trend of 146.29–145.86, after which one may open long positions with the target of 150.82.

Resistance levels: 151.80, 155.50.

Support levels: 148.47, 146.17.

Trading tips

Long positions can be opened from the 148.47 mark with the target of 151.79 and stop-loss around 147.42. Implementation time: 9–12 days.

Short positions can be opened below the level of 147.42 with the target of 143.81 and stop-loss of 148.85.

Hot

No comment on record. Start new comment.