Current trend

The USD/CHF pair is showing a slight decline, testing 0.8800 for a breakdown. Market activity remains low as trading participants await the release of key macroeconomic statistics.

In particular, today the minutes of the US Federal Reserve meeting will be presented, which may clarify the prospects for a potential easing of monetary policy in May or June. Also, during the day, representatives of the American regulator will give speeches, and they can assess further steps of the Fed: most traders believe that officials will begin to lower the interest rate in July and reduce it by 90 basis points, despite the fact that inflation rates have not slowed down recently as experts predicted, and the risks of rising consumer prices remain. Members of the US Federal Reserve board traditionally speak more cautiously, predicting the possibility of two or three adjustments to borrowing costs before the end of the year, a total of 75 basis points.

Tomorrow at 16:45 (GMT 2) February business activity statistics from S&P Global will be published in the United States: the Manufacturing PMI is expected to decline from 50.7 points to 50.5 points, and the Services PMI may decline from 52.5 points up to 52.0 points.

The franc, in turn, is provided with some support by data from Switzerland presented the day before. Export volumes in January increased from 18.79 billion Swiss francs to 22.80 billion Swiss francs, and Imports from 17.52 billion Swiss francs to 18.07 billion Swiss francs. In turn, the trade surplus increased from 1.271 billion Swiss francs to 4.738 billion Swiss francs, supporting the position of the national currency.

Support and resistance

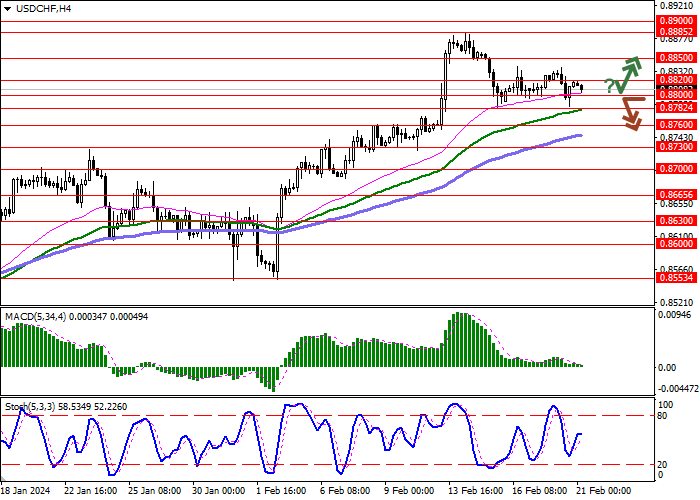

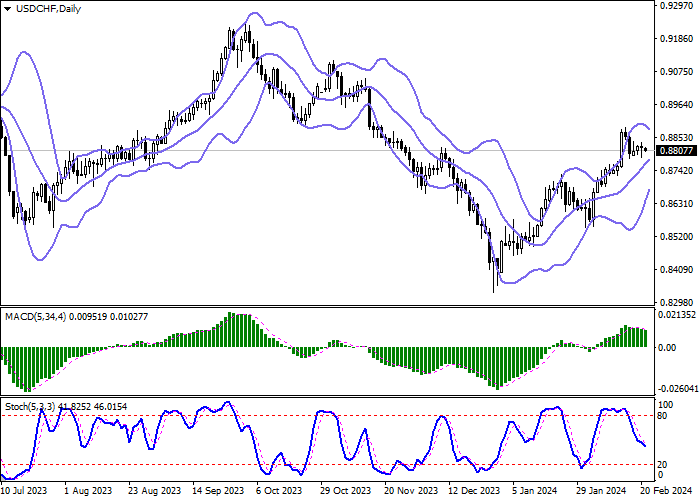

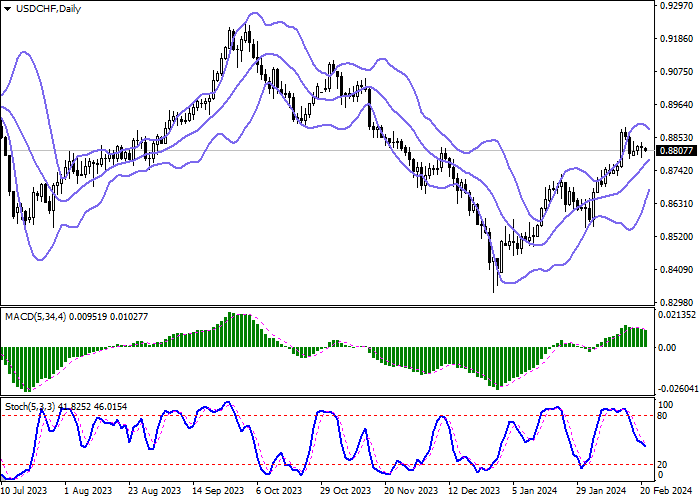

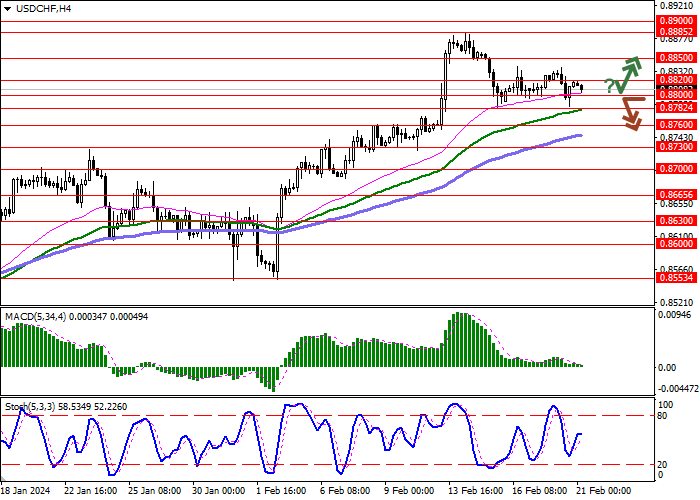

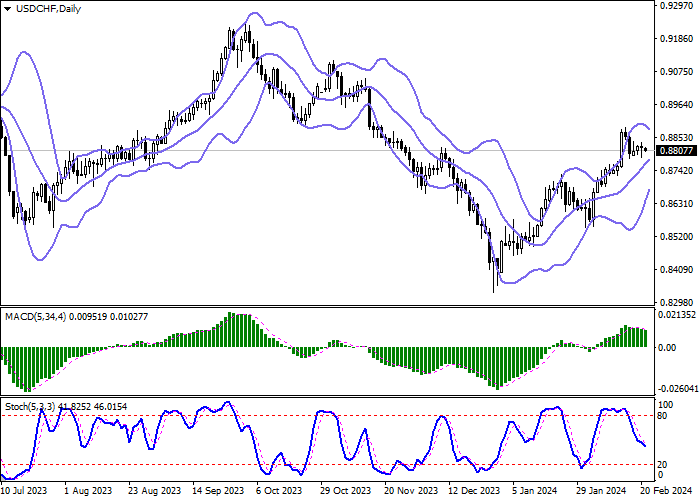

Bollinger Bands on the daily chart show a steady increase. The price range is actively narrowing, reflecting ambiguous nature of trading in the short term. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic shows similar dynamics, being approximately in the center of its working area, which indicates sufficient "bearish" potential in the near future.

Resistance levels: 0.8820, 0.8850, 0.8885, 0.8900.

Support levels: 0.8800, 0.8782, 0.8760, 0.8730.

Trading tips

Short positions may be opened after a breakdown of 0.8800 with the target at 0.8760. Stop-loss — 0.8820. Implementation time: 1-2 days.

A rebound from 0.8800 as from support followed by a breakout of 0.8820 may become a signal for opening long positions with the target at 0.8860. Stop-loss — 0.8800.

Hot

No comment on record. Start new comment.