Current trend

The EUR/USD pair has been declining for the second month in a row, forming a new downtrend and currently holding near 1.0765: quotes are pressured amid likely changes in the timing of interest rate cuts by the US Federal Reserve. Previously, market participants expected that a change in the course of monetary policy would begin in March, then the focus of expectations shifted to May, but after the publication of January inflation data this week, a decrease in borrowing costs is expected no earlier than June or even in the second half of the year.

Recall that the consumer price index CPI was 3.1% YoY instead of the expected 2.9%, and the base indicator was 3.9% with a forecast of 3.7%. Thus, inflation is declining more slowly than expected, and the labor market remains strong, which, combined with likely supply delays due to problems of navigation in the Red Sea, contributes to the persistence of risks of rising consumer prices. Under these conditions, the continued maintenance of interest rates by the US Fed at current levels looks completely logical.

A similar situation is observed in the Eurozone: in January, the CPI was 2.9% instead of the expected 2.7%, and the base CPI was at 3.3% instead of 3.2%; however, the European economy, unlike the American one, is on the verge of recession and needs support, which may force officials of the European Central Bank (ECB) to start to lower interest rates faster than the US Fed will do. In this regard, it is worth highlighting the comments of the head of the Bank of France, Francois Villeroy de Galhau, who said that the European regulator should not delay monetary policy easing too much.

Under these conditions, a further decline in the EUR/USD pair in the medium term seems more likely.

Support and resistance

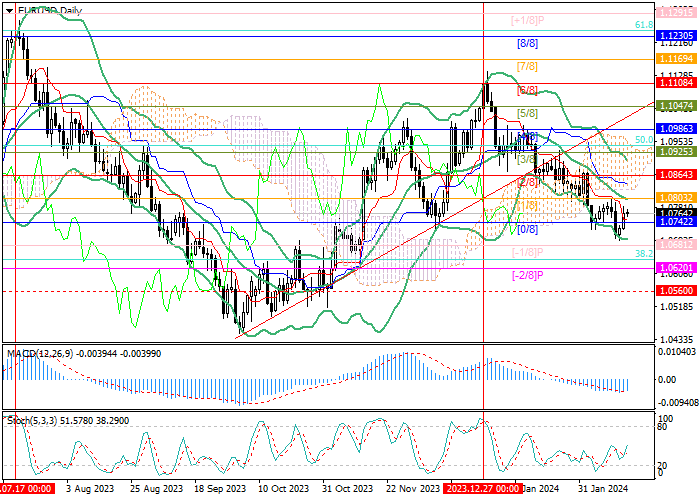

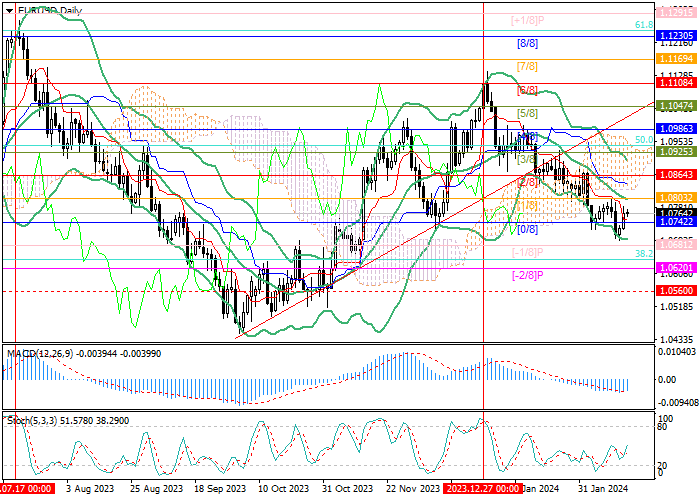

Technically, the price has regained some of the positions lost during the week, and is now in the area of 1.0760. If the level of 1.0742 (Murrey level [0/8]) is broken down, the decline in quotes may resume to 1.0620 (Murrey level [-2/8]) and 1.0560. The key for the "bulls" is the level of 1.0864 (Murrey level [2/8]) above the central line of Bollinger Bands; after consolidation above it growth can resume to 1.0986 (Murrey level [4/8]), but so far this scenario seems less likely.

Technical indicators confirm the formation of a downtrend: Bollinger Bands are pointing downwards, MACD is stable in the negative zone, while the upward reversal of Stochastic does not exclude growth, but its potential is seen to be limited.

Resistance levels: 1.0864, 1.0986.

Support levels: 1.0742, 1.0620, 1.0560.

Trading tips

Short positions should be opened below the 1.0742 mark with targets of 1.0620, 1.0560 and stop-loss around 1.0810. Implementation period: 5–7 days.

Long positions can be opened above 1.0864 with the target of 1.0986 and stop-loss around 1.0790.

Hot

No comment on record. Start new comment.