Current trend

During the Asian session, the American dollar shows downward dynamics in the USD/JPY pair, holding close to the psychological level of 150.00. Market activity remains low at the beginning of the week as American trading floors are closed to celebrate Presidents’ Day. At the same time, investors continue to evaluate the data on manufacturing inflation published last Friday.

Thus, the producer price index increased by 0.3% MoM and by 0.9% YoY, higher than the predicted 0.1% and 0.6% and the December values of −0.1% and 1.0 %, respectively. In addition, trading participants paid attention to the publication of the consumer confidence index from the University of Michigan, a leading indicator predicting consumer spending: in February, it rose from 79.0 points to 79.6 points, slightly lower than the estimated 80.0 points.

Today, Japanese investors followed data on the factory orders. At the end of December, the index recovered by 2.7% after a sharp decline of 4.9% earlier, although analysts predicted a correction of only 2.5%. The figure fell by 0.7% YoY after sharp November dynamics of –5.0%, although experts expected a more rapid decline of –1.4%.

Meanwhile, traders are trying to predict the Bank of Japan’s further steps, namely, the timing of the abandonment of the negative interest rate policy. Earlier, the head of the department, Kazuo Ueda, said that officials were closely monitoring the annual wage negotiations between trade unions and company management, which will end in mid-March, as well as other indicators to confirm the presence of positive dynamics, which, in turn, will act as a driver for changing the “ultra-dovish” course. The current inflation forecast for fiscal year 2025 is 1.8%. Analysts at the International Monetary Fund (IMF) noted that their forecast for Japan’s economic growth for 2023 remained unchanged at 1.9% even after the publication of poor data on gross domestic product (GDP) for October-December. The Q4 statistics recorded a decrease in the indicator by 0.4% YoY after –3.3% earlier, although experts expected 1.4%, and by 0.1% QoQ after –0.8% with preliminary estimates at 0.3%.

Support and resistance

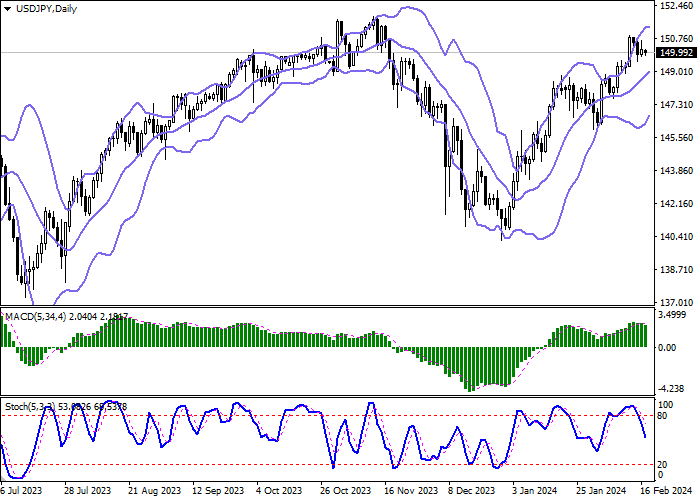

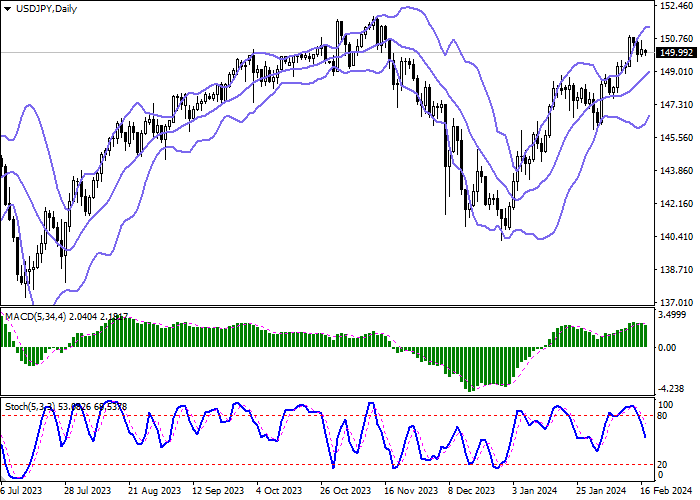

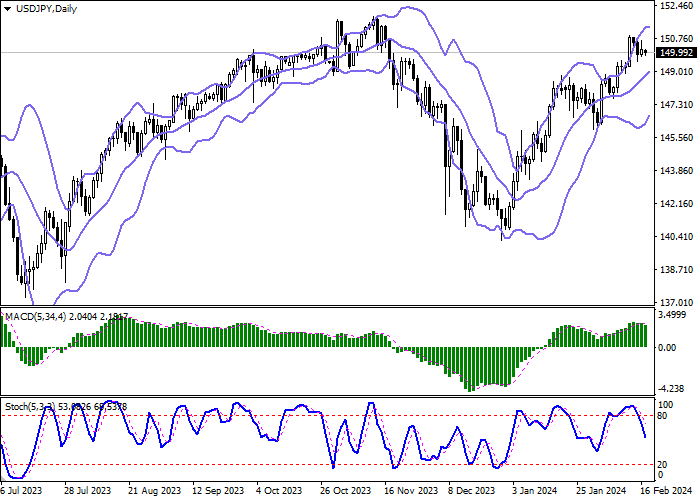

On the daily chart, Bollinger Bands are showing strong growth: the price range is narrowing from below, reflecting the ambiguous nature of trading in the short and ultra-short term. MACD maintains a poor sell signal, located below the signal line. Stochastic shows a more confident decline, located in the working area center, indicating sufficient potential for further development of the “bearish” trend soon.

Resistance levels: 150.50, 151.00, 151.50, 152.00.

Support levels: 150.00, 149.50, 148.89, 148.00.

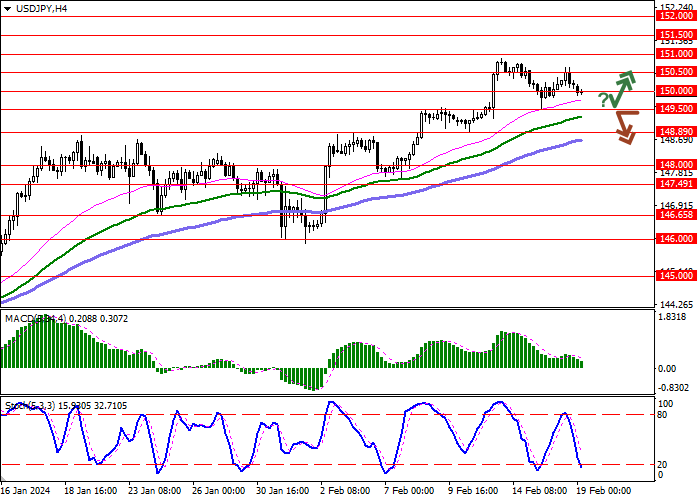

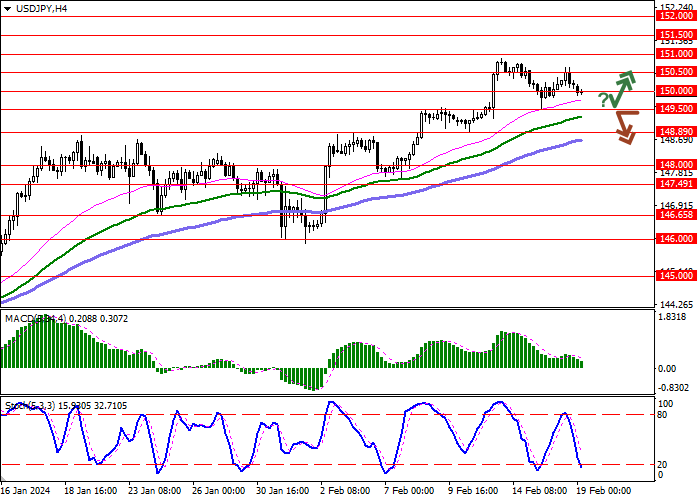

Trading tips

Short positions may be opened after a breakdown of 149.50 with the target at 148.50. Stop loss – 150.00. Implementation time: 1–2 days.

Long positions may be opened after a rebound from 149.50 and a breakout of 150.00 with the target at 151.00. Stop loss – 149.50.

Hot

No comment on record. Start new comment.