Current trend

The NZD/USD pair shows mixed trading dynamics, holding near 0.6100. Trading participants are in no hurry to open new positions, preferring to wait for today's publication of macroeconomic statistics from the United States.

In particular, January data on producer inflation will be presented, which will provide a more complete picture of the situation in addition to the statistics on the Consumer Price Index published earlier. The annual rate in January slowed down from 3.4% to 3.1%, which turned out to be higher than market forecasts of 2.9%, and the monthly rate adjusted from 0.2% to 0.3%, while Core CPI excluding Food and Energy remained at 3.9% against preliminary estimates of 3.7%. Against this background, trading participants revised expectations regarding the pace of interest rate reduction by the US Federal Reserve, which provided significant support to the American currency. Meanwhile, macroeconomic data presented the day before contributed to a cooling of "bullish" sentiment: Retail Sales volumes decreased by 0.8% in January after growing by 0.4% in the previous month, while analysts expected -0.1%.

The instrument is moderately supported by optimism from statistics from New Zealand. The Manufacturing PMI strengthened from 43.4 points to 47.3 points in January, exceeding analysts' expectations.

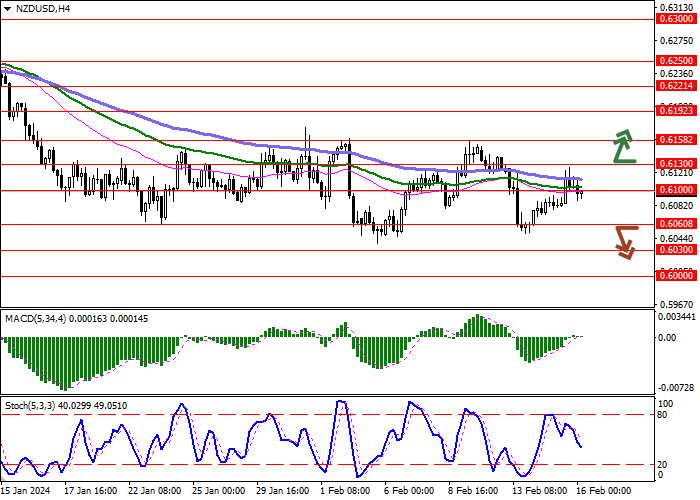

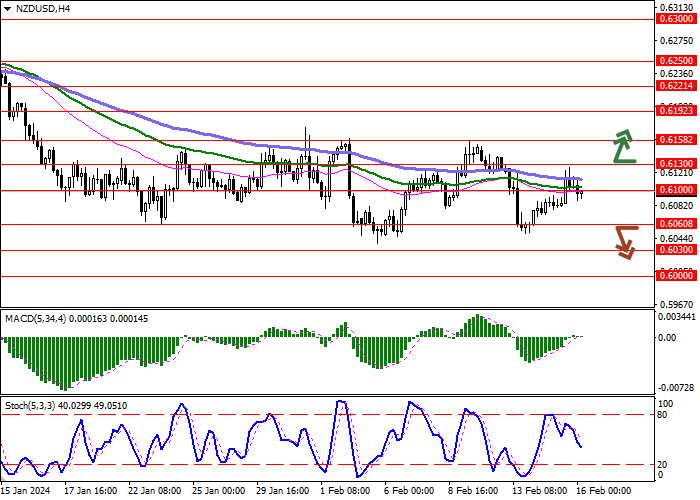

Support and resistance

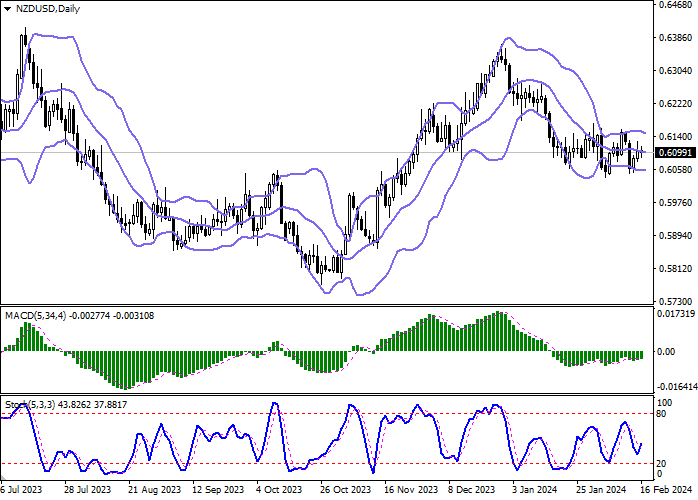

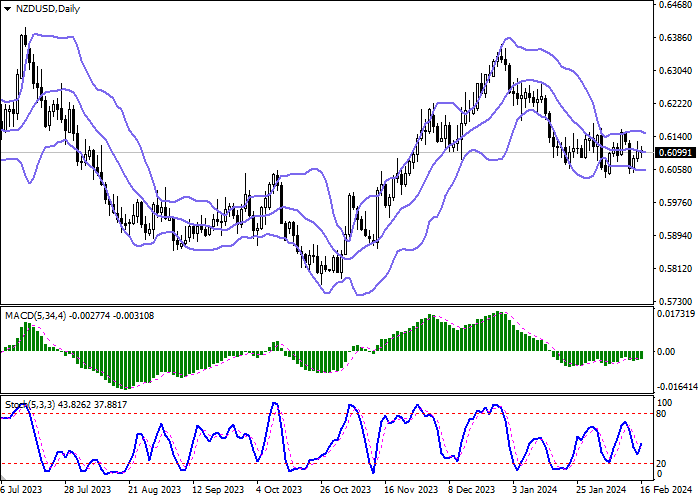

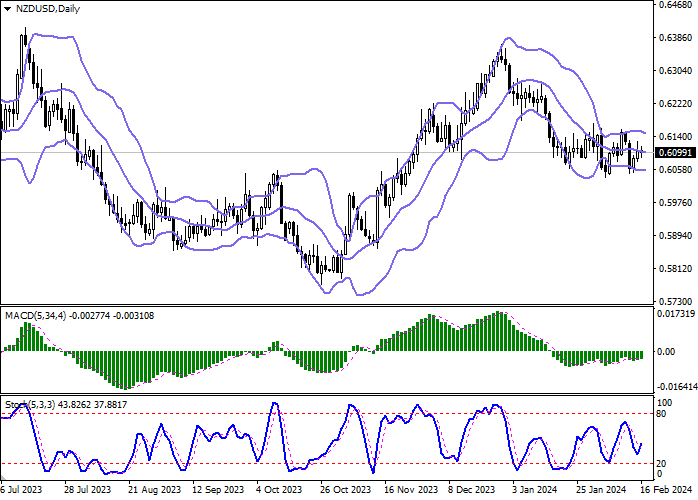

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowing from above, being spacious enough for the current activity level in the market. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic, approaching the level of "20", reversed into an upward plane, reacting to the emergence of corrective dynamics in the middle of this week.

Resistance levels: 0.6100, 0.6130, 0.6158, 0.6192.

Support levels: 0.6060, 0.6030, 0.6000, 0.5950.

Trading tips

Long positions can be opened after a breakout of 0.6130 with the target of 0.6192. Stop-loss — 0.6100. Implementation time: 2-3 days.

The return of "bearish" trend with the breakdown of 0.6060 may become a signal for new sales with the target at 0.6000. Stop-loss — 0.6090.

Hot

No comment on record. Start new comment.