Current trend

During the Asian session, the USD/TRY pair is actively growing, testing 30.8000 for a breakout, while yesterday, it was approaching the next psychological resistance level of 31.0000.

Yesterday, the American dollar failed to consolidate at new highs after the publication of macroeconomic statistics: sales volumes decreased by 0.8% after growing by 0.4% as analysts expected only –0.1%, and industrial production fell by 0.1 % after zero dynamics in December relative to forecasts of growth of 0.3%. The percentage of production capacity utilization in January dropped from 78.7% to 78.5%, while experts expected it to reach 78.8%. However, initial jobless claims for the week of February 9 adjusted from 220.0K to 212.0K, better than the estimates of 220.0K.

The lira is under pressure amid growing economic problems at home, with the “hawkish” rhetoric of the Central Bank of the Republic of Turkey failing to support the national currency. Investors are trying to predict the steps of the new head of the regulator, Fatih Karahan, who replaced Hafize Gaye Erkan, who failed to reduce inflation in the economy. Thus, during her work, the borrowing cost changed eight times (the last time, on January 25, the figure changed by 2.5% to 45.0%), but the consumer price index increased from 47.00% to 64.86%. Thus, the measures taken were not enough to bring the situation under control against high domestic demand and rising wages, the low value of which increased by 34.0% in July and by 49.0% at the beginning of this year. Karahan has already assured that the bank will maintain a tight monetary policy if the inflation forecast worsens. So far, it remains at 36.0% at the end of this year, 14.0% by the end of 2025 and 9.0% in 2026. The official believes that price growth will peak in May, and its slowdown will begin in the second half of the year.

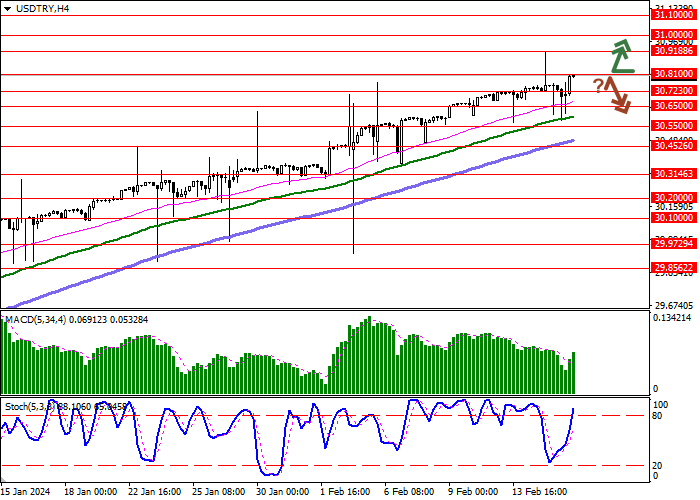

Support and resistance

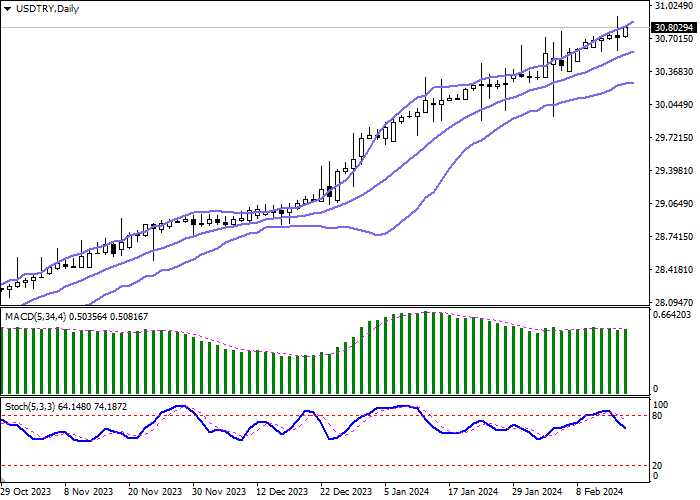

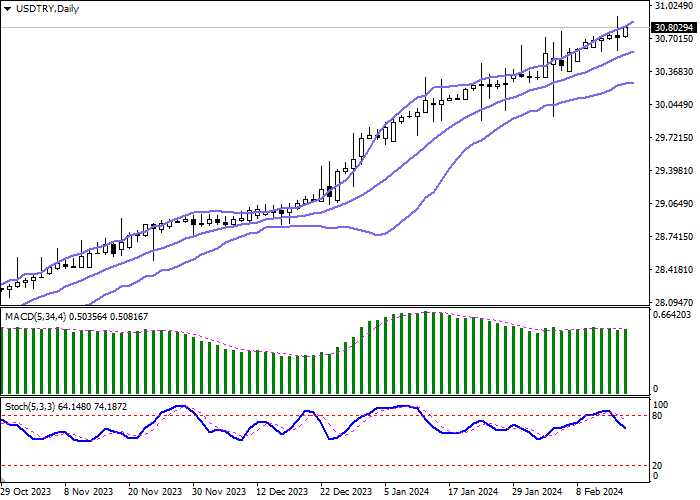

On the daily chart, Bollinger Bands are steadily growing: the price range is expanding from above, letting the “bulls” renew local highs. The MACD indicator reverses upwards, preparing to generate a buy signal (the histogram should be above the signal line). Stochastic, on the contrary, maintains a downward direction, signaling that the American dollar may become overbought in the ultra-short term.

Resistance levels: 30.8100, 30.9188, 31.0000, 31.1000.

Support levels: 30.7230, 30.6500, 30.5500, 30.4526.

Trading tips

Long positions may be opened after a breakout of 30.8100 with the target at 31.0000. Stop loss – 30.7000. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 30.8100 and a breakdown of 30.6500 with the target at 30.4526. Stop loss – 30.7500.

Hot

No comment on record. Start new comment.