Current trend

The price of North American light oil WTI Crude Oil is correcting in a sideways trend around 77.20 against a tense world geopolitical situation and uncertainty regarding European countries' oil purchases.

According to a Bloomberg report, supplies of Russian oil by sea over the past week decreased by 360.0K barrels per day to 3.13M barrels per day, resulting in a reduction over the past four weeks of 30.0K barrels per day, and the total the volume reached 3.27M barrels per day. The main destinations remain India and Turkey, while oil transportation to European countries has completely stopped. Thus, until recently, only Bulgaria purchased Russian oil but its government decided to switch to more expensive purchases through Turkey to circumvent the embargo, like other states in the region.

Against this background, investment demand for WTI Crude Oil contracts on the Chicago Mercantile Exchange (CME Group) increased. Over the past week, the average value was 1.12M contracts, significantly higher than 0.876M at the beginning of the month. Demand volumes at the end of January did not exceed 0.790M items, and the current trend reflects stable demand supporting the quotes.

Support and resistance

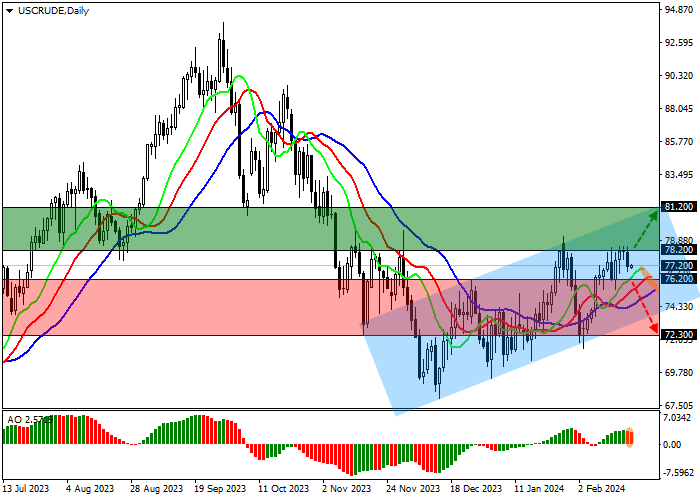

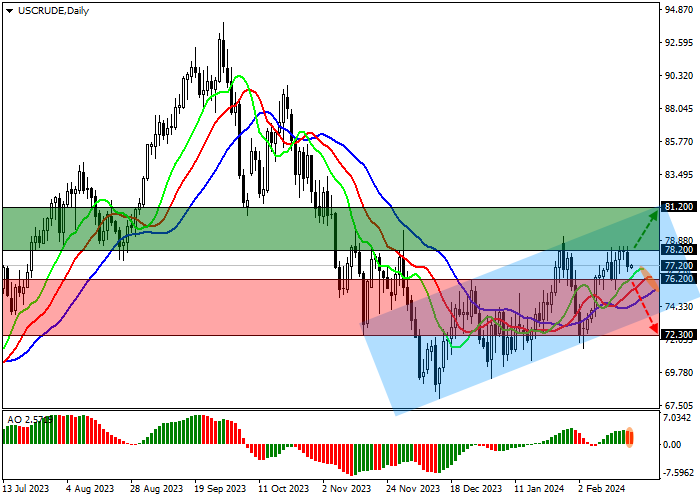

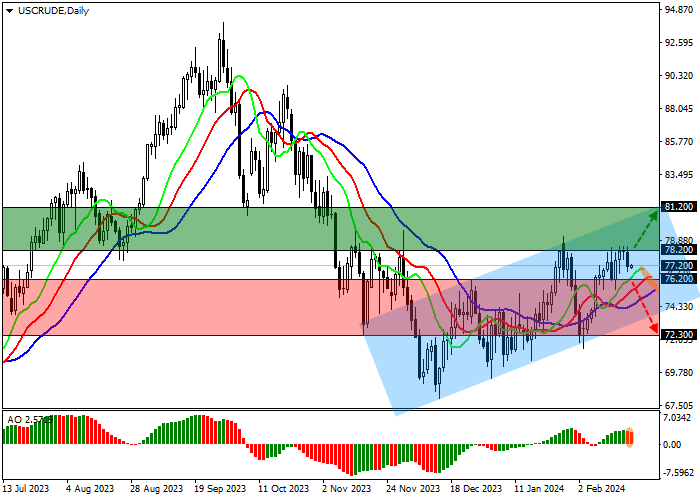

On the daily chart, the trading instrument is trying to reach the resistance line of the local ascending channel 80.00–72.00, correcting around 78.00.

Technical indicators are holding a buy signal: fast EMA on the Alligator indicator are above the signal line, and the AO histogram is forming corrective bars above the transition level.

Resistance levels: 78.20, 81.20.

Support levels: 76.20, 72.30.

Trading tips

Long positions may be opened after the price rises and consolidates above 78.20 with the target at 81.20. Stop loss – 76.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 76.20 with the target at 72.30. Stop loss – 79.00.

Hot

No comment on record. Start new comment.