Current trend

One of the leading US indices, the NQ 100, is showing corrective dynamics at 17882.0 against the background of the ongoing reporting season and rising bonds.

Semiconductor materials supplier Applied Materials Inc. released financial results yesterday, posting revenue of 6.71 billion dollars, beating the 6.48 billion dollars expected by analysts. Earnings per share were 2.13 dollars, also beating estimates of 1.9 dollars and 2.12 dollars reported in the prior-year quarter.

The income of the IT company EPAM Systems Inc. amounted to 1.16 billion dollars against the backdrop of 1.14 billion dollars that experts were counting on and 1.15 billion dollars recorded in the previous quarter. Earnings per share rose to 2.75 dollars from 2.73 dollars, with estimates of 2.50 dollars.

Despite the positive reports from the component companies, the index is still under pressure from the situation on the domestic bond market, where positive dynamics remain. The 10-year bonds are trading at 4.262%, above their February 1 low of 3.878%, while the 20-year yield is 4.547%, also above its early February low of 4.259%.

The growth leaders in the index are Airbnb Inc. ( 6.40%), Tesla Inc. ( 6.22%), Moderna Inc. ( 6.04%), DoorDash Inc. ( 5.22%).

Among the leaders of the decline are Datadog Inc. (-3.17%), MongoDB Inc. (-2.53%), Cisco Systems Inc. (-2.43%).

Support and resistance

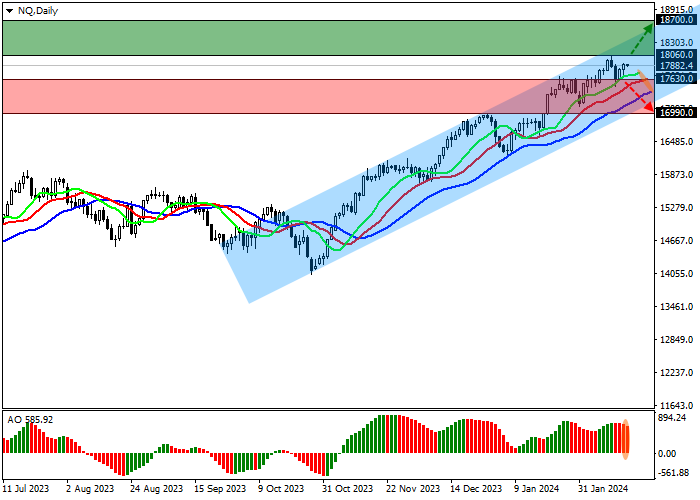

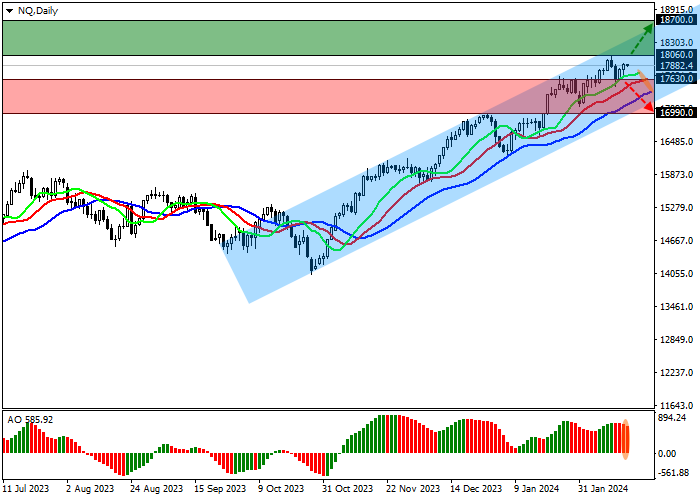

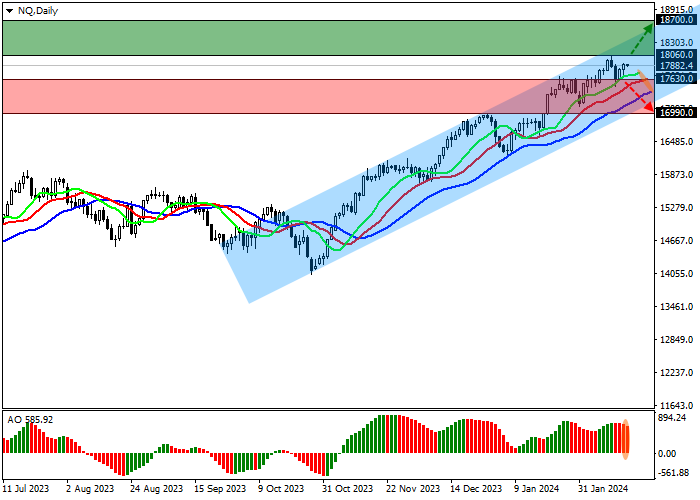

On the daily chart, the index quotes continue their global correction, which is developing within an ascending corridor with boundaries of 18300.0–17000.0.

Technical indicators hold a buy signal, which remains quite stable: fast EMAs on the Alligator indicator are above the signal line, and the AO histogram is forming new corrective bars, holding in the buy zone.

Support levels: 17630.0, 16990.0.

Resistance levels: 18060.0, 18700.0.

Trading tips

If the asset continues growing locally and consolidates above 18060.0, long positions with the target at 18700.0 will be relevant. Stop-loss — 17800.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 17630.0, short positions can be opened with the target at 16990.0. Stop-loss — 17900.0.

Hot

No comment on record. Start new comment.