Current trend

Shares of AT&T Inc., one of the largest American telecommunications conglomerates, are adjusted and trading around the 17.00 mark.

Against the positive financial report for Q4 and the whole of 2023, analysts are reviewing the emitter's stock estimates: JPMorgan Chase & Co. experts raised the recommendation from "Neutral" to "Overweight" with an improvement in the target price to 21.0 dollars from 18.0 dollars previously. Analysts noted the company's actions in expanding the network of fiber-optic locations, the number of which has already reached 26.0 million and may exceed 30.0 million by the end of 2025.

In the report itself, AT&T Inc. announced the addition of more than 1.7 million new paid phone subscribers in 2023, with 5G network coverage exceeding 210.0 million people. Free cash flow in 2023 reached 16.8 billion dollars, exceeding expectations of 16.0 billion dollars. Revenue for Q4 2023 was 32.0 billion dollars, up from 30.35 billion dollars in the previous period, and earnings per share (EPS) were 0.54 dollars, slightly below the 0.56 dollars forecast.

AT&T Inc. expects adjusted EBITDA to grow by 3.0% and adjusted EPS to range from 2.15 dollars to 2.25 dollars. Capital investments by the end of 2024 may range from 21.0 billion dollars to 22.0 billion dollars.

Support and resistance

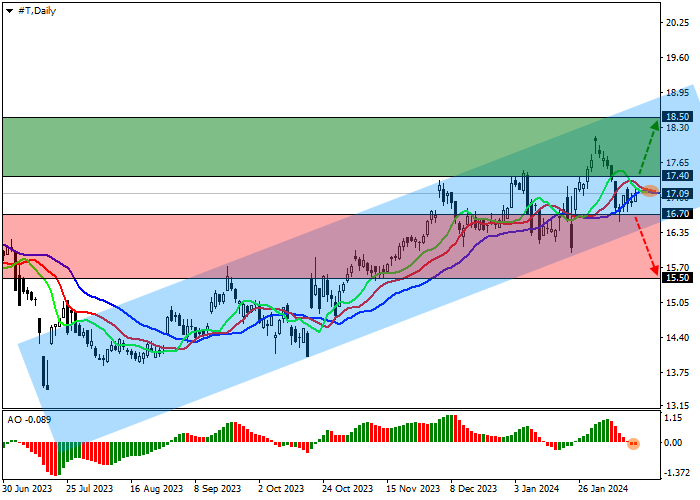

On the D1 chart, the company's stock is trading above the support line of the ascending corridor with dynamic borders of 18.50–16.30.

Technical indicators have been holding the buy signal for a long time: the range of EMAs fluctuations on the Alligator indicator remains directed upwards, and the AO histogram forms new correction bars, being close to the transition level.

Support levels: 16.70, 15.50.

Resistance levels: 17.40, 18.50.

Trading tips

In the event of a reversal and continued growth of the asset and price consolidation above the resistance level at 17.40, one may open long positions with the target of 18.50 and stop-loss of 17.00. Implementation time: 7 days and more.

If the asset continues to decline and consolidate below the support level at 16.70, one can open short positions with the target of 15.50 and stop-loss of 17.20.

Hot

No comment on record. Start new comment.