Current trend

The Australian dollar is actively adding value during the Asian session, holding around 0.6543 and developing the strong “bullish” momentum formed in the middle of last week, when the AUD/USD pair retreated from the local lows of November 14. Today, investor activity reduced due to Presidents’ Day in the United States. Meanwhile, the US currency continues to be supported by expectations of a slower reduction in interest rates.

Macroeconomic data on manufacturing inflation presented last Friday confirmed the continuing economy risks. The core index in January grew by 0.5% MoM and 2.0% YoY, higher than the previous values of –0.1% and 1.7%, respectively. The dynamics also exceeded the preliminary calculations of experts at 0.1% and 1.6%. Also on Friday, weekly data on the labor market were published, showing resistance to the current tightening of monetary policy. Initial jobless claims increased by 212.0K, less than both expectations of 219.0K and the previous figure of 220.0K, while the total claims increased from 1.865M to 1.895M. In turn, the national real estate market continues to remain poor: the number of building permits issued in January fell by 1.5% compared to the positive dynamics of 1.8% earlier, and the housing starts decreased by 14.8% after an increase of 3.3% in December.

Meanwhile, the focus of Australian investors is the publication of January labor market data, which was poor: total employment increased by only 0.5K instead of the expected 26.4K, and full employment by 11.1K, while the unemployment rate rose from 3.9% to a two-year high of 4.1%. The publication of these data allows most market participants to expect the Reserve Bank of Australia (RBA) to begin cutting interest rates in August but regulator representatives remain cautious. Speaking in the Australian Parliament today, the head of the department, Michelle Bullock, reaffirmed that inflation in the services sector remains elevated, and its overall level will reach the target range of 2.0–3.0% no earlier than 2025. Tomorrow at 02:30 (GMT 2), trading participants will pay attention to the publication of the RBA meeting minutes: the officials kept the value unchanged but stated their readiness for any changes in monetary policy if necessary.

Support and resistance

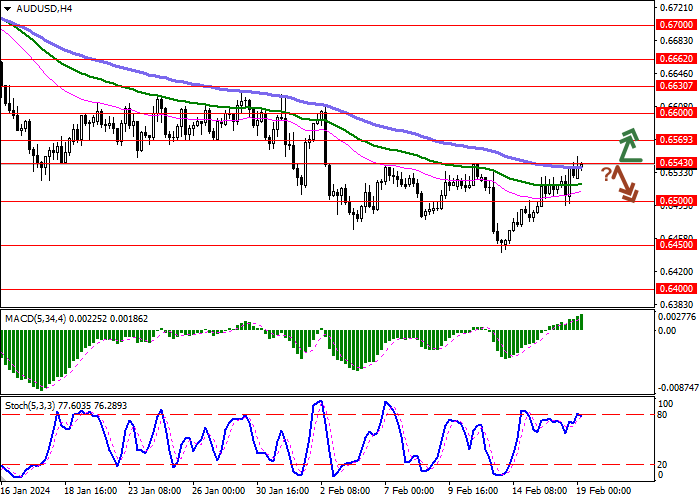

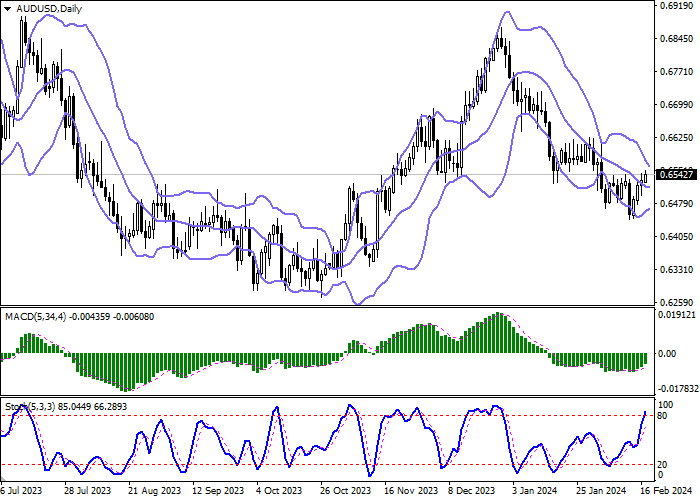

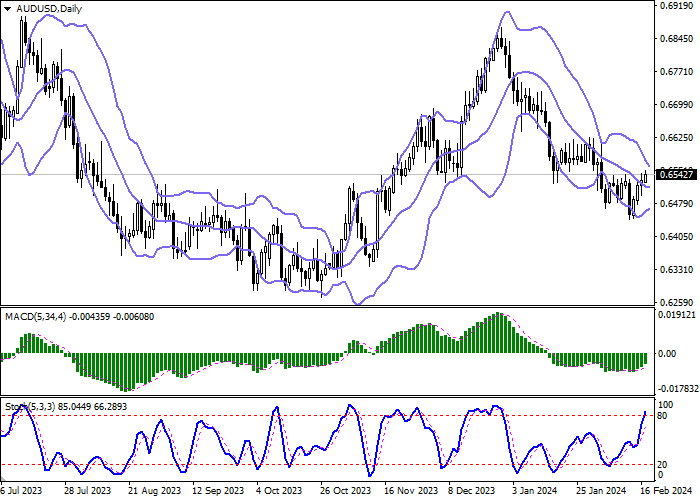

On the daily chart, Bollinger Bands reverse horizontally: the price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. MACD is growing, maintaining a strong buy signal and located above the signal line. Stochastic is close to the highs, indicating that the Australian dollar may become overbought in the ultra-short term.

Resistance levels: 0.6543, 0.6569, 0.6600, 0.6630.

Support levels: 0.6500, 0.6450, 0.6400, 0.6356.

Trading tips

Long positions may be opened after a breakout of 0.6543 with the target at 0.6600. Stop loss – 0.6510. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 0.6543 and a breakdown of 0.6500 with the target at 0.6450. Stop loss – 0.6525.

Hot

No comment on record. Start new comment.